Will the Federal Reserve give markets a shock this week?

With US inflation coming in higher than expected, markets are nervously awaiting the Federal Reserve’s response. John Stepek looks at what’s likely to happen.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The big economic event last week was US inflation data. In the end, it all panned out calmly. Inflation was a bit higher than expected, but markets shrugged it off.

This week’s big event is the Federal Reserve’s reaction to it all.

So what’s likely to happen, and what should you keep an eye out for?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The week’s biggest event

On Wednesday this week, the Federal Reserve announces its latest decision on monetary policy. In the UK, we’ll hear about it after the market’s closed for the day.

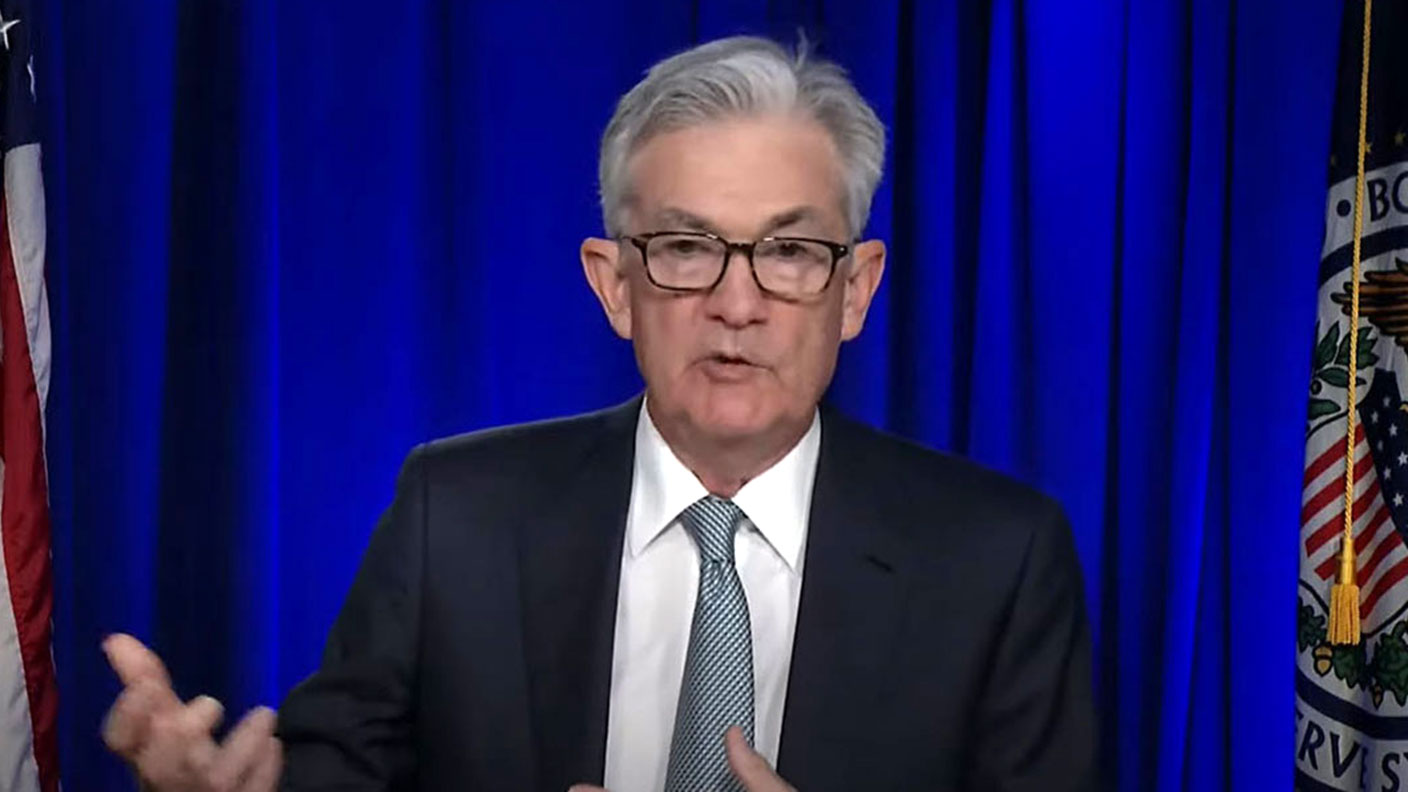

Investors will want to see what the Fed’s current thinking on inflation is. Is the Fed still comfortable with the idea that inflation is transitory? Or is it getting edgy? Will Jerome Powell say that it’s time to start thinking about tapering? Or will he wave it all away as nothing to worry about yet?

Like it or not, this could have a big market impact – in the short term at least. As I’ve said more than a few times in the past, it’s odd to think that so many prices in so many different markets all across the globe can be moved so sharply by the prognostications and eyebrow twitches of a handful of people in a room somewhere. But that’s the system we live with.

Clearly, we’re not mind readers and we have no crystal balls. And in the end, if you’re genuinely a long-term investor, this sort of event shouldn’t faze you. If your portfolio can’t endure the tiny bit of potential turbulence caused by a single economic data release, or an unexpected sentence in a Fed statement, then you need to revisit your strategy.

However, unless you plan to ignore the news entirely (I actually think this is a good strategy 99% of the time – it’s just one that a lot of people struggle to enact), then it’s useful to understand what’s going on.

When you have a rough idea of what to expect from various events, then it can help you to keep control of your own emotional reactions to swings in the market. If you can minimise the element of surprise, you can also minimise your propensity to panic.

So what’s the likely outcome here? When it comes to binary (or near-binary) decision making, you have to assume that people will take the path of least resistance. You just need to work out what that is.

The good news is that right now, it’s still pretty obvious.

Always pick the path of least resistance

There are really only two options here. Option one is that the Fed could start talking tough on inflation, and saying that it wants to tighten monetary policy earlier than markets expect. Option two is that the Fed keeps to its “we’ll watch and wait” mantra.

Inflation is becoming more of a talking point. It’s very clear that there are cost pressures out there. However, it’s also very far from clear that it’s a long-term problem. I think it will be, but that’s certainly not the consensus view right now, either in markets or in the press.

And loath as I am to admit it, that’s perfectly reasonable. There is more than enough confusion in the data to allow room for debate. You can still make the case that inflation will be “transitory” (and there are still quite a few smart people who reckon we’re in for yet another deflationary dip – I’m not in that camp but I respect many of those who are).

You just need to look at the reaction to last week’s higher-than-expected inflation data to realise that markets are currently willing to believe that this is temporary. Gold is drifting lower. US bond yields actually fell (you’d expect them to rise if inflation was really viewed as a long-term issue).

So here’s what could happen.

If the Fed goes for option one, markets will panic, the dollar will strengthen and most other things will go down, including the US stockmarket. And interest rates might well spike (at first) which is the last thing they want.

They’ll get push back from “opinion formers” too. People will wonder why the Fed is already talking about tightening when unemployment – which it says is the priority – is still so high. The Fed will have to explain its views. It’ll be like kicking a hornets’ nest.

If the Fed goes for option two, then markets will remain broadly on their current path, which for most markets is either meandering around, or steadily edging higher. The opinion formers will be calm. The Fed won’t have to explain anything – it’s easy to stick to the “transitory” argument for a while yet.

In short, the Fed can easily kick this debate along the road until at least the depths of summer. It can then use the annual central bankers’ conference at Jackson Hole to start warming markets up to a “taper” if it feels it necessary to do so.

Which of those options is the path of least resistance? Option two, clearly. So your only real concern there is whether Powell speaks with enough “dovish” intonation to keep markets calm. I suspect he’ll err on that side of things – he’s had enough practice by now.

Indeed, if we get any surprises at all I imagine it’ll be that the communication is even more relaxed than anyone expects. But we’ll see what happens on the day.

And if you haven’t already subscribed to MoneyWeek magazine, get your first six issues free here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Will Donald Trump sack Jerome Powell, the Federal Reserve chief?

Will Donald Trump sack Jerome Powell, the Federal Reserve chief?It seems clear that Trump would like to sack Jerome Powell if he could only find a constitutional cause. Why, and what would it mean for financial markets?

-

Can Donald Trump fire Jay Powell – and what do his threats mean for investors?

Can Donald Trump fire Jay Powell – and what do his threats mean for investors?Donald Trump has been vocal in his criticism of Jerome "Jay" Powell, chairman of the Federal Reserve. What do his threats to fire him mean for markets and investors?

-

Do we need central banks, or is it time to privatise money?

Do we need central banks, or is it time to privatise money?Analysis Free banking is one alternative to central banks, but would switching to a radical new system be worth the risk?

-

Will turmoil in the Middle East trigger inflation?

Will turmoil in the Middle East trigger inflation?The risk of an escalating Middle East crisis continues to rise. Markets appear to be dismissing the prospect. Here's how investors can protect themselves.