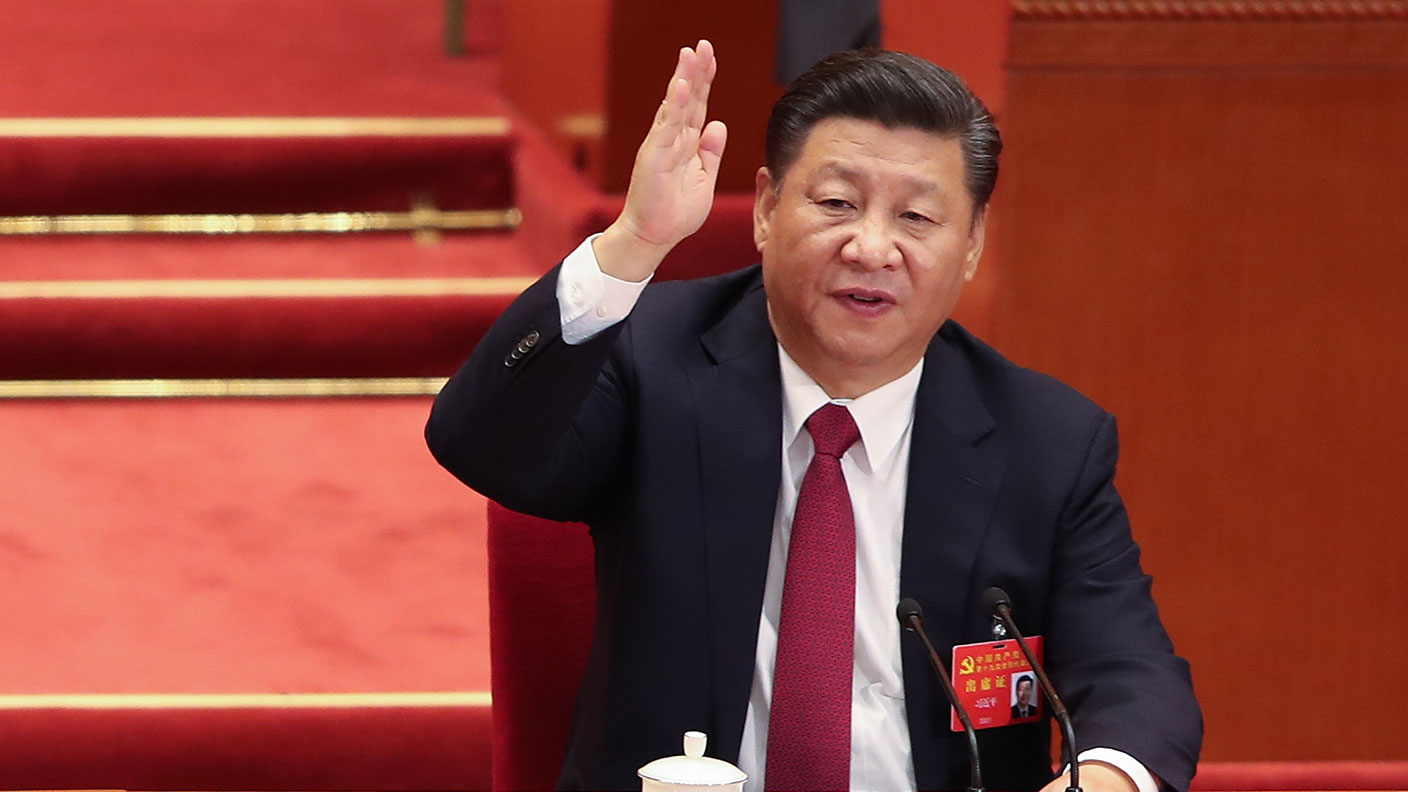

China unveils £1.08 trillion stimulus package to tackle debt

China's new stimulus package addresses local government debt but fell short of many investors' expectations – here's why

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

China has announced a ¥10trn (£1.08 trillion) stimulus package, but investors are “disappointed”, say Samuel Shen and Tom Westbrook on Reuters. Since September, Beijing has unveiled interest-rate cuts and an “unprecedented” ¥800 billion stock market rescue package.

The CSI 300 share index jumped 25% but has lost momentum in recent weeks as markets have awaited more details on stimulus plans. The new ¥10 trillion package addresses local government debt, but included “no measures to facilitate bank recapitalisation and/or boost consumption”, Nomura analysts tell the Financial Times. The emphasis is on “stabilisation rather than stimulus”.

China needs to tackle hidden debt

China’s central government has relatively low debt levels, but the same cannot be said for provincial administrations, say Meaghan Tobin and John Liu in The New York Times. Local governments have borrowed heavily for years to finance infrastructure projects and hit official growth targets.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Covid didn’t help – debt levels in many provinces doubled from 2018 to 2023. Local officials got around borrowing limits by using off-balance sheet “local government financing vehicles” (LGFVs). LGFVs are “quasi-commercial infrastructure firms” that enjoy state backing, says The Economist. LGFV's debt is thought to have been $8.6 trillion by late 2022. The new stimulus will allow local governments to refinance these debts at a lower interest rate, yielding ¥600 billion (£65 billion) in savings over five years. But that amounts to “less than 0.1% of China’s expected GDP” over the period.

Total central and local Chinese state debt is just over 50% of GDP, says Jacky Wong in The Wall Street Journal. But add in LGFVs, and public debt “has risen from 73% in 2019 to 102%”, according to Morgan Stanley estimates. China’s local governments are “responsible for the bulk of public spending from infrastructure to education” but they “lack reliable revenue sources to match”. They used to rely on land sales to make ends meet, but a sluggish housing market has slashed that income.

With Donald Trump vowing to impose 60% tariffs on China, investors think further stimulus could be coming. Goldman Sachs thinks a 60% tariff could cut Chinese GDP by 2%, compared with a 0.65% hit from the 2018 trade war.

There is a “mismatch” between investors’ expectations and Beijing’s priorities, warns Nicholas Spiro in the South China Morning Post. Markets think Trump’s tariffs, which will hit Chinese exporters, will force officials to stimulate domestic consumption to compensate. But the government does not want to overheat the economy or send debt levels soaring again. As Robin Brooks of the Brookings Institution puts it: “China has only one option in response to tariffs: allow the [yuan] to fall hard and fast... Markets should stop chasing China stimulus.”

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn