The Asian beer company to buy now

As investors around the world have piled into cyclical “recovery” stocks, defensive sectors such as booze have been all but ignored. That’s left some great opportunities for smart investors, says Cris Sholto Heaton – such as this Thai beer company.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When times are tough, it's tough being sober. That's why investors turn to a defensive sector such as booze when a bear market sets in then lose their taste for it as soon as the rebound is underway.

Hence Diageo, the world's biggest drinks firm fell just 35% during the slump, but is up only 28% from the bottom. Meanwhile, a cyclical stock like chemicals firm Akzo Nobel was off 65% - but is now up 73% from its lows.

Of course, the problem is that investors get this the wrong way round. As I discussed last week, the time to buy cyclicals was when no-one else wanted to go near them. Today, with everyone chasing growth again, some of the best opportunities are in the staid stocks that have been left behind.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This week, I'm going to take a look at one stock that's lagged the rebound - a Thai company. Now, as I've written before, the ongoing political problems in Thailand make me extremely cautious about the Thai market in general and my views on that haven't changed (see here for more: Thailand looks cheap so is it time to buy?).

But a good stock in a poor market can still be attractive and I think this one is...

A spirits business that packs a real punch

Thai Beverage (SP: THBEV) is one of Thailand's two big alcoholic drinks firms (its main rival is the privately held Boon Rawd Brewery). Thai Bev was formed in 2003, collecting together a number of drinks businesses owned by controlling shareholder Charoen Sirivadhanabhakdi. It listed in Singapore in 2006.

Its biggest and most profitable division is spirits, which includes both traditional white spirits' drunk mostly by rural and older consumers and the more expensive brown spirits' such as whiskies.

ThaiBev is the dominant player in the local spirits market, accounting for 75% of total sales. It has around 80% of the white spirits market, but sales in this are likely to be flat in future. So its spirits strategy is focused on promoting brown spirits - where it accounts for around 60% of sales to drinkers who are becoming wealthier and moving upmarket.

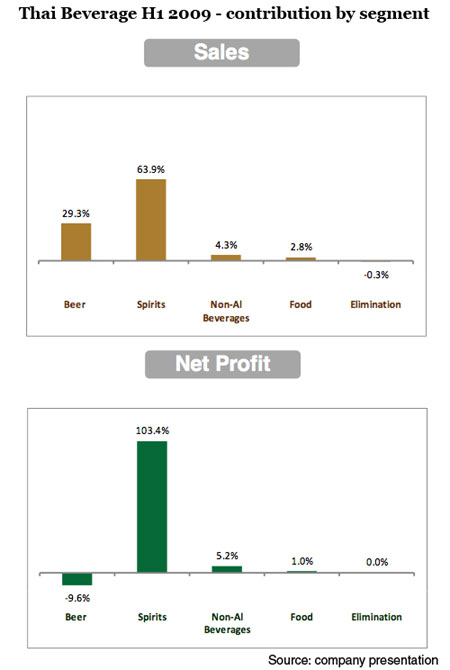

In beer, the firm accounts for just under half of Thai sales, but its strength is in the economy' segment, where growth prospects are also limited. So here again the strategy is to move into the upmarket segments, presently dominated by Boon Rawd products and foreign brands (mostly Heineken). As the chart above shows, the beer segment is currently loss-making as it reshapes its sales and distribution network; this is likely to turn around in the next year or so as restructuring pays off.

These divisions account for most of ThaiBev's sales, but it has a number of small, faster-growth businesses. Last year, it bought local soft drinks producer Oishi to gain exposure to a relatively underdeveloped market in Thailand; its sales in this area were up 21.5% year-on-year in the first half.

It has also been targeting export markets in the UK and US (you may know its Chang beer brand from its sponsorship of Everton Football Club). In addition, it also owns several small Scottish distilleries and recently bought a local spirits producer in China's Yunnan province. Although overseas sales are still small less than 5% of overall sales the trend is promising; Chang sales in the US were up 60% in the first half.

ThaiBev is well-placed to invest in faster growth

These growth markets are what makes Thai Beverage interesting. The firm trades on a p/e ratio of 11.7 times last year's earnings and dividend yield of 5.7%; in other words, it's being priced for minimal growth, since its sales are dominated by the low-to-no growth economy beer and white spirits segments. This is in line with its headline results in recent years, as the table below shows - but I think this is overlooking its potential.

Given its relatively low debt load net debt to equity was 22% at the end of June and cash-generating business, ThaiBev is well-placed to invest in promoting upmarket brands, boosting exports and making acquisitions. This is the kind of stock you want to own in the aftermath of a global credit crunch. It has the firepower for deals at a time when debt-dependent buyers can no longer compete.

I expect ThaiBev's fast-growth segments to become much more significant as a percentage of its sales in the next few years. This will mean overall earnings will grow more quickly than the market expects. It still wouldn't be a high-growth stock, but the effect would be significant since it's currently priced for almost nothing.

On top of this, I think ThaiBev is a good way to have exposure to the possibility of a turnaround in Thailand. If things keep stumbling along, its business will still do well especially since given its dominant position in the lower-end segments. But if the political problems are resolved, sentiment and the economy should improve and that should benefit ThaiBev substantially as more consumers move up to its more expensive spirits.

Time for this stock to be reassessed

ThaiBev was a major IPO when it first floated in Singapore and was briefly included in the Straits Time Index benchmark. However, sluggish sales growth and Thailand's problems have made it a poor performer (see share price chart below) and contributed to a loss of investor interest. But improvement in either of these areas should put it back on the radar and potentially lead to a big re-rating. In the meantime, investors get a substantial dividend to compensate them for their patience.

This said, there are the usual risks involved in this company, including the fact that it is controlled by one major shareholder and operates in a heavily regulated and sometimes controversial industry. In addition, there are a couple of firm- and country-specific risks.

First, because it is in the middle of reshaping its beer business, trying to move upmarket, breaking into foreign markets and buying foreign assets, there's a possibility of its strategies failing. Its existing business should allow it to support a strong dividend, but with little further upside to its current valuation.

Secondly, the political situation in Thailand remains unguessable. My base case is that things remain stagnant and the economy fails to achieve its potential due to uncertainty, lack of leadership and problems pushing through reform and investment. A resolution would mean more upside for ThaiBev's business and shares. But it's possible that things could get much worse and lead to serious unrest.

Both of these worst-case scenarios are possible, though I think they're unlikely. But given the considerable potential upside over the medium term and a sizeable dividend in the meantime, I think the risk-reward trade-off is good.

Can you trust Chinese statistics?

Moving on to a totally different topic, you may have seen a bit of comment recently on the reliability of Chinese statistics. Some analysts are questioning whether the GDP numbers are completely bogus and whether any kind of recovery is even happening.

There's no doubt that many Chinese statistics are not reliable. This isn't necessarily because they are fiddled by the central government (although they may be). Simply collecting quick and accurate data in a country like China is extremely difficult.

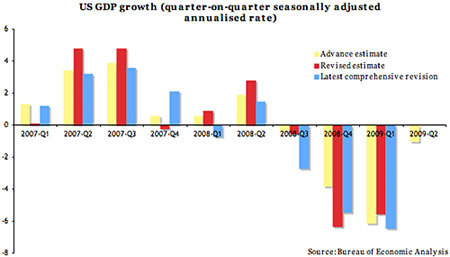

This isn't solely a problem for developing economies of course. As the chart below shows, early estimates for key statistics such as US GDP can undergo some pretty significant changes (and the monthly payroll numbers, which markets obsess over, are always revised to the extent of being totally useless).

Still, it's true to say that a figure of, say, 9% for Chinese GDP growth is not at all reliable. It's only useful to give us a rough idea of magnitude and whether the economy is slowing down, speeding up, overheating or whatever. And we need to compare it with other data to see if the picture is consistent.

The latest GDP number was 7.9% year-on-year, up from 6.1% year-on-year the previous quarter. Measured in the same way as the US - ie quarter-on-quarter seasonally adjusted and annualised - that would probably be a mid-teens growth rate.

Whether such a rapid rebound is genuine is hard to say - I'd agree this may be overstating things. But if we look at other figures - such as electricity generation, industrial production, imports, consumer confidence surveys and so on - these have also risen sharply in the last few months.

This strongly indicates that the Chinese economy is picking up speed. Of course, that doesn't mean we can dismiss all concerns about the risk of excessive loan growth, mal-investment and so on - these are definitely things to keep an eye on. But it suggests that doubts over whether the Chinese rebound is happening at all are misguided.

None of this, of course, justifies the enormous run-up in the domestic stock market this year. The CSI300 has wobbled a bit in the last few weeks on fears that authorities will tighten lending, as you can see below. Whether this is the end of the rally is impossible to say - bubbles never end when you expect. But when it bursts, the bottom is likely to be a long way down.

The latest on Singaporean Reits

Finally, another follow-up to my Singaporean Reits follow-up a fortnight ago (see here for the background: The two Singaporean real estate funds to buy now). Last week, Ascendas Reit made a S$300m ($210m) private placement of 185 million new shares, equal to around 11% of its outstanding shares.

This was a suprise; A-Reit had already raised S$400m in January to reduce its gearing and wasn't in any clear need of more capital. But while issuing more shares is rarely good news - because existing investors get diluted - this placement looks a fairly sound move.

Around $175m will be used to fund the new facility A-Reit is building for Singapore Telecommunications. The remainder is for acquisitions or new-build opportunities that come its way post-crisis, which was one of my reasons for picking A-Reit in the first place. As one of the stronger Reits around, it's well-placed to profit from the tougher conditions of the next couple of years. So while the initial dilution is 11%, the long-term impact is likely to be minimal at worst and hopefully actually add value in the long run.

So my opinion on A-Reit is unchanged - but the fact that one of the strongest S-Reits favours equity over debt financing for new projects reinforces my view that some others that have not yet raised new equity are likely to do so. In particular, I think it will be hard for Ascott to hold at 39% debt/assets when A-Reit is now down to 29% after this placement, so I still think that taking some profits on this one after such a large run-up would be a good idea.

In other news this week...

India and the Association of Southeast Asian Nations (ASEAN) signed a long-awaited free-trade agreement that aims to remove tariffs on 80% of goods over the next three to six years. The deal is unlikely to have much immediate impact, but is another encouraging move towards the better trade connections that Asia will need to form over the next few years. The previous week, India signed a trade deal with South Korea. At the same meeting in Bangkok, China and ASEAN also signed a cross-border investment agreement, adding to a free-trade deal agreed earlier this year

Private equity firm Texas Pacific Group and China's Legend Holdings are to invest HK1.65bn (US$213m) for an 11% stake in Hong Kong-listed Wumart Stores, the largest supermarket chain in Beijing. The deal is TPG's second investment this year in Chinese retail in May it invested $80m for a stake of up to 14.5% in shoe retailer Daphne International.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn