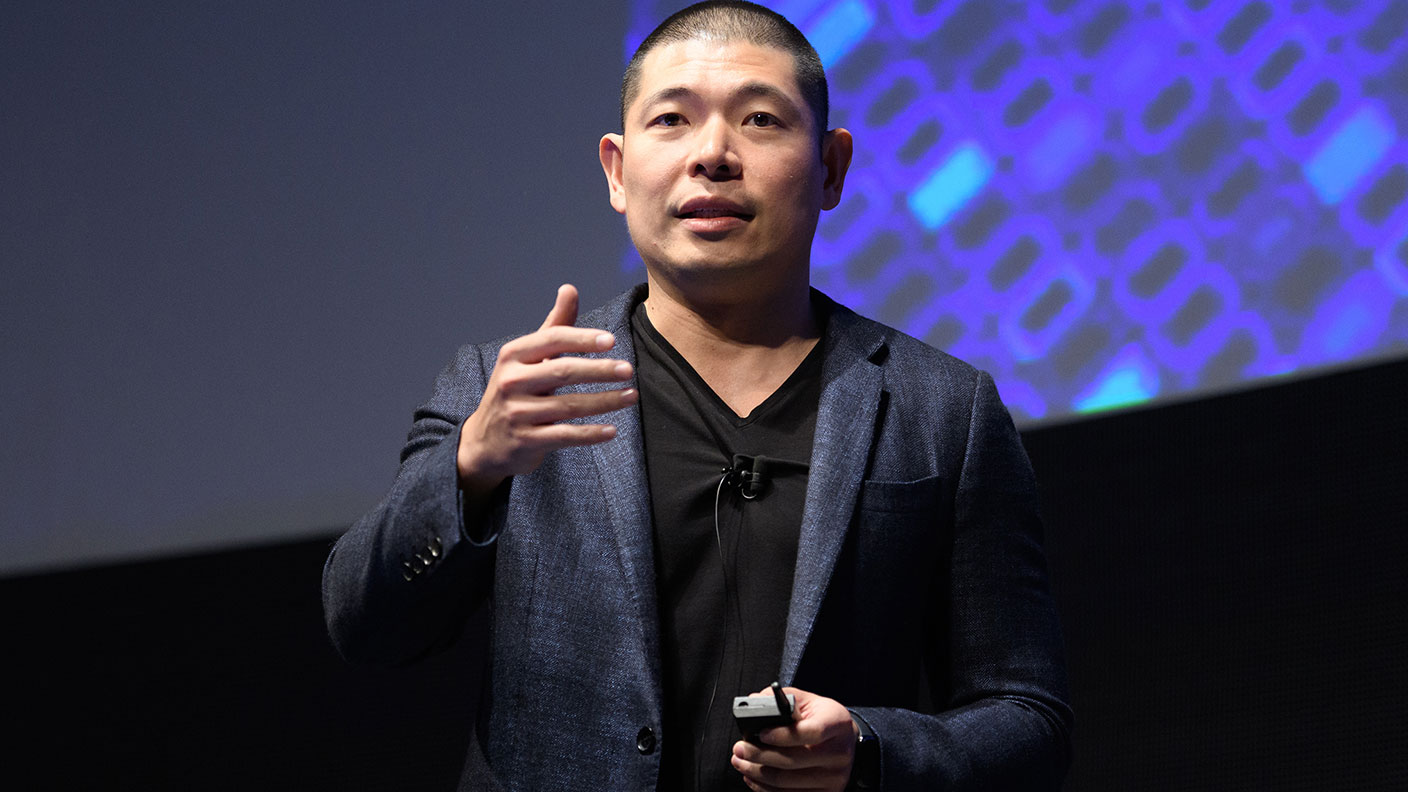

Anthony Tan: the Malaysian business scion taking on Uber

Anthony Tan has always been unabashedly ambitious and, in taxi-hailing apps, saw his chance to get into the history books. The competition, though, may be about to hot up.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Parental relationships can be important when starting new businesses. Rarely more so than in the case of Anthony Tan – originator of the Asian “super-app” Grab, which having proved “an Uber killer” in its home markets is now readying for a $35bn-$40bn Wall Street float in the largest special purpose acquisition company (SPAC) deal yet seen.

Tan’s mother was one of the first investors in Grab’s Malaysian forerunner MyTeksi – the online taxi-booking service founded by the youthful entrepreneur in 2012, says the BBC. She was also pivotal to the app’s acceptance among institutional investors. “We saw how he spent time with his mum, how he talked to her, and how much respect he gave her,” says Kee Lock Chua of Vertex Ventures. “That told us he had strong character and conviction. Besides the solid idea, that helped us make the decision to invest in the business.” Chua’s firm paid $11m for a 22% stake in Grab: by the time he exited seven years later, it was worth “more than ten times that amount” – a measure of the company’s mushrooming growth as it expanded beyond taxis into food delivery, insurance, payments and lending across eight countries to become Southeast Asia’s most valuable start-up.

“The eye-popping numbers give a sense that Tan is blazing a trail for the entire region,” says the Financial Times. That is “very much in character”. Born into one of Malaysia’s wealthiest families, Harvard-educated Tan, now 39, has always been “unabashedly ambitious”, proclaiming just two years after founding the company that “if we get this right, we can literally go into the history books”. According to a lawyer whose firm works for Grab, “Anthony always wants to be number one”. He’s also spiritually driven, citing Jesus Christ as a business hero and describing his job as a “mission” to serve Southeast Asians’ needs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It could all have been very different, notes a Harvard Business School profile. As a scion of the family behind Tan Chong Motor, one of Malaysia’s biggest car distributors, Tan was expected to join the family business. But he was bitten by the entrepreneurial bug while at Harvard. Challenged by a classmate, he came up with a plan to revamp the Malaysian taxi market.

Only connect

It’s perhaps Tan’s unique mix of connections – he was “heavily influenced” by meetings with tech founders such as YouTube’s Steve Chen, and “lean start-up” gurus – that has done most to fuel Grab’s growth, says the FT. Supporters say it took someone like him “to navigate Southeast Asia’s interlinked world of politics and business”. But he’s never lost touch with street life. Now married and living in Singapore, he can often be seen eating cai fan (a cheap rice dish) in shopping malls. That familiarity with business on the ground helped in the epic battle to oust Uber. While the latter was seen as a competitive threat by local cab drivers, Grab was perceived as an ally. Thus when Tan decided to leverage Grab’s customer-base and offer financial services, it was viewed more as a helpful evolution than a power grab, says the BBC.

That said, the risks to Grab are mounting. There’s a danger that local governments will emulate China’s crackdown on e-commerce giants getting into digital banking. More imminently, he faces the challenge of debuting on Wall Street “just as institutional enthusiasm for SPACs is waning and short-sellers are circling”, says the Financial Times. “Anthony is a street fighter,” says a former employee. He may need to be.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

Luana Lopes Lara: The ballerina who made a billion from prediction markets

Luana Lopes Lara: The ballerina who made a billion from prediction marketsLuana Lopes Lara trained at the Bolshoi, but hung up her ballet shoes when she had the idea of setting up a business in the prediction markets. That paid off