Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Without dividends, investing in stocks is a waste of time. Data from the London Business School and Credit Suisse show that US equities returned an average 6% a year since 1900. Without dividends, that falls to just 1.7%. So the news that the dividend swaps market now expects a 65% drop in dividends between the end of 2007 and 2009 is hardly reassuring for equity investors.

But some argue that this is overdone. Morgan Stanley points out that "even in the 1930s depression" dividends fell just 55%. So the swap market is implying either "total meltdown, or a compelling investment opportunity", says Andrew Lapthorne of Socit Gnrale. Those investors who think it's the latter, might well be eyeing the yields on equity income funds, particularly with savings accounts offering barely-there interest rates.

But be careful. Just because an equity income fund has a high yield doesn't mean it will be able to maintain it. As Harpreet Sajjan at Financial Express Research points out: "Banks, one can assume, won't be paying lucrative dividends this year as they have done in the past." But because they make up 16% of the FTSE 100, many funds still have exposure to banks. New Star High Income, for example, yields 10.2%, but over 25% of its holdings are financials-related.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

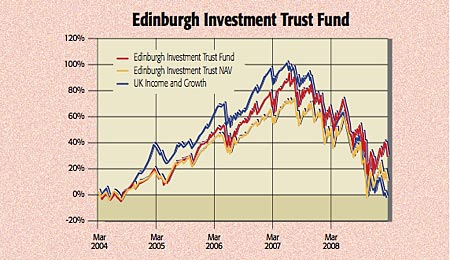

For a more sustainable yield, Sajjan suggests investors look for funds with little or no constraints on where they invest, such as the Trojan Income fund. Down 12.1% over one year against 29.8% for the equity income sector, it currently yields 5.4%. However, as we recently pointed out, a better bet for sustainable income might be investment trusts (Need income? Try an investment trust). They only have to pay out 85% of the income they make every year to shareholders, and can keep the rest for leaner times. The City of London Investment Trust (LSE:CTY), for example, which yields 5.8%, has been able to raise its annual dividend each year over the past 42 years. And Neil Woodford's Edinburgh Investment Trust (LSE:EDIN) offers a healthy yield (6.3% in this case) and trades at a discount to its net asset value. Better still, the fees charged on investment trusts are lower too.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how