Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Scan the Companies section of the FT and you find plenty of comment on large, well-known firms. But what about their smaller cousins? Comment tends to be sparse from both papers and analysts. Yet, as investor Jim Slater once noted of many large companies, "elephants don't gallop". Pick the right small firm, he added, and it could jump like a flea.

Long-term performance numbers confirm that size isn't everything; over time, you're better off investing at the small end of the company scale. And 'value' stocks that are cheap measured by low price/book, price/earnings and price/earnings-growth ratios tend to do best. Between 1927 and 2005, US small-cap value stocks rattled along at 12% annually, according to research by stockmarket scholars Eugene Fama and Kenneth French. By contrast, the US stockmarket overall rose by just 6.7% on an annualised basis.

It seems that small-cap stocks sized between about $250m and $1bn can grow faster because they're more flexible. Their overheads tend to be lower, and they can increase their sales more rapidly than larger rivals because they have a lower market share. Yet they're often rated lower by the market because their share registers are less dominated by the major investors to whom most analysts pander. So fewer investment firms follow them and less time is spent analysing their results. Tricks are missed and bargains go unearthed.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That's all very well, but private investors may lack the necessary expertise, or time, to identify the good apples too. So here are two shortcuts. Look first for an out-of-favour, but recovering, market. Japan fits the bill. As fund manager Simon Somerville says, "Japan is completely unloved by everyone", having shrunk a record 3.8% in the first three months of this year. Yet HSBC economist Seijii Shiraishi believes the economy has already "probably bottomed".

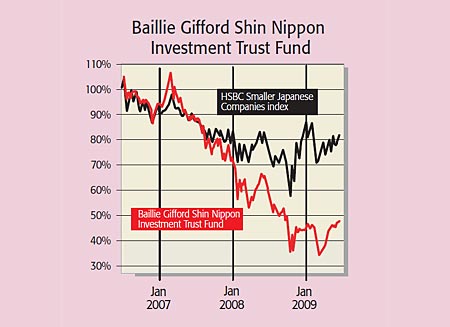

Next, find a decent fund to remove the headache of detailed research. The Baillie Gifford Shin Nippon Investment Trust (LSE: BGS), for example, is down an eye-popping 51.5% over three years, but has recovered 22% since we recommended it two months ago. But it still trades at a discount of 15% to its asset value, so you're buying into its investments on the cheap.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.