A sustainable competitive advantage is the key to a company’s success

Two professional investors tell us where they’d put their money. This week: Ben Goldsmith and Luciano Suana of the Menhaden Resource Efficiency trust.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

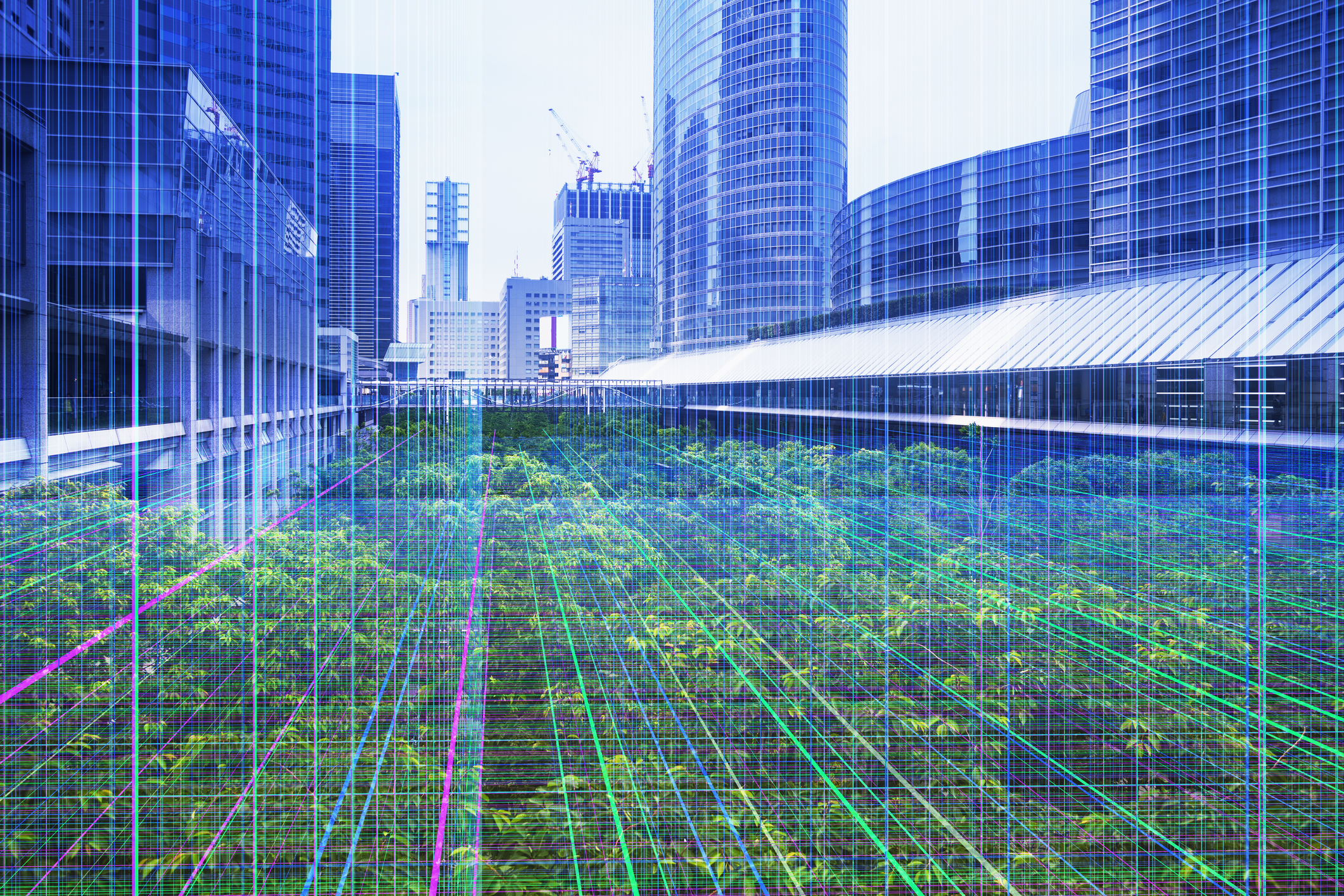

Menhaden Resource Efficiency seeks to invest in businesses that either deliver or benefit from the more efficient use of resources. Our approach recognises companies working to reduce their environmental footprints. We overlay this thematic focus with strict criteria covering both quality and value. We like to own businesses with enduring assets (and franchises) generating cash flows that are predictable over the long term and not at risk of disruption.

These businesses must benefit from enduring competitive advantages and possess genuine pricing power, enabling them to outgrow inflation. Finally, we want to buy them at reasonable valuations. This approach has served us well. Our equities span three broad themes: technology/cloud; aviation; and infrastructure. These all offer secular growth and their industry structures provide the incumbents with formidable competitive positions.

Post-pandemic air travel takes off

Commercial aviation’s recovery from Covid is nearly complete. Air travel remains a growth story. Three-quarters of the global population have never been on an aeroplane. Strict regulations and efficiencies from operating fewer aircraft models bolster growth in the sector and deter rivals. Fleet renewal requirements and the need to decarbonise remain unchanged.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We own positions in Airbus (Paris: AIR) and Safran (Paris: SAF) as the firms’ aircraft and engines offer a step change in fuel efficiency. Both companies’ decarbonisation targets have been recognised by the Science Based Target initiative. They are the dominant suppliers in the fastest-growing narrow-body aircraft segment. Airbus’s production is sold out until 2029. Deliveries should increase from a target of 720 this year to more than 1,000 in the coming years and underpin significant earnings growth. Safran should continue to benefit from a growing installed base of engines and their recurring high-margin aftermarket sales.

Cloud computing, meanwhile, offers major cost and emission savings compared to traditional enterprise datacentres. These stem from economies of scale and higher utilisation rates. The demand for computing power and the value it provides is only increasing. We hold positions in each of the major providers: Amazon (Nasdaq: AMZN ), Microsoft (Nasdaq: MSFT), and Alphabet (Nasdaq: GOOGL).

Amazon’s CEO Andy Jassy says cloud computing is still in an early innings: 90% of IT spend remains on-premises. These firms will be among the chief beneficiaries of growth in artificial intelligence (AI). We expect their cloud businesses to support their earnings growth rates for a long time.

Driven by duopolies

Economies of scale mean that transporting freight by rail is up to four times more fuel-efficient than by road. This provides North American rail operators with a significant cost advantage over trucks on longer-haul routes as no one is building railroads today. The industry operates in a series of duopolies and companies have pricing power. GDP growth should prove supportive of volumes.

We hold positions in Canadian National Railway (Toronto: CNR), Canadian Pacific, now renamed Canadian Pacific Kansas City (Toronto: CP) and Union Pacific (NYSE: UNP). Their long routes lessen competition from trucks. Their management teams consistently return cash to shareholders via dividends and buybacks. The Canadian duo should benefit from faster volume growth as Canadian ports gain market share from US ports. Canadian Pacific’s volume growth should also benefit from new routes following the acquisition of Kansas City Southern. New leadership at Union Pacific should help it fulfil its potential and deliver genuine improvements in operations and profits.

Join us at the MoneyWeek Summit on 29.09.2023 at etc.venues St Paul's, London.

Tickets are on sale at www.moneyweeksummit.com

MoneyWeek subscribers receive a 25% discount.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ben Goldsmith is CEO of Menhaden Capital Management

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?

-

Why our rickety internet infrastructure needs an upgrade

Why our rickety internet infrastructure needs an upgradeBriefings The internet is an increasingly essential part of international infrastructure. Recent events have shown that it is also vulnerable to collapse.

-

Quiz of the week 30 January – 5 February

Quiz of the week 30 January – 5 FebruaryFeatures Tesla chief Elon Musk tweeted messages in support of an obscure cryptocurrency this week, sending its price soaring. But which one? And what else happened this week? Test your recollection of the events of the last seven days with MoneyWeek's quiz of the week.

-

Quiz of the week 21-27 November

Quiz of the week 21-27 NovemberFeatures Test your recollection of the events of the last seven days with MoneyWeek's quiz of the week.

-

Bezos bails out Washington Post

News Amazon's founder has surprised many with his about-turn purchase of one of America's leading newspapers.