How to pay for the pandemic

Covid-19 has proved extremely expensive. It’s time to consider fresh sources of government revenue, says Edward Chancellor

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The war on Covid-19 has proved remarkably expensive. The US federal deficit last year ran to $3.4trn. That’s nearly 95% of Washington’s total tax take. How to foot the bill? So far, President Joe Biden’s administration has only proposed tinkering with the current tax system. The White House has called for the maximum tax rates on income, corporate and capital gains to rise (capital gains tax might also become payable on estates). UK prime minister Boris Johnson is considering a reduction in the tax benefits enjoyed by pensions. Given Britain’s poor savings record, a raid on retirement plans appears ill-advised.

Rich Americans are expert at avoiding income taxes. Investigative journalists at ProPublica have revealed that several of America’s richest citizens – including Jeff Bezos, Elon Musk, George Soros and Carl Icahn – didn’t pay federal income tax in some years. In 2015, some 14,000 US taxpayers paid more income tax than Berkshire Hathaway’s boss Warren Buffett. The Sage of Omaha enjoys a relatively low income-tax bill because he seldom realises capital gains and Berkshire doesn’t pay a dividend. Corporate America is equally adept at minimising its tax liabilities. The five most valuable US companies – Microsoft, Apple, Facebook, Alphabet and Amazon – pay 15% of their profit in taxes, nearly a third less than last year’s statutory US corporate tax rate of 21%. It’s time to consider fresh sources of government revenue. Here are some possible new taxes to do the trick:

Wealth Tax

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Billionaires might find it harder to avoid a wealth tax than income tax. Besides reducing inequality, an annual wealth levy, which already exists in some form in prosperous economies including Switzerland and Norway, could replace capital gains and the hugely unpopular estate tax. The richest 25 Americans, from Bezos to eBay’s founder Pierre Omidyar, are worth $1.8trn dollars, according to Forbes. A 2% tariff on their wealth would raise around $36bn, many multiples of what they pay in income tax. But critics claim such a levy would discourage enterprise and hurt small businesses.

Leverage Tax

Financial analyst Martin Hutchinson has mooted a tax on corporate leverage. Hutchinson argues that leverage is a source of financial instability. In recent years, companies have taken advantage of easy money to get further and further into debt. A leverage tax would reduce debt-funded buybacks and other types of financial engineering. Instead of “de-equitising”, firms would have an incentive to replace debt with equity. AT&T is currently the most leveraged non-financial US corporation with total liabilities close to $350bn. If those liabilities were taxed at 2%, the phone company would pay nearly $7bn more.

Monopoly Tax

As Adam Smith pointed out, a dynamic economy requires free competition. Yet, as Jonathan Tepper shows in his recent book, The Myth of Capitalism, the US economy has become dominated by corporate behemoths. Research suggests that companies with dominant market positions are more profitable, but tend to invest less.

It used to be the job of antitrust regulators to dismantle monopolies, but lately they have sat on their hands. A profits tax based on market share would do the job more efficiently while raising tons of cash. As Tepper writes, “If we have progressive income tax because the marginal utility of money is lower for the very wealthy, why should we not tax corporations similarly?”. Facebook currently pays around 13% of its profit in taxes. If the social-network giant’s tax rate was based on its global market share, its corporate rate would increase more than fivefold. Society would benefit if the monopoly rents currently enjoyed by Facebook, Google and other tech giants went into the public purse.

Green Sales Tax

A key weakness of capitalism is that those responsible for damaging the environment often avoid paying up. The British-born economist and Nobel laureate Ronald Coase suggested long ago that the state should charge companies for “externalities”, such as pollution. An alternative approach would be to include environmental costs in a sales tax. Such a tax would mimic the “sin taxes” already added to tobacco and petrol. Thus, diesel-powered cars would attract a higher sales tax than electric vehicles, and the tax on intensively reared beef would be higher than grass-fed beef. The level of the green sales tax could be linked to the amount of carbon dioxide emitted in production.

Since externalities are hard to measure, such a tax would be administratively complex. Besides, there’s a danger that any new tax will have unforeseen consequences. When William of Orange introduced the Window Tax in 1696 to pay for Britain’s war with France, homeowners bricked up their windows. After France introduced a wealth tax in the 1980s, thousands of millionaires fled the country. President Emmanuel Macron abolished the tax in 2017.

Political realities mean few, if any, of these proposed new taxes will see the light of day. Instead, politicians will resort to the oldest tax of all, a tax that requires neither legislation nor the assent of the people. Since ancient times, states have met the costs of war by debasing their currencies. Little has changed in the interim. Today, central banks are busy printing money to buy government debt. An inflation tax is in the offing. Even the canny Buffett will have trouble escaping its reach.

A longer version of this article was first published on breakingviews.com.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

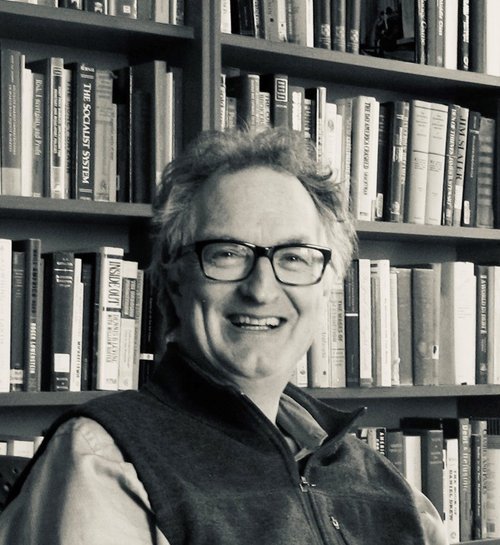

Edward specialises in business and finance and he regularly contributes to the MoneyWeek regarding the global economy during the pre, during and post-pandemic, plus he reports on the global stock market on occasion.

Edward has written for many reputable publications such as The New York Times, Financial Times, The Wall Street Journal, Yahoo, The Spectator and he is currently a columnist for Reuters Breakingviews. He is also a financial historian and investment strategist with a first-class honours degree from Trinity College, Cambridge.

Edward received a George Polk Award in 2008 for financial reporting for his article “Ponzi Nation” in Institutional Investor magazine. He is also a book writer, his latest book being The Price of Time, which was longlisted for the FT 2022 Business Book of the Year.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

The scourge of youth unemployment in Britain

The scourge of youth unemployment in BritainYouth unemployment in Britain is the worst it’s been for more than a decade. Something dramatic seems to have changed in the labour markets. What is it?

-

In defence of GDP, the much-maligned measure of growth

In defence of GDP, the much-maligned measure of growthGDP doesn’t measure what we should care about, say critics. Is that true?

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again