Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It is widely believed that how January goes, so goes the year; however, such a simplistic process cannot be relied upon.

The market historian John K Harris has researched deeper, and come up with some valuable insights that were recently reported in Barron's. What he did was to filter the data, and concentrate on those Januarys that followed the high of the previous year falling in December.

For the whole history of the S&P 500 covering 82 years, only 24 years - including 2009 - meet this criteria. Of those 24, he found that 18 were followed by positive Januarys and for those 18 individual years the average returns were subsequently 17.2%. There is therefore a high probability that 2010 will be a good year for equities if January is a positive month.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The balance of six individual years saw negative Januarys. The subsequent average return for those six years was -3.5%. If January turns out to be a negative month there is a very high probability that 2010 will be a weak year for equities.

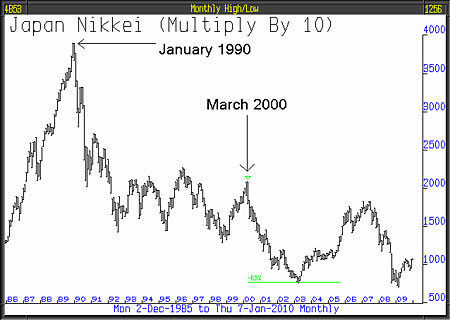

We are confident with our long held view that the bear market that started in the year 2000 is still unfinished and the extraordinary energy of the stock markets from March last year will prove to be no more than a rally in a bear market. If we are right, that the bear market is unfinished, how was the Japanese bear market after its first ten years?

As can be seen from the chart, in its tenth year it returned to considerable weakness and over the ensuing three years, declined 63%. Is it likely that FTSE and other developed world stock markets could fall by a similar amount? Yes.

Reports from retailers such as John Lewis and Next, have confirmed that holiday shopping was better than expected. This gives support to economic recovery hopes. However, bizarrely, Nationwide's Consumer Confidence Index for December fell to 69 from 74 in November, the sharpest drop since November 2008. How could that be? Why would consumers have been so willing to part with their cash if their confidence was so low? One possible answer is that it was about saving the VAT. If that turns out to be so, it was tomorrow's purchases being brought forward - it's not surprising that Next warns of a recovery threat.

Gary Shilling, in his latest Insight publication, says: ", at some point, stock investors will likely have to consider seriously the corporate earnings prospects for this year. At the end of 2009, the S&P 500 index was selling at 20 times the $56.45 in operating earnings per share for the last year estimated by top-down Wall Street strategists a hefty number. They forecast $60.59 for this year, so the stock market is selling at a 19 P/E for 2010 operating earnings, still very high by historic standards. This earnings estimate assumes a sharp economic recovery this year with real GDP rising 3.5%, according to the consensus forecast of economists.

"In our view, economic growth will be much closer to zero this year with S&P operating earnings around $50 per share. That would put the stock market selling now at an unsustainable P/E of 22.

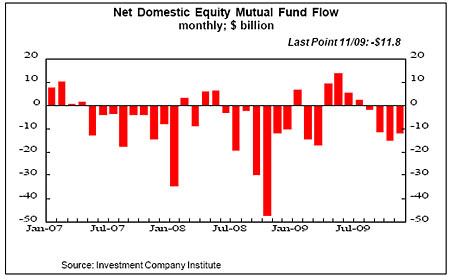

"If we're right and the economy weakens rather than strengthens early this year, stockholders will probably be in for an agonising reappraisal. That's not true at present. The VIX index, which measures volatility in S&P 500 options, recently dropped to 20, indicating investor complacency. Stock trading volume has fallen sharply, suggesting waning shareholder interest as does the net withdrawals from US stock mutual funds."

How likely is it that earnings will follow through on the scale required? Because it will require a significant increase in company revenues which is not likely to take place if businesses continue to cut costs and consumers continue to retrench.

Apparently, capital spending in the recession tumbled by more than it has at any time since the Great Depression. Any rebound in capital expenditure can't occur without an improvement in consumer spending. David Rosenberg of Gluskin Sheff, has said that 90% of the third quarter's US economic growth came from stimulus measures.

Quite clearly the performance of stock markets in January is going to have an influence upon our portfolio's future shape. If January turns out to be positive, then the rally is likely to continue and we would look to see how the portfolio might better benefit from that. Most likely by buying emerging markets and specific sectors in the developed world markets. If January is a negative month, the outlook going forward will be very bearish, this will cause future adjustments to be different from those suggested just above.

Strangely, both in the UK and the US, Keynesian policies have failed to increase broad money supply. The Bank of England has specifically noted that the money supply, excluding distortions from the financial sector, is falling at an annualised rate of 5.3% in spite of their asset purchases.

The US Fed's measure of money supply M3 was discontinued four years ago. This broadest of money supply indicators, which includes savings and institutional deposits is shrinking in real terms. This information is available because of John William's Shadow Government Statistics who have continued to estimate M3 from published sources. M3 shrinkage has only occurred four times before, each time it signalled the onset of a recession or a sharp deterioration in the contraction already under way.

This article was written by Full Circle Asset Management, and was published in the threesixty Newsletter on 8 January 2010

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how