Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Index tracker funds have many good points. They're cheap, easy to understand and in the long run you're more likely than not to outperform a good proportion of active fund managers. But they're not perfect.

A stockmarket index such as the FTSE 100 is based on market capitalisation. So the higher a stock's share price, the bigger its weighting in the index. So you can argue that trackers force you to buy high and sell low. Say you'd bought an exchange-traded fund (ETF) tracking the FTSE 100 ten years ago, during the internet bubble. You'd have put 13% of your fund into Vodafone and more than 20% to telecoms (the worst-performing sector over the next decade), but only 2% to mining (the best performing).

So is there a 'better' tracker available? The best-known alternative fundamental indexation has been developed by US firm Research Affiliates. This index weights its components based on four accounting metrics: cash flow, sales, book value, and dividends. Supporters argue that this produces a far more stable portfolio over time it doesn't fluctuate wildly with investing fashion. And because it avoids buying high and selling low, you get better returns.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Critics, including indexing giants iShares and Vanguard, argue that a traditional capitalisation-weighted index is simply 'the market' and Research Affiliates' approach is a disguised 'value' portfolio. What's the point in tracking the market if you then try to second-guess it?

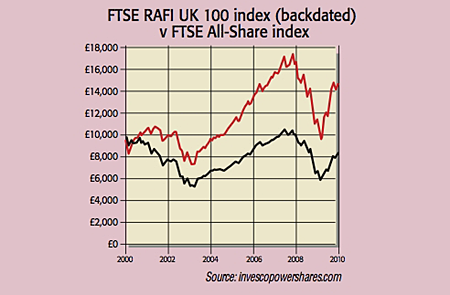

The RAFI ETFs are also pricier. Invesco Powershares' FTSE RAFI UK 100 ETF (LSE: PSRU) has an expense ratio of 0.5% a year, as opposed to 0.3%-0.4% for most UK-listed FTSE 100 ETFs. The other nine Powershares RAFI funds, covering international markets, cost from 0.39% to 0.85%. That said, the Powershares website shows that the FTSE RAFI UK 100 index returned 4% a year over the decade, against an average -1.59% a year from the FTSE All-Share (though this uses back-testing for most of the period). It doesn't work every year. In 2008 RAFI's indices tended to do poorly as the 'value' approach meant they had heavier weightings in financials than cap-weighted indices. However, assuming you want exposure to the underlying market (of course, if you think a double-dip's on the way, neither type of tracker will protect you from a market fall), then the RAFI option is worth a look.

Paul Amery is editor of www.indexuniverse.eu , the top source of news and analysis on Europe's ETF and index fund market.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?