The inflation scare is far from over, warns the Bank of England

The Bank of England's chief economist has warned that UK consumer price inflation will soon spike as the economy reopens, calling it a “tiger” that could prove “difficult to tame”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Is inflation a “tiger” or a “pussycat”? asks Gurpreet Narwan in The Times. Andy Haldane, the chief economist at the Bank of England, has warned that UK consumer price inflation will soon spike from its current level of 0.7% as the economy reopens. Haldane likened inflation to a “tiger” that has been “stirred by the extraordinary events… of the past 12 months”. It could prove “difficult to tame”. Not all of his colleagues agree. Deputy governor Dave Ramsden notes that UK inflation expectations (as measured by surveys) remain “well anchored” for now.

Bond markets totter

Concern about a more inflationary outlook rocked global bond markets last week. As bond prices fell, the US ten-year Treasury bond yield spiked towards 1.6%, a significant rise from the 0.9% level at which it started the year. The surge in yields hit stocks: higher bond yields prompt investors to sell shares and buy bonds. America’s tech-focused Nasdaq index plunged by 3.5% last Thursday, its worst one-day performance since October. The following day the FTSE 100 dropped by 2.5%.

The FTSE bounced back 1.3% on Monday, generating “a huge sigh of relief”, says Russ Mould of AJ Bell. Progress on Joe Biden’s $1.9trn stimulus bill (see page 10) soothed markets. Bond yields settled, with the US ten-year trading around 1.4%, calming fears that last week’s yield tantrum could precipitate an even larger rout.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The bond yield spike shows that markets disagree with the US Federal Reserve about the economic outlook, says Eoin Treacy for fullertreacymoney.com. Fed chair Jerome Powell insists that the recovery is shaky, pointing to high US unemployment. That means interest rates will need to stay low for a long time. Investors, by contrast, increasingly think we are heading for a swift reflationary recovery. That would drive inflation higher and force the Fed to hike interest rates sooner rather than later.

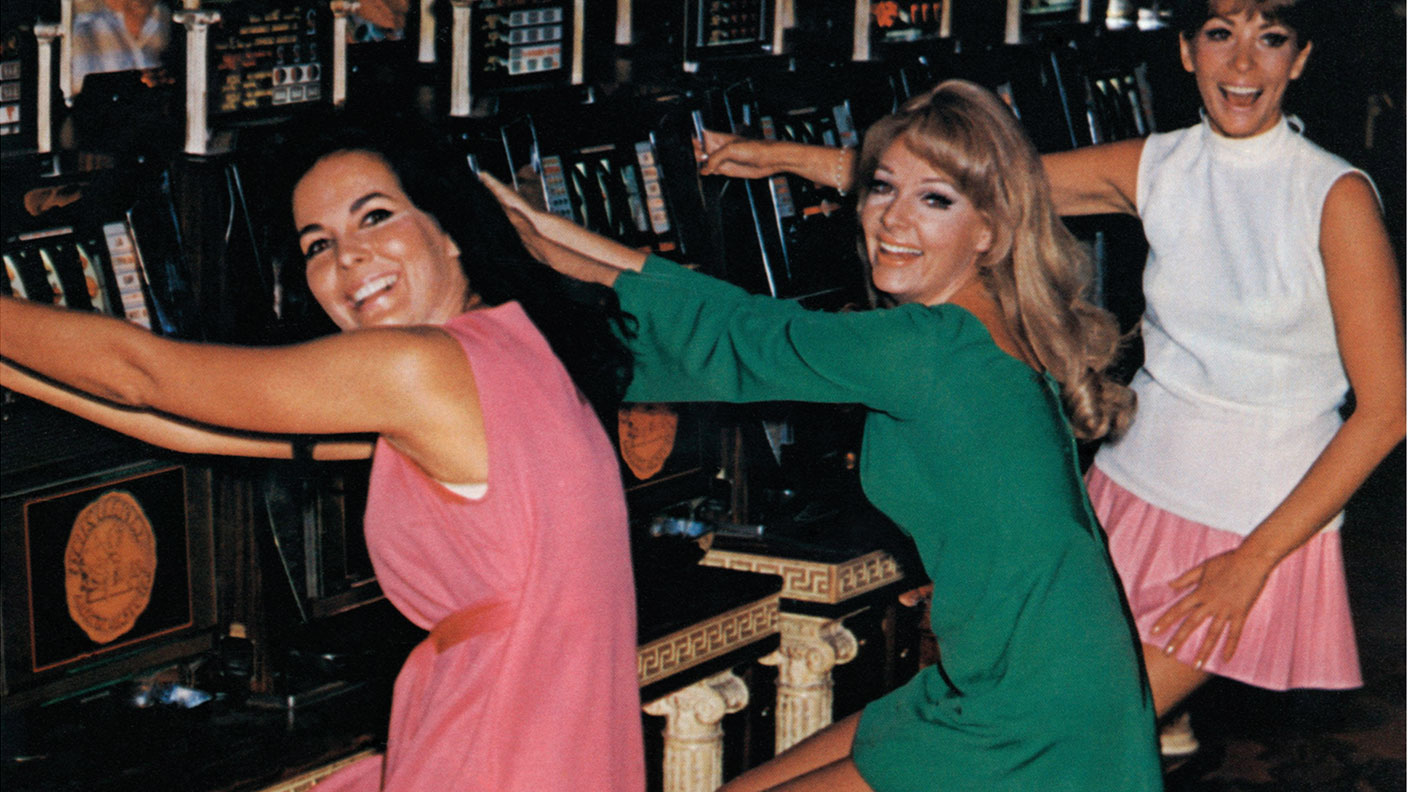

Swinging back to the sixties

Expect more “turbulence”, says the Financial Times. Investors have grown so accustomed to ultra-low interest rates and quiescent inflation that even a modest shift to a “higher-rate, higher-inflation regime” could unleash “cascades of repricing” and “swingeing losses” for portfolios. “In truth, this is a good news story”; markets are anticipating a robust recovery and higher but not uncontrollable inflation. Inflation doves point out that massive quantitative easing (QE) after the financial crisis did not bring higher inflation, say Michael Bordo and Mickey Levy in The Wall Street Journal. But where that cash ended up as “excess reserves that sloshed around” the banking system, this time stimulus is far bigger and more direct – state cheques have been paid straight to US households.

“There is a long history of high budget deficits” heralding inflation; inflation began to tick up in the mid-1960s but governments on both sides of the Atlantic kept on spending, which led to crippling stagflation that blighted Western economies until the 1980s. It can be a surprisingly “short march” from low inflation back to high inflation.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

The scourge of youth unemployment in Britain

The scourge of youth unemployment in BritainYouth unemployment in Britain is the worst it’s been for more than a decade. Something dramatic seems to have changed in the labour markets. What is it?

-

In defence of GDP, the much-maligned measure of growth

In defence of GDP, the much-maligned measure of growthGDP doesn’t measure what we should care about, say critics. Is that true?

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton