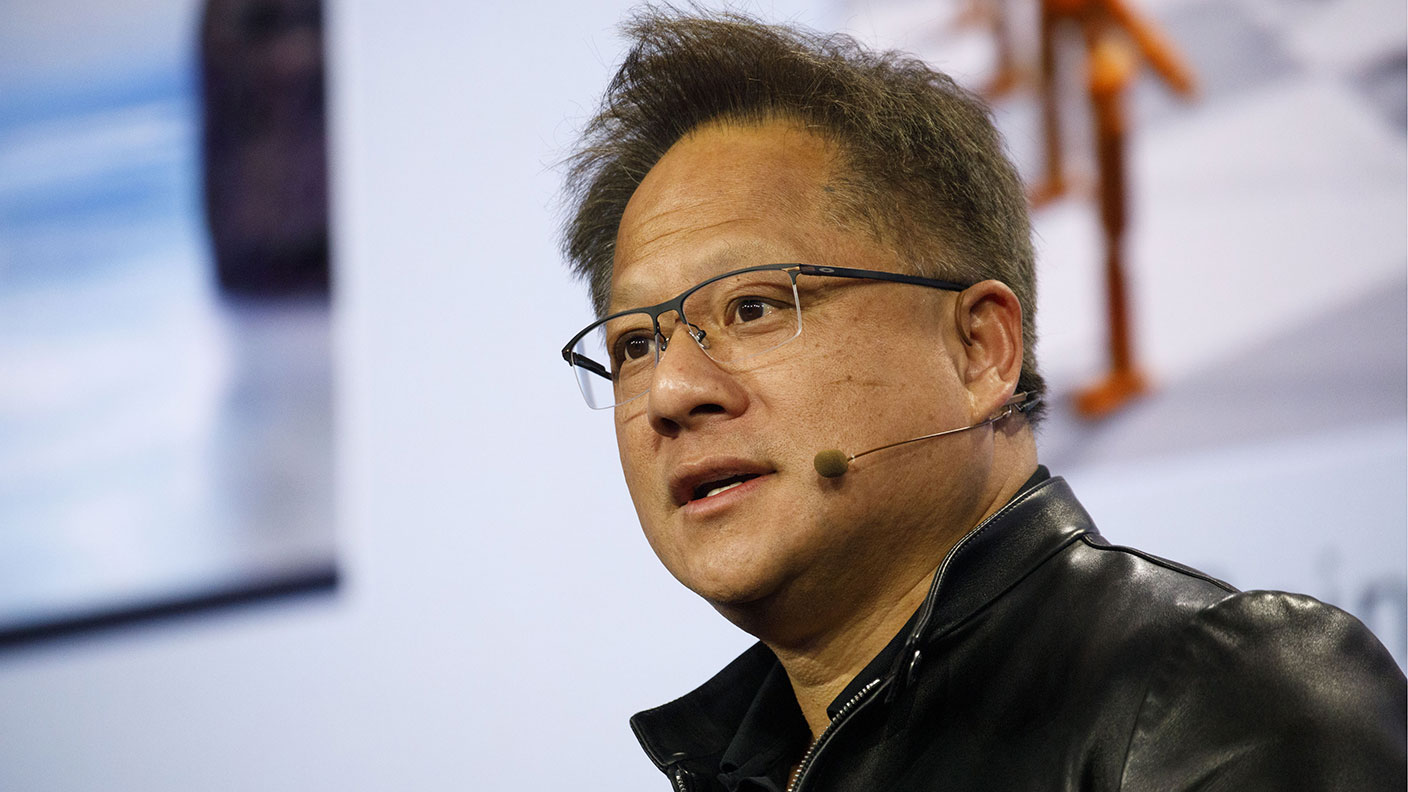

Nvidia’s Jensen Huang: prophet of the AI age

Jensen Huang’s Nvidia started out in computer games. That may have been merely a toehold on the route to global dominance in the tech industry.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In 1993, Jensen Huang quit a well-paid position as a Silicon Valley chip designer to launch a videogames venture with two friends. They called it Nvidia – a play on the Latin word for “envy”. At the time, “many people thought he was mad”, says The Times, and he struggled to raise seed capital. But nearly 30 years on, Huang is presiding over the largest and most valuable semiconductor company in the world and hailed as one of tech’s great visionaries. “Jeff Bezos, Elon Musk – I put Jensen in that group,” says one admirer.

Sprinkled with 21st-century gold dust

With hindsight, Nvidia’s early focus on games seems “an unconventional path” to global dominance, says the Financial Times. But Huang’s great breakthrough was the realisation that the data-intensive chips needed to create imaginary gaming worlds could be put to more scientific uses. The sector then was “a zero billion-dollar market”, he tells Forbes. But “we postulated” that this new industry, with its “rich and beautiful” 3D graphics, was going to be one of the largest in tech. After floating in 1999, Nvidia evolved from making PC graphics cards to graphics processors (GPUs) before taking the major leap into programming GPUs for more general-purpose tasks in 2007. Its chips have since become “the main engines for training the neural networks at the heart of artificial intelligence [AI]” – in other words, 21st-century gold dust. Nvidia’s shares have leaped tenfold since 2016.

Huang, 58, cuts a somewhat flamboyant figure, habitually adding a leather jacket to the all-black Silicon Valley uniform, and sporting a prominent tattoo based on Nvidia’s logo at the top of one arm, says Fortune. He had it done to mark the stock hitting $100 and claims to have cried “like a baby” from the pain.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Born in 1963 in Taiwan, Huang moved to the US a decade later and grew up in Oregon. His education – at a Baptist boarding school in rural Kentucky – was somewhat unusual, and duties included cleaning the bathrooms daily for a dorm of 150 boys. But he describes it as a formative experience, adding that he “loved every minute”. A trained electrical engineer – he studied first at Oregon State and then Stanford – Huang has always combined his talents with technology with a “ruthless focus on execution”, Adobe chief executive Shantanu Narayen told Fortune. He’s not the sort of visionary who talks “about going to Mars or something”, observes an early Nvidia backer. “His vision is out five to ten years.” He’s widely admired for positioning his company to take advantage of blossoming trends: for understanding “where the puck is going”.

Of late, Huang’s puck has been whirling around the Cambridge HQ of Arm, the UK chip champion he hopes to buy from Japan’s SoftBank for about $40bn – assuming the UK government, which is examining the deal on national-security grounds, allows the deal to go head. Huang reckons that acquiring the chipmaker at the heart of most smart devices globally will be a transformative move – hastening his vision to unleash “the modern Big Bang”.

Unsurprisingly, the rest of the industry has misgivings about such a stranglehold of power. Moreover, the US-China trade war, and the current acute shortage of chips, have rammed home, even to the most technically illiterate, the strategic importance of semiconductors. Huang may go down in history as one of the great prophets of the AI age. Unfortunately for him, perhaps, the rest of the world has cottoned on.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

Luana Lopes Lara: The ballerina who made a billion from prediction markets

Luana Lopes Lara: The ballerina who made a billion from prediction marketsLuana Lopes Lara trained at the Bolshoi, but hung up her ballet shoes when she had the idea of setting up a business in the prediction markets. That paid off