Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As we said two weeks ago, all interest rate roads lead to zero. The Bank of England has taken one step closer; UK rates are now 1% - a 315 year low - and set to go lower. The effect of this latest action is negligible, it's a bit like firing a gun into a dead animal - it makes a lot of noise and causes a lot of mess, but doesn't achieve very much other than highlighting the paucity of ideas.

As intimated in the previous issue of the 360 newsletter, we have now increased clients' portfolio exposure to long-dated gilts from 10% of portfolio values to 15%. We are heartened in this decision, believing strongly that we are investing alongside the Bank of England which is no bad thing. Mervyn King has been very explicit in his recent remarks, not only saying that the economic condition facing the UK is as bad as it could be, but also that quantitative easing will commence, probably in March, an important purpose is to buy gilts and drive down the yields. If the yields decline, gilt values rise.

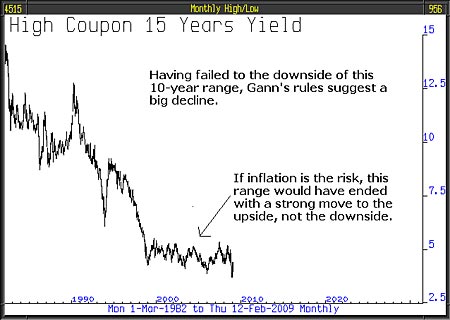

We publish below the long-term chart for 15-year gilt yields. Recently the yield fell below a ten-year range, according to W D Gann, and what should now follow is an extensive move in the direction of that break. We haven't yet had an extensive move, we have only had a modest move albeit it over a short period of time, and following that a subsequent retracement back to the 30-week moving average.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Turning your eyes now to the shorter term chart below, this rally to the 30-week moving average has clearly failed, which should mean that we are on the next leg down of a journey, possibly to 2.5%. The potential upside for gilts therefore is just huge.

Those who are worried about excessive issuance and higher inflation should also consider austerity-driven falling demand and over-supply of goods. We are confronted with monetary inflation and gold's benefiting from that; however, over-supply at a time of credit crisis is very negative for retail price inflation.

If, as we expect, the stock market is going to break down again and other asset markets such as property are going to further weaken, where else but in gilts will the pension funds put their money, and where else will the risk averse put their money?

Everybody says that gilts will go down in value because of increased issuance, except that nobody seems to have told the gilt market. The end of the 10-year trading range should have been marked by gilt yields breaking to the upside if inflation was a genuine risk; the fact that it was to the downside says that no matter how unlikely, inflation and issuance are not issues for the foreseeable future.

Owning long-dated gilts is a thoughtful investment position, we watch it like a cat watches a mouse hole, we reconsider the investment decision every day and if price action behaves in a way we don't expect, consider closing the position. Our mantra is, don't lose money and outperform cash by as much as possible. Our diligent work process is targeted to achieve that.

This article was written by John Robson & Andrew Selsby at Full Circle Asset Management ,as published in the threesixty Newsletter on 13 February 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.