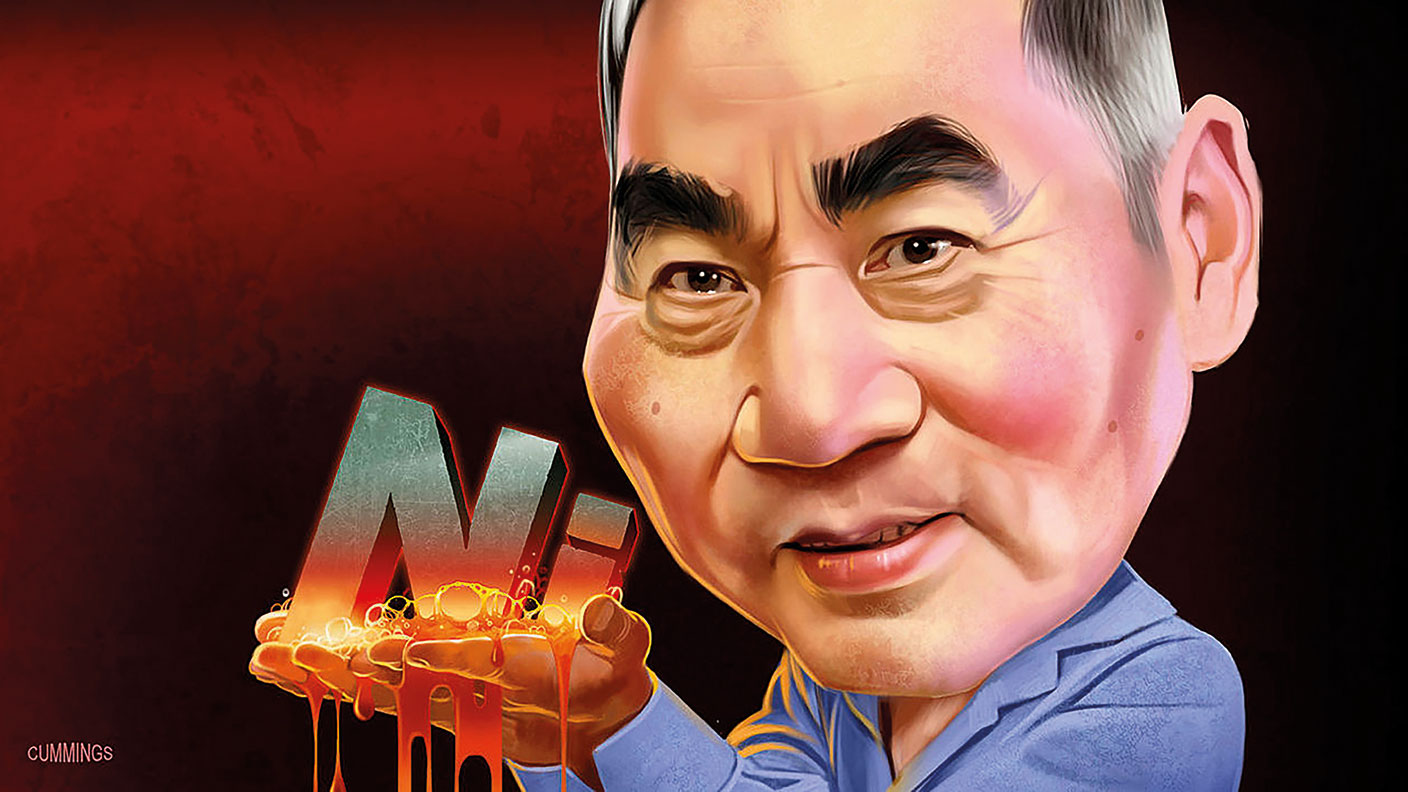

Xiang Guangda: the “Big Shot” who broke the nickel market

The founder of the world’s largest producer of stainless steel recently found himself on the painful end of a wrong-way bet on the nickel price. The “Nickel King” has always loved a punt, says Jane Lewis

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

He’s known as “Big Shot” in China for the towering position he commands in the metal industry. But it took a huge wrong-way bet on the price of nickel to catapult Xiang Guangda to global fame, says Bloomberg. The founder of Tsingshan – the world’s largest producer of stainless steel and nickel – has secured his place in the annals of investment as the central actor in “one of the most dramatic weeks in metals-market history” following an epic short squeeze that “plunged the entire industry into chaos, briefly brought a handful of brokerages to the brink of failure, and raised existential questions about the future of the London Metal Exchange”.

Following a week-long hiatus, the exchange has now reopened after Tsingshan, which sustained potentially ruinous paper losses of $8bn, reached a “standstill agreement” with its banks that they will not make margin calls or close out its nickel positions, says Breakingviews. They’d been directed to co-operate by the Chinese government, indicating that Xiang continues to enjoy the support of Beijing – albeit at “arm’s length”.

The first bucket of gold

Born in 1958, into a working-class family, Xiang was fortunate to hail from Wenzhou – “a buzzing city in the coastal Zhejiang province renowned for turning out some of the country’s most famous entrepreneurs”, says the Financial Times. According to Chinese media reports, he got his first job fixing machinery at a state-run fishery where he was guaranteed work under China’s “iron rice bowl” employment system – later swept away by Deng Xiaoping’s economic reforms. In the late 1980s, Xiang joined millions quitting their state jobs to start up businesses, earning his “first bucket of gold” making doors and windows for China’s state-run carmakers. A trip to Europe in 1992 – where he noted that BMW and Mercedes-Benz were making their own windows – persuaded him that the clock was ticking on his central business, so he pivoted to stainless steel after spotting an opportunity to “wean China off its dependence” on imported metal.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The switch to stainless steel meant focusing on a crucial ingredient – nickel, says Fortune. Xiang began pouring cash into countries with big nickel reserves, notably Indonesia. The decision to invest just before the country announced plans to ban exports of nickel-bearing ore was slammed as over-risky by some traders, says the FT. But not for the first time Xiang “proved them wrong”. His good relationship with a politically influential army general smoothed the way for securing his place in a critical 21st-century industry (nickel is essential in electric car batteries and the like). In the mid-2000s, Tsingshan was just a small stainless steel producer in Wenzhou. Now it’s responsible for almost a quarter of global production. It has gone from nothing to being by far the biggest player in just ten to 15 years. He has been hailed as “a visionary” and described as the “Steve Jobs of metals”.

A force to be reckoned with

Acquaintances say that Xiang’s “Achilles heel” is that “he loves to punt”. Indeed, despite the carnage he has wreaked on metal markets, he remains committed to his “wager” that nickel prices are set to fall – thanks to a technological breakthrough in making nickel matte, an intermediate product which, once purified, can be used in EV batteries, thus “drastically” increasing output and driving prices down, says Breakingviews. Regardless of recent ructions, China’s “Nickel King” is still a force to be reckoned with.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

Luana Lopes Lara: The ballerina who made a billion from prediction markets

Luana Lopes Lara: The ballerina who made a billion from prediction marketsLuana Lopes Lara trained at the Bolshoi, but hung up her ballet shoes when she had the idea of setting up a business in the prediction markets. That paid off