Collectables: market in Tintin artwork takes off

Tintin, the Belgian boy-reporter cum adventurer, is in demand once again. Chris Carter reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Last year, a drawing of young cartoon reporter Tintin carving a propeller from a tree trunk sold for $1.1m with Dallas-based Heritage Auctions. It was special because it was the original artwork used for the first published magazine cover to feature Tintin in February 1930. It was a fitting illustration because the market in artwork by Tintin’s Belgian creator, Georges Rémi, known as Hergé, has truly taken off in recent years. The current price record was set in 2014, when a signed page of drawings from 1937 fetched €2.6m with Artcurial. The Parisian auction house boasts that eight out of the ten most expensive works by Hergé at auction have gone under its hammer.

Tintin’s faux pas

On 21 November, that number looks set to become nine when the initial artwork for Le Lotus Bleu goes up for sale. The Blue Lotus, as it’s called in English, was published in 1936. It is the fifth album in the series, and sees Tintin travel to China to disrupt the opium trade. He is assisted in his mission by the trusty Chang, and there is a good reason for his appearance. The previous four albums had tended to draw on “clichés and crude stereotypes”, as the official Tintin website puts it. Indeed, the notorious second album, Tintin in the Congo (1931), came under renewed scrutiny during the 60th anniversary of Congolese independence from Belgium this summer. The Blue Lotus marked a turning point (although, as Sam Leith notes in The Daily Telegraph, some might still take issue with the depiction of the “toothy, sadistic, harakiri-prone Japanese”). Hergé did his research on Chinese culture and the work expresses the evolution of Hergé’s thinking. The Blue Lotus is indeed considered to be one of the better Tintin adventures.

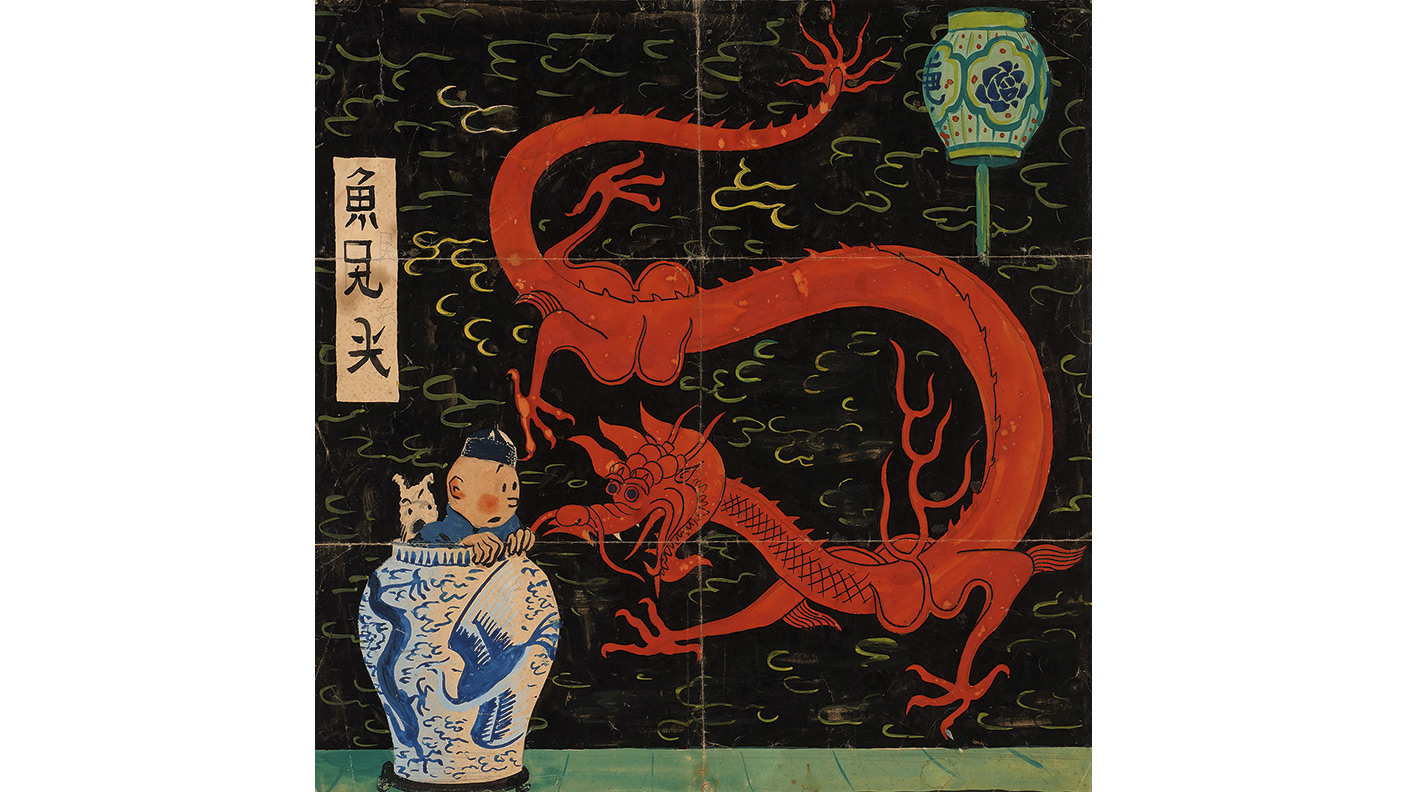

The initial artwork Hergé produced for it was, however, never used. The Indian ink, gouache and watercolour on paper image of Tintin and Milou (Snowy) peeking out from a Ming vase, while seemingly being menaced by a Chinese dragon (look closer and you will see it’s actually the wallpaper), was deemed too costly to reproduce with the four-colour technique used in 1936. The publisher, Louis Casterman, turned it down. According to the auction house, Hergé gave it to the publisher’s young son, who kept it in a drawer (see right).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

“This artwork is a genuine masterpiece encapsulating Hergé’s genius and is probably the most beautiful Tintin album cover ever!” says Eric Leroy, comic-strip expert at Artcurial. Artcurial has valued the artwork at up to €3m for the sale next month.

A disputed history

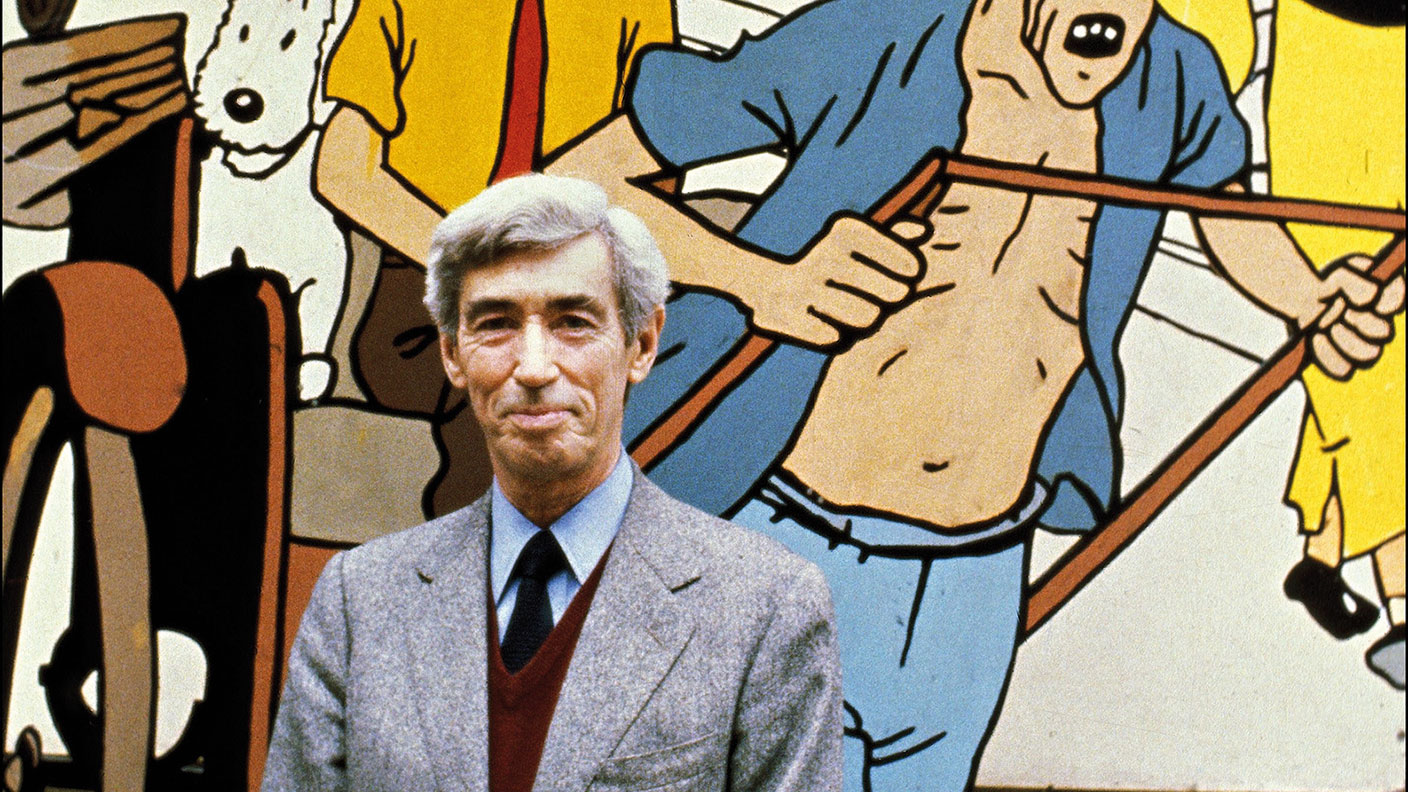

It will be the first time Hergé’s initial artwork for The Blue Lotus goes up for auction. The piece was inspired by a picture of Anna May Wong, the Chinese-American actress who appeared with Marlene Dietrich in the 1932 film Shanghai Express, says Bruno Waterfield in The Times. After it was rejected for being too expensive to reproduce, Hergé (pictured) gave it to Jean-Paul Casterman, the publisher’s young son. The boy tucked it away for safe-keeping. That’s the official version of events. “Hergé’s old friends say this account is as fanciful as any Tintin tale: they are aghast that the picture is up for auction, and say it was pinched from the author,” says Leo Cendrowicz on i news.

“I met Jean-Paul in 1990 and he told me that it was a present from Hergé, who didn’t think the rejected picture had any value,” Eric Leroy, Artcurial’s comic-book expert, tells Cendrowicz. (Hergé died in 1983, and the younger Casterman in 2009. The present sellers are the latter’s children.) “Tintinologists… say it is inconceivable that Hergé… would have given it to a boy he’d never met,” says Cendrowicz. Hergé always signed his gifts, they point out, and the timing of the sale comes “just months after the deadline lapsed for any legal challenge to the picture’s ownership”. One theory is that Hergé sent the image to the publisher and it was simply never sent back. Either way, the sale is going ahead and it is expected to set a new auction record for a European comic-strip drawing next month.

Auctions

Going…

Around 440 rare cinema posters are heading for auction with the Prop Store in London on 5 November. Together, they are expected to fetch at least £180,000. The top lot is a Dr. No poster from 1962, featuring the famous “007” gun logo for the first time. It is expected to sell for at least £8,000. An Australian Mad Max poster from 1979, considered the “holy grail” of posters for this film, has been valued at between £3,000 and £4,000. And a Star Wars: The Empire Strikes Back (1980) poster is estimated to fetch from £2,500. But “the auction is suitable for fans with a variety of budgets”, says MSN.com. At the lower end of the price spectrum, a poster advertising Jurassic Park, from 1993, has a price tag of £100-£200.

Gone…

“We’re in a brave new world when a 167-million-year-old dinosaur proves the most contested lot in a virtual auction of 20th-century fine art,” says Melanie Gerlis in the Financial Times. But that is what happened at the Christie’s evening sale in New York last week. The male Tyrannosaurus rex from the Late Cretaceous period, nicknamed Stan, “roared ahead” from an initial $3m bid to sell in London for a record $31.8m (with fees). It was in a “remarkable state of preservation” thanks to its final resting place in a small streambed, according to the auction house. “It is one of the largest, finest, and most complete specimens ever found of the undisputed king of the dinosaurs.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton