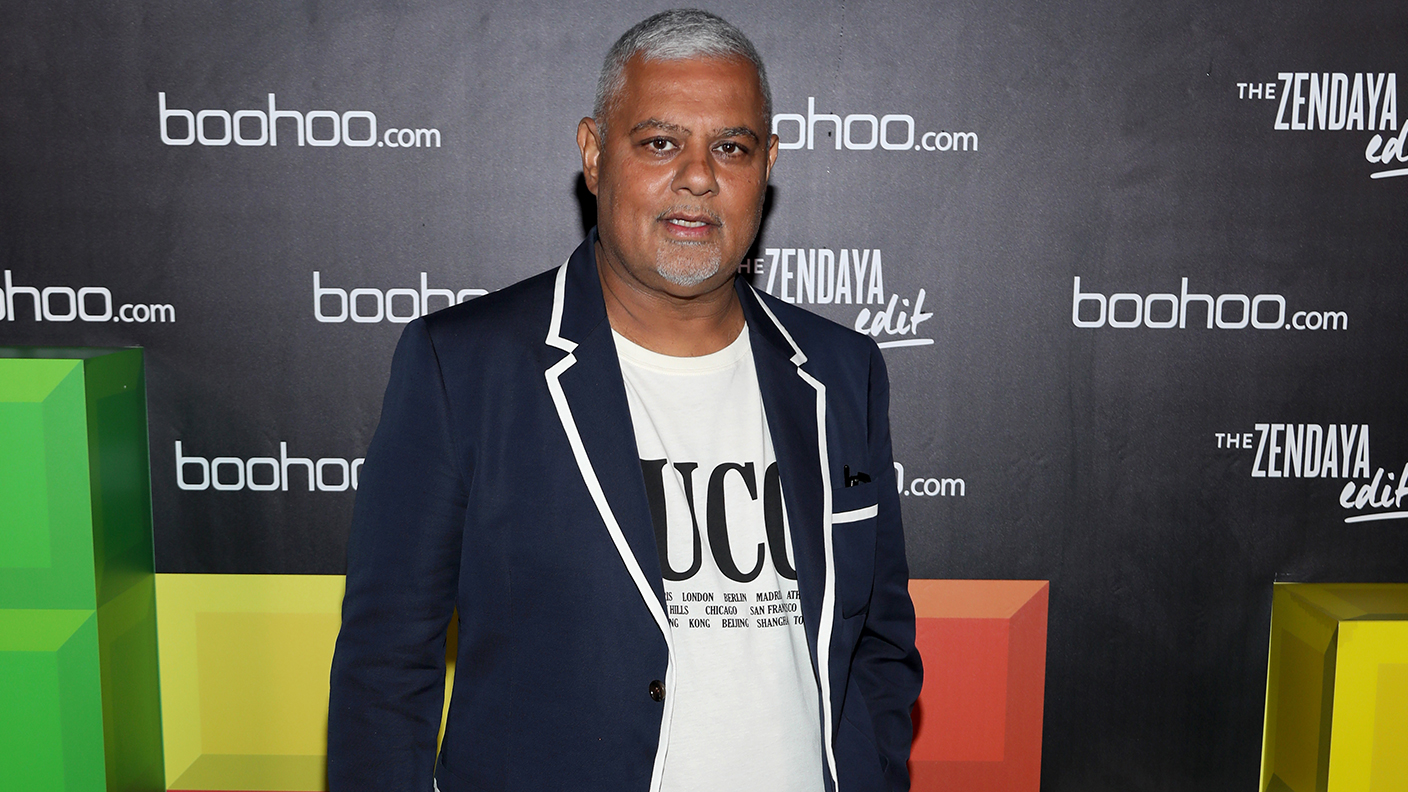

Mahmud Kamani: a modern rags-to-riches tale

Mahmud Kamani turned fast-fashion website Boohoo into a business worth billions. The coronavirus crisis may have brought the company’s biggest challenge yet.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When Boohoo, the Manchester-based fast-fashion sensation, floated in 2014, the FT observed how business in the old “Cottonopolis” had changed. Although the former mill district in the city’s northern quarter was still “a centre for the rag trade”, fortunes once made “by making clothes” were “now made from selling them”. No-one better exemplified this shift than Mahmud Kamani – an entrepreneur who “grew up on these streets” and went on to disrupt the British high-street with his online emporium.

The firm’s “explosive growth” – on the back of its PrettyLittleThing and Nasty Gal brands, plus some clever Instagram marketing – has defied the “doom and gloom” engulfing many rivals, says Business Insider: in the past five years, it has gone from £195m in sales to £1.2bn, making a billionaire of Kamani.

Sweatshops in the spotlight

This month, Boohoo hit its first rough patch since listing. With up to 3,000 new lines arriving on its website each week, the firm’s status as “teen tailor of choice” was built on reacting quickly to trends, says the FT. Hence the need to source locally: over half of the company’s clothes are made in the UK – by a network of small, independent, mainly Leicester-based factories. The Midlands city has long attracted scrutiny over working conditions in these, but it took the Covid-19 pandemic and a resulting Sunday Times investigation into unhealthy “sweat-shops” to make this an urgent issue.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Hence some £2bn was wiped off Boohoo’s value last week amid allegations about some of its suppliers. The firm said that it was “shocked and appalled” by the claims, had severed ties with two suppliers and commissioned an independent investigation into its supply chain, notes The Daily Telegraph. But given a row over the generous bonuses awarded to Kamani and Boohoo co-founder Carol Kane, the timing was unfortunate. Some investors are spooked about how thoroughly the company knows its own supply chain.

Doubtless Kamani, 55, will hope this turns out to be a small bump in Boohoo’s spectacular trajectory and in his family’s rags-to-riches tale. Kamani’s father,

Abdullah, arrived in Britain from Kenya in 1968 “with a wife, four children and a few hundred pounds” and got into the rag trade using “family ties with Asia and Africa to import clothing”, says FT. The young Kamani cut his teeth in the business selling cheap clothes, under the Pinstripe label, to high-street brands including H&M, Topshop and Primark.

It was there that he met Kane, a designer for the brand. Both were quick to see the internet as a way “to cut out the middleman” and market directly to customers, says The Sunday Times. So in 2006, they set up Boohoo. The partnership covered all the bases: “He had the money, while Ms Kane knew the industry and the tastes of fashionable young women”, says the FT. It helped that Kamani was a natural salesman with “bags of energy”.

Keeping it in the family

All three of Kamani’s sons caught “the family bug”. PrettyLittleThing was set up by Adam and Umar in 2012 when they were teenagers. The youngest son, Samir, now heads the menswear division, BoohooMan.

The younger generation are practised hands on social media – titillating followers with shots of celebrity parties, glamorous cars and exotic holidays. But Kamani himself rarely gives interviews.

Earlier this year he stepped down as CEO to become Boohoo’s executive chairman, but this is unlikely to be a prelude to retirement. “Some people like golf, others like football. I like work,” he once told The Mail on Sunday, pointing out that, even at the age of 80, his father still showed up in the office every day.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

Luana Lopes Lara: The ballerina who made a billion from prediction markets

Luana Lopes Lara: The ballerina who made a billion from prediction marketsLuana Lopes Lara trained at the Bolshoi, but hung up her ballet shoes when she had the idea of setting up a business in the prediction markets. That paid off