An ETF to buy to profit from the complacency over Italy

Investors have become complacent over the dangers facing Italy. Paul Amery tips one exchange-traded fund to buy for when the reality finally hits home.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

For those with long enough memories, the stalemate bequeathed by Italy's late-February election is nothing new. Only the actors on the stage change, with comedian Beppe Grillo's Five Star Movement the latest beneficiary of popular discontent with the Italian ruling elite.

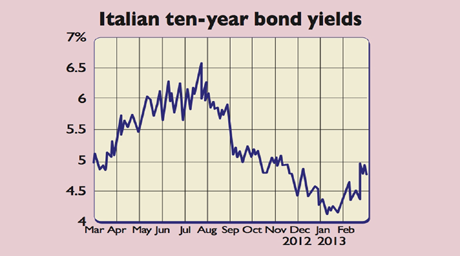

But what has been surprising in the aftermath of the election is the relative stability of the financial markets. The yield on the ten-year Italian bond, a benchmark for the confidence of investors in Italy's ability to repay its debts, has stayed near its recent lows. At 4.7%, it's well below a peak of 7.5% recorded in late 2011.

Grillo's pre-election promises included two that should really be spooking the markets more than they have. He said he would hold a referendum on leaving the euro and also introduce a temporary freeze on interest payments on government bonds in other words, default on Italy's €2trn public debt.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Investors may be hoping that Grillo won't gain access to the levers of power, that he's joking, or that they will be bailed out, come what may, by the European Central Bank (ECB). Since September last year, the ECB has promised to intervene in Europe's government-bond markets, where necessary, to boost prices and bring borrowing costs down.

However, the problem with relying on the ECB, says Citibank's Willem Buiter, is that "sovereigns take a holiday from painful decisions every time the pressure is off". They promise reforms but don't deliver on them, buying time but not resolving the underlying problem.

For the last year, indebted southern European governments have benefited hugely from the gigantic game of bluff being played by the ECB, while 80%-90% of those previously betting on a eurozone implosion have already been forced to exit their positions, according to one observer.

If you are on the side of the sceptics and think that Grillo's threats carry more weight than market participants assume, you could consider a short sale of one London-listed exchange-traded fund that tracks an index of Italian government bonds.

The iShares Barclays Italy Treasury Bond ETF (LSE: SITB), for example, is heavily exposed to bonds that are relatively sensitive to a change in interest rates and sentiment. To sell it short, you'll need a margin account with your broker and knowledge of the associated risks. Then this could be a bet well worth taking for the coming months.

Paul Amery edits www.indexuniverse.eu, the top source of news and analyses on Europe's ETF and index-fund market.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul is a multi-award-winning journalist, currently an editor at New Money Review. He has contributed an array of money titles such as MoneyWeek, Financial Times, Financial News, The Times, Investment and Thomson Reuters. Paul is certified in investment management by CFA UK and he can speak more than five languages including English, French, Russian and Ukrainian. On MoneyWeek, Paul writes about funds such as ETFs and the stock market.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn