Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

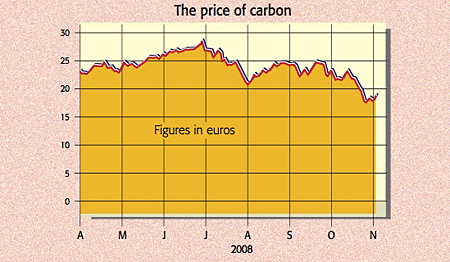

Carbon credits, which we tipped back in July, have fallen in value from €23 a tonne at the start of the summer to €18 a tonne now. The slowing economy means lower demand for oil and other carbon-emitting fuels. And as Kjertsti Ulset of research group Point Carbon tells Business Green, "any potential recession would mean lower emissions from industry, which would result in lower demand for carbon credits".

But will the price of credits keep falling from here? It seems unlikely. That's because the price of carbon credits depends only partly on how long and nasty the recession is. What's more important is what happens with the third stage of the European Emissions Trading Scheme (EU ETS), which runs from 2012-2020. The idea behind carbon credits is that each government in the EU gets an annual emissions allocation. It then splits this between polluting companies in the form of carbon credits known as European Union carbon allowances (EUAs). If a company's emissions are below its allowance, they can sell their spare credits to those who have breached their own allowance. Since the scheme began in 2005, trading has grown rapidly. Total EU ETS trading in the first half of 2008 was valued at about €30bn, equal to 750 million tonnes of CO2. That's an 80% rise year on year, according to ETF Securities, making the EU scheme by far the biggest in the world.

During the current phase (2008-2012), the EU has set a target of cutting emissions by just 10%. But during the third phase, it's already agreed to cut by 20%, and a 30% cut could be in the pipeline if there's international agreement, says Trevor Sikorsky of Barclays Capital. If that happens, governments will set companies tighter targets, pushing the price of credits up. Barclays expects the price of EU credits to rise to €26 by the end of 2008 and €34 by 2010-2012. Beyond that, analysts at Point Carbon think there will be a rise from e30 to e75 by 2020, as more firms, including airlines, are included in the scheme.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how