Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

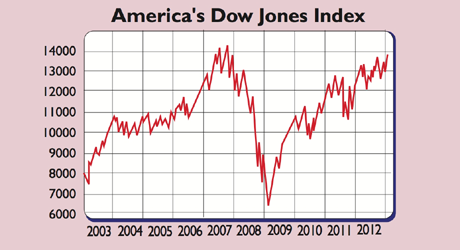

The bulls are running rampant. America's Dow Jones Index, after its best start to the year since 1987, is near a new record high. The FTSE 100 has eclipsed 6,300 for the first time since 2008. The US Vix index, a reflection of the expected volatility in the market, is at April 2007 levels, showing that investors haven't been this relaxed since before the financial crisis.

But "when everyone stops worrying about safety that is when you should worry", says Matt King of Citigroup. The rally isn't completely unjustified: American economic data and earnings have been better of late and lawmakers have postponed a potential spat over the debt ceiling. Europe is looking calmer and optimism among German executives has fuelled hope that Germany will avoid recession. Chinese data has improved.

After "brooding about calamity", even half measures such as a three-month delay in the US debt ceiling stand-off "can feel like a reprieve", says Kopin Tan in Barron's. Similarly, "against lowered expectations", the 7.7% year-on-year rise in fourth-quarter profits that US firms have reported can seem like cause for celebration. But the markets' "group hug" is starting to look overdone.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The sheer speed of the rally and the dominance of cyclical stocks suggests that markets think "a strong economic recovery is at hand", says John Authers in the Financial Times. This looks too optimistic. The latest data from Europe may show a slight improvement, but are still consistent with a recession, says Capital Economics.

China will be loath to stimulate its economy too much for fear of reigniting the debt-driven investment boom. And the unsolved fiscal stand-off in the US Congress means there is still plenty of scope for spats to damage both economic growth and stock prices.

Indeed, $200bn of tax hikes are on the way and they could well be followed by large spending cuts in March if these are not postponed by a new deal. Ron Sloan of Invesco notes there is little scope for US earnings to rise this year as profit margins are already high. Then there's the euro crisis, which is likely to flare up again at some stage as the southern states are struggling to keep a lid on deficits.

With markets red hot and prospects for a sustainable economic recovery far from encouraging, the odds of a setback are growing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how