Funds: it's time to get into Japan

With its banks able to fund themselves, Japan is largely free from the West's current financial problems - and may be at a 'sound starting point' for recovery. Jody Clarke profiles the best funds to buy to get into Japan.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Credit is the lifeblood of the modern economy, which is one reason why we're all in so much trouble. Not many banks are raising lending right now most can't afford to. But Japanese banks are different. Having suffered Japan's huge bust in the early 1990s, they've already been through the pain of deleveraging and balance-sheet repair that most Western banks are only now embarking on. With comparatively clean slates, they lent out 3.7% more year on year last month, and should make a 200bn profit ($2.2bn) in the nine months to December. That's down 80% on 2007, but it's still a profit more than many of their Western peers can boast.

But even though Japan is free from the West's current financial problems, the credit crunch has brought other woes. Chief among them is the battering its export sector is taking from the strong yen in December, Japanese exports fell 35%. Just a year ago, $1 bought 113. Today, it fetches around 90, amid the unwinding of the carry trade where investors borrowed cheaply in yen and invested in high-yielding currencies such as the New Zealand dollar. That's driven up the price of Japanese products abroad, just as US and European consumers are curbing their spending. This is bad news for companies such as Sony, which sells 80% of its products abroad. "With growth in Asia and other emerging economies slowing, there is nothing to support Japanese exports," says Yoshiki Shinke at Daiichi Life Research Institute. Yet exports account for just 18% of Japanese GDP against almost 40% in China and 25% in the UK. So theoretically, Japan shouldn't worry too much about foreigners not buying its products. And because the Japanese have pulled money out of overseas investments, households are sitting on a lot of cash. That should be supportive for both consumer spending and stocks.

But "just like elsewhere, the economy has hit a brick wall", says Chris Taylor, manager of the Neptune Japan Fund.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

His fund is up 85% over one year, but only because he took a massive short position on the Topix in September. Car sales are down a fifth Toyota is shutting its plants for 25% of its forecast production days and department store sales are off 10%, says The Economist. "So the earnings forecasts are still way too optimistic. Firms are beginning to downgrade and some may cut their dividends," says Taylor. Goldman Sachs expects the economy to shrink by 3.8% this year.

Others are more upbeat. The Nikkei 225 fell by 42% last year, pushing the average dividend yield up to around 2.6%. That's more than twice the rate of return on ten-year Japanese government bonds, and looks pretty sustainable even as earnings fall, says Shoji Hirakawa, Tokyo-based chief strategist for Japanese equities at UBS. "The dividend yield is still attractive," he wrote in a recent report. "Even if profit falls sharply, dividend growth is often maintained in the initial year of an earnings deterioration phase."

Stocks are cheap. The "majority of the market is trading below book value", says Matthew Brett, Japanese specialist at Baillie Gifford. Over half the firms on Tokyo's Topix trade below book value trading at a lower price than they would theoretically get if they were shut down and their assets sold off. The index is trading on a price-to-book ratio of 0.86, compared with the FTSE 100 on 1.22 and S&P 500 on 1.65. On the Graham Dodd valuation measure (which compares earnings over the past ten years to the current market cap), Japan is at its lowest level since data began in the 1970s. "There is clearly a lot of economic uncertainty. But Japan is at a very different point" to other developed economies. "There's been no excess of animal spirits for a long time and banks are still able to fund themselves. So it is at a sound starting point" for a recovery.

Corporations seem to agree more than a third of Tokyo-listed firms have now taken the opportunity to buy back shares. We believe you should follow their lead see below for some suggestions.

The best funds to buy

With exporters coming under the most pressure from the yen's strength, focusing on smaller and medium-sized domestic stocks could be a wise move in the year ahead. Baillie Gifford Japan Trust (LSE:BGFD) invests in small to medium-sized Japanese stocks, including discount store group Don Quijote. The trust is down around 16% over the past year, but trades on a hefty discount to net asset value of 14%.

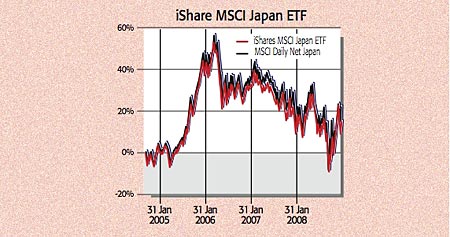

Alternatively, investors can simply track Japanese stocks through an exchange-traded fund (ETF). The iShares MSCI Japan ETF (LSE:IJPN) tracks the MSCI Japan index (see chart). The fund has total annual costs of 0.59%. The broader Lyxor ETF Japan Topix (LSE:LTPX) is cheaper with annual costs of 0.5%, and tracks Japan's Topix index. It's up 23% over the past three months, and up 3% over one year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jody studied at the University of Limerick and was a senior writer for MoneyWeek. Jody is experienced in interviewing, for example digging into the lives of an ex-M15 agent and quirky business owners who have made millions. Jody’s other areas of expertise include advice on funds, stocks and house prices.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.