Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

So, you think the dollar's going to crash, eh?

Then what are you going to run to... the euro? Ha! You might just be jumping from the frying pan to the fire...

What makes a euro better than a dollar? Nothing.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

They're both paper money. The US dollar is "backed by the full faith and credit of the US government." I'm not sure what that gets me. But the euro is backed by... what exactly?

The US and Europe were both hit by the Great Recession. As I've showed you recently, the US appears to be coming out of it. Europe isn't. The Economist forecasts the Euro-area economy will shrink by 4.4% this year.

Well, then, you must get paid more for putting your money in Europe, right? Nah... Benchmark 10-year bonds in Germany pay less interest than their US counterparts. No interest-rate advantage.

OK... Then Europe must not face the kind of inflation we're likely to see in the US, right? Wrong again. For 2009, inflation in the US will likely be negative (-0.4% is the consensus forecast, believe it or not). While in Europe, inflation is expected to be positive (+0.4%).

Well there's got to be some reason to buy the euro... How about because it's cheap relative to the dollar? Wrong again! And this is the one that really gets me...

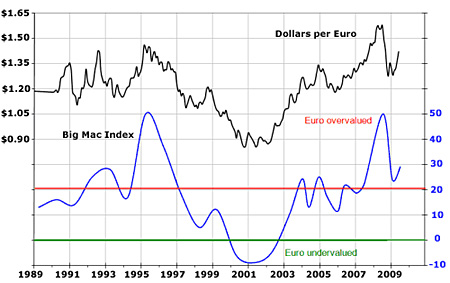

The euro is actually more than 30% overvalued today versus the US dollar. That's according to one of my favorite currency indicators the Economist's "Big Mac Index".

Once or twice a year, the Economist finds the prices of a McDonald's Big Mac all over the globe. You see, a Big Mac is essentially the same all over the world. So in developed countries, all things being equal, a Big Mac should cost roughly the same. When you start seeing big discrepancies, you know something is out of whack with the currency.

I've tracked this Big Mac Index for 20 years. The track record has been pretty good... When a Big Mac gets cheap in Europe (relative to the US), the euro eventually rises. And when a Big Mac gets expensive in Europe (relative to the US), the euro eventually falls.

See for yourself:

The Big Mac Index shows the euro is way overvalued

Right now, the euro is overvalued at $1.42, based on the Big Mac Index. It's only been up at these heights once before... back in 1995 (I'm using the German mark as a proxy). The euro crashed over the next six years, bottoming in 2001.

When the world economy started to unravel in 2008, investors wanted dollars, not euros. Now that we've had a few months of sunshine, investors like euros again. But why?

What makes a euro better than a dollar? Nothing.

So before you consider getting your money out of the dollar and into the euro, think about what you get for your money... With the euro, what you get is a currency that's 30% overvalued with no advantages over the dollar whatsoever.

I'm not excited about the future of the US dollar. But I'd rather keep my cash in dollars than euros right now...

This article was written by Dr Steve Sjuggerud for the free daily investment email DailyWealth

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King