Collectables: rum comes of age

Rum, the party spirit, is being taken seriously by collectors, says Chris Carter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

No longer just the frivolous spirit of pretty cocktails and beach parties, rum has come of age. Sales shot up by 53% over the past 12 weeks, making it the “spirit of the summer”, according to Waitrose. “We’ve been anticipating the year of rum for a while and it has finally arrived,” says John Vine, a spirits buyer at the supermarket. And while white rum is still the overwhelming mass-market favourite, “sipping rums” are becoming more popular.

Globally, during the five years to 2019, sales at the cheaper end grew by just 0.6%, according to research from IWSR Drinks Market Analysis. But in that same time, as Emily McAuliffe notes for BBC News, the high-end section of the market, comprising bottles costing $28 and more, grew by 8.3%. It seems the world is developing a taste for the finer stuff, even if rum still has some way to go before catching up with the sky-high prices fetched by some rare whiskies. But is that the right comparison to make?

Rum versus whisky

“Comparisons are often made between the whisky trade and aged rums, but it’s not that simple,” Isabel Graham-Yooll, auction and private client director at Whisky.Auction, tells MoneyWeek. “It was notable that whisky enthusiasts in particular, with their pre-existing knowledge and experience of the spirits market, were quick to identify highly collectable rums, for example from closed distilleries, with the most interesting flavour profiles. My tip would be to follow their lead.” Dawn Davies, head buyer at The Whisky Exchange, an online retailer of a wide range of rums, and sister company to Whisky.Auction, agrees. “There is not the same market for aged rums,” she says. “Although those in the know will pay well for old bottles of Wray and Nephew – a 1940s Wray went for $55,000, the 1780 Harewood rum went for over $100,000 [in 2014] – there is definitely a growing interest.”

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The best rum deals

So, where next for the rare rum market? “In the last decade, I have noticed a lot of rum brands trying to break through, but that is really only part of the story,” says Graham-Yooll. “It’s the special rums that are most sought-after and the race is on to find the next great cask, perfectly aged from an underappreciated distillery.”

“We’re seeing even recent bottlings such as Destino by Foursquare and Velier going at auction for double their release value,” adds Davies. “The closed Caroni distillery is where many rum collectors begin, but in truth every region, every island, has its own unique style, so good collectors quickly learn to identify the bottlers, such as Velier, that routinely hunt down the best rums,” says Graham-Yooll. Davies also likes Caroni, along with Uitvlugt and “old bottlings of Wray and Nephew, and Bacardi”.

Millennials are among the “biggest collectors”, but there are lots of established spirits collectors who are “good at identifying the best bottles to buy”, says Graham-Yooll. “It is not the general consumer buying these rums, but people with knowledge,” Davies agrees. “I would say [it’s] rum geeks.”

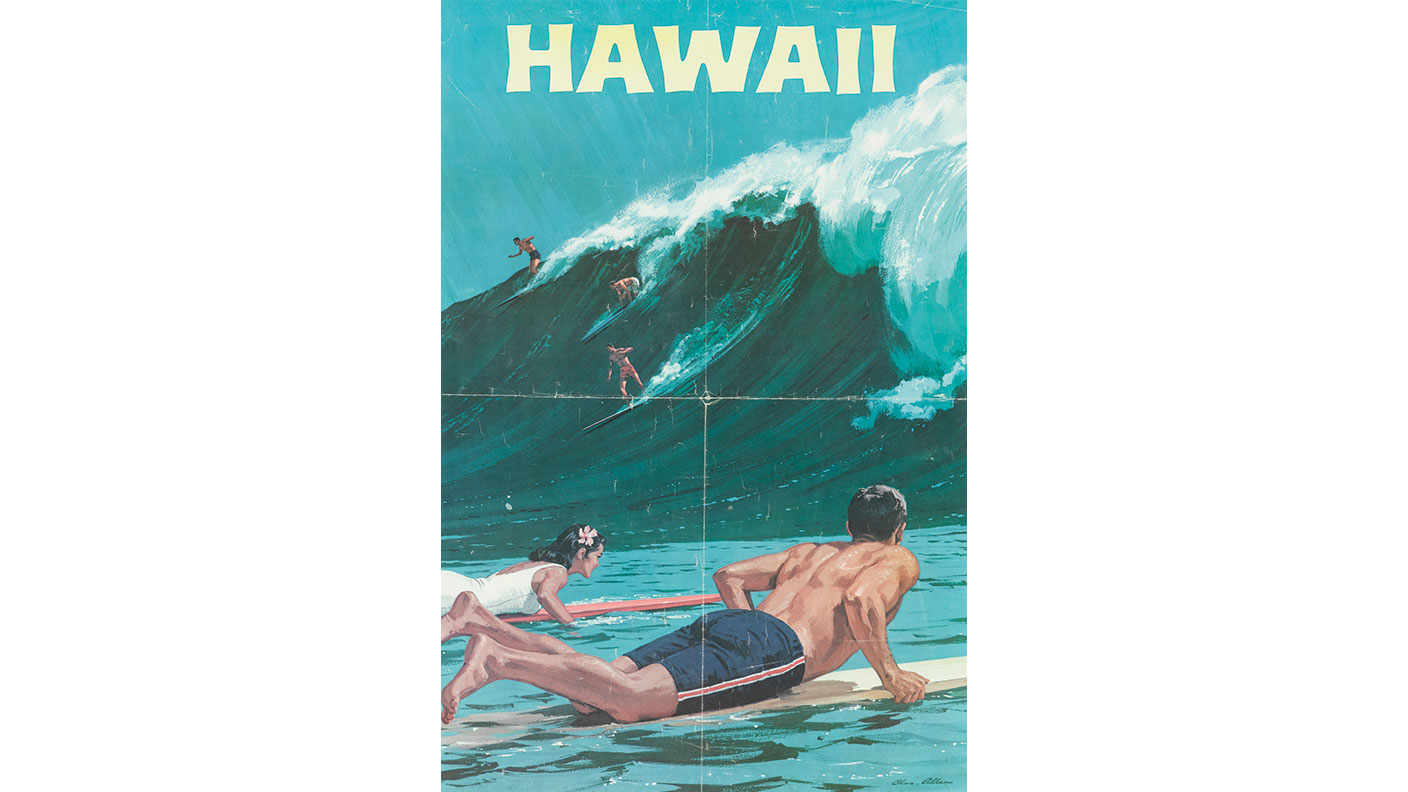

Surf's up!

Rum-based tiki cocktails, golden beaches and shaggy-haired dudes clutching longboards are what springs to mind when we think of surf culture. But there is more to it than that, says Bonhams. “Surfing is a lifestyle, comprising not just surfboards, but also the art, music, and literature that has grown up around it.” The history of surfing is “the story of innovation in the pursuit of pleasure. There is always a better wave; there is always a better board”, says Catherine Williamson, director of entertainment memorabilia at the auction house, which is hosting an online sale in partnership with Turner Classic Movies (it runs until Wednesday). Bonhams will be hoping that sentiment still holds true among the bidders for its array of surfboards, such as the Pacific Systems Square Nose Redwood from the 1920s. It is valued at up to $10,000.

Auctions

Going…

A bottle of the oldest Japanese whisky, a 55-year-old Yamazaki (pictured), is to be sold with Bonhams in Hong Kong on 21 August. It was released in June through a lottery system to residents in Japan. All 100 bottles were distilled in the 1960s and matured in Japanese Mizunara oak and white oak casks, giving the whisky a “deep reddish amber colour with a complex agarwood and sandalwood nose, rich in fruity scents... [and] a sweet aftertaste”. The gold-dusted bottle is housed in a black Mizunara oak box with Suruga lacquer, while the bottle mouth is wrapped in handmade Echizen Washi (a type of paper) and tied with a traditional Kyoto braided cord. It has been given an upper price estimate of HK$780,000 (£77,000).

Gone…

A rare bottle of 80-year-old Moutai, a brand of the traditional Chinese sorghum-based spirit baijiu, sold for ¥1.97m (£216,000) at an auction in eastern China last month – twice the pre-auction estimate. The bottle bears the “Lay Mau” label, which changed after the brand merged with three other distillers in southwestern China in 1953 to form the current state-owned company and widely known brand Kweichow Moutai. Vintage barrels and bottles of baijiu are popular among collectors in China and prices have been rising in recent years, says Natalie Wang on The Drinks Business.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

The UK regions with the highest proportion of homes above the inheritance tax threshold

The UK regions with the highest proportion of homes above the inheritance tax thresholdHigh house prices are pushing more families into the inheritance tax trap across the country

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive