Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

You'd think the biotech industry would be worried right now. If American lawmakers push through a 'follow on' biologics bill, biotech firms will be forced to compete with generic versions of the drugs it took them years to develop, pushing down prices. But it's not as easy as that. Biotech drugs don't just "come about by throwing chemicals in a test tube", says Geoffrey Hsu, manager of the Biotech Growth Trust (LSE:BIOG).

Made from living cells, these drugs are "difficult to make, so if not done exactly right can result in different reactions, clinical profile and efficacy". So even if the bill is passed, there's no guarantee competitors will be able to create generic rivals rapidly. That means biotech should continue to thrive, just as it did in 2008.

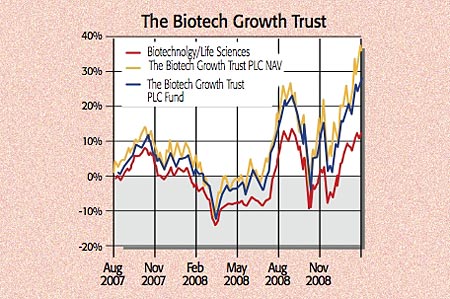

Up 26% over one year, Hsu's fund has been helped by sterling's drop against the dollar and the defensive nature of the industry. "If someone is dying of cancer, they'll get the drug no matter how the economy is," he says. Some shrewd stock picks have also paid off. Life sciences group Tepnel Life Sciences was bought for 27p a share last month by Gen-Probe. At the beginning of 2008, it traded at 11p. More acquisitions are expected this year as big pharma diversifies into biotech.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Focusing on mid-cap companies that don't need regular infusions of cash, Tsu invests 60%-80% of the fund in firms with a biotech slant that have yet to turn profitable. This might sound like a risky approach to investing, he says, as only a minority of companies will make it to profitability. But "our job is identify which ones will". An investment trust, the fund trades on a discount of 8.6%.

Contact: 020-3008 4910

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }

td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

The Biotech Growth Trust top ten holdings

| Amgen Inc | 13.6 |

| Gilead Sciences Inc | 11.7 |

| Genentech Inc | 8.0 |

| Celgene Corp | 6.4 |

| Vertex Pharmaceutical | 5.3 |

| Genzyme Corp | 4.9 |

| Biogen Idec Inc | 4.7 |

| Allos Therapeutics | 4.2 |

| Onyx Pharmaceuticals | 3.7 |

| Infinity Pharmaceuticals Inc | 3.6 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how