The best ways to invest in the emerging market consumer

As developed countries continue to grapple with huge debt burdens, emerging markets are poised to take off. And while their consumers aren't ready to replace the US yet, they are steadily growing in prosperity - and economic importance. Here, Cris Sholto Heaton looks at the best ways to cash in on the East's consumer boom.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It's been quiet in Asia in the run-up to Chinese New Year. Almost all the excitement has been in Europe, as markets waited in hope that Greece would be given a helping hand by the rest of the eurozone.

Unsurprisingly, this is turning into a farce. It's not just that governments can't come up with a genuine commitment to sort things out. What's more important is the fact that Greece is one of the smaller landmines in the developed world.

Yet there's little sign that anyone is going to acknowledge this. The risks in the developed world are growing all the time. That makes emerging Asia's prospects look much better by comparison...

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Many governments are in serious trouble

The developed world's problems go far deeper than most want to admit. Rising government debt is a serious problem.

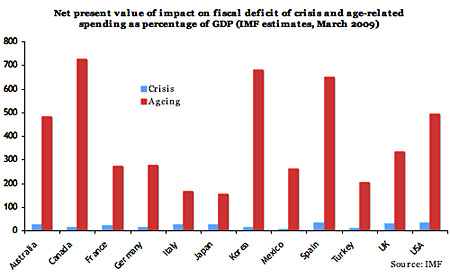

But the real problem is what's coming down the road. I showed you the chart below last week, but it bears repeating. As you can see, the cost of the crisis and the bailout so far (in blue) is nothing compared with estimates of these government's future age-related liabilities, such as pensions and healthcare (in red).

Figure 1. IMF estimates of crisis and future age-related spending

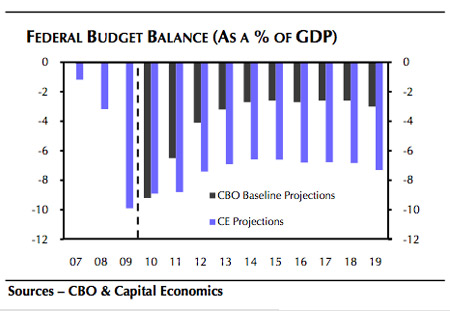

For all the talk of getting national finances back in order, there's little sign of it happening soon. For example, the US budget deficit won't fall below 2% over the next decade, even on official Congressional Budget Office (CBO) projections (see chart below).

Figure 2. Forecast US budget deficit (via Capital Economics)

The reality is likely to be worse as Capital Economics' own forecast above suggests. Although most economies have returned to growth, that's all been due to increased government spending. Underneath, many remain far from healthy. Consumers and businesses are still paying down debt (deleveraging). That means that once the stimulus is pulled out, growth is likely to recede.

That will leave governments with a dilemma. Try another round of stimulus? Or let a nasty recession take its course? Doing nothing is politically tough. So the odds are we'll see more stimulus. But when that's withdrawn, as long as deleveraging continues, we'll see another slump then probably more stimulus.

Inflation is the only way out

This was what happened in Japan in the nineties. With the private sector deleveraging, only increased government spending could keep the economy out of recession. Whenever the government tried to tighten policy, a slump set in again.

So far from improving their finances, many developed economies are likely to be in worse shape a few years from now. With debt levels rising and ageing liabilities looming larger, the question of how to solve the problem will grow.

I'm not optimistic that decent solutions will be found. These are the same governments who have tried to cure economies suffering from excessive consumption and inadequate investment by bribing people to buy more cars. Instead, we should expect the worst.

One option is outright default. This is unlikely (though not unknown) in countries that still control their currencies. But it's not inconceivable in some of the eurozone in the long run. More commonly, we'll probably see a lot of governments defaulting on promises already made. Pensions will be cut, retirement ages raised further and so on.

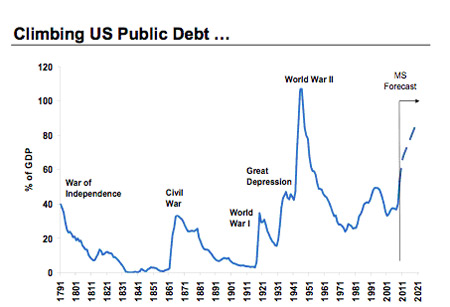

But hand in hand with this, governments will try to inflate away their debt. Just as they did in the post World War II era. Back then, the US public-debt-to-GDP ratio topped 100%.

Figure 3. US public debt to GDP ratio (via Morgan Stanley)

Over the following ten years, it came down at an average of 5.2% a year. That was mostly achieved through inflation. Just 1.5 percentage points was due to real growth in the economy 3.7 percentage points was due to inflation.

This time, the necessary level of inflation could be much higher. Morgan Stanley analysts estimate that the US will need inflation of 4%-6% over the next decade just to stabilise the debt-to-GDP ratio at its current level.

Expert tips & advice for investing in Asia! Claim your FREE guides from MoneyWeek that include:

- How to go about investing to Asia

- Which brokers to use to buy foreign shares

Emerging markets are poised to boom

So the outlook in the developed world is not good: sluggish economies, rising government debt, near-term deflation and medium-term inflation. On the other hand, the emerging world looks broadly sound.

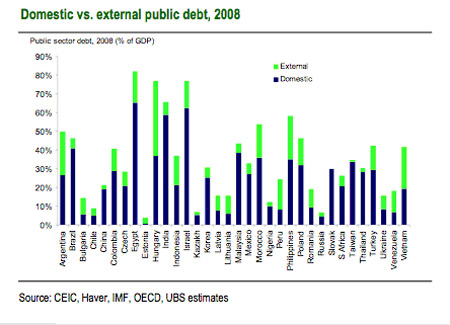

There are exceptions, but in general emerging market (EM) public finances look much sounder than developed world ones (see chart below). Debt levels are lower. And most debt is owed in the borrower's own currency rather than US dollars or other foreign currency. This is a big turnaround from a couple of decades ago, when many EMs were more highly indebted with extensive foreign currency borrowings.

Figure 4. Public debt to GDP ratio, selected emerging economies (via UBS)

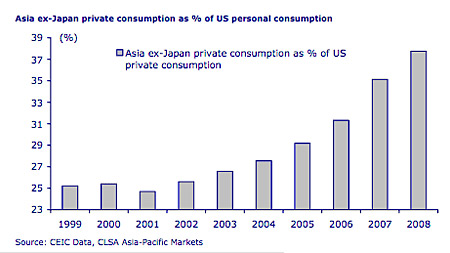

Even more importantly, consumer debt remains low. And while emerging market consumers aren't ready to replace the US yet, they are steadily growing in importance, as the chart below shows.

Figure 5. Emerging Asia private consumption compared to the US (via CLSA)

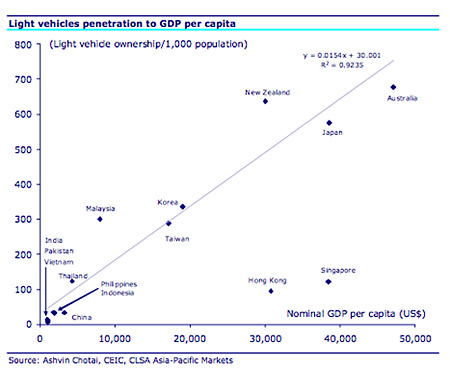

The emergence of hundreds of millions of new consumers in these countries will be the key shift in the coming century. Despite the progress of their economies in recent years, this has barely begun. For example, car ownership remains way behind developed world levels, as the chart below shows.

Figure 6. Light vehicle ownership versus GDP (via CLSA)

What's coming in emerging markets can be loosely compared to America's post-war consumer boom of the fifties and sixties. This era saw huge growth in sales of cars and durables, pharmaceuticals, household products, personal care goods and prepared foods, and of entertainment and eating out. It also saw rapid growth in the sectors that go with such a boom: consumer credit, advertising, and distribution and logistics to name a few.

A better long-term bet than bonds

With the same trend under way in emerging markets, history suggests that some of the best returns will be achieved in these sectors. Stocks such as McDonald's, Coca-Cola, Revlon, Pfizer and Kodak were star performers in the US during the boom.

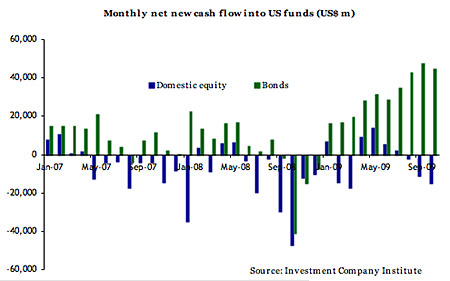

Yet while flows into emerging markets have picked up well and some investors are increasingly aware of the theme, even more are trying to find a new way to make money in developed markets. Having been disappointed by shares in the dotcom bust and most recently by real estate, money is now flowing into bond funds, as the chart below shows.

Figure 7. US mutual fund investment flows

Could this be the start of a bond bubble? Quite possibly. Bonds could deliver decent returns over the next couple of years in a short-term deflationary environment, which is likely to lure even more investors in. So if you're investing in decent corporate debt, I wouldn't suggest selling yet. There could still be gains to come. But if you believe that governments will try to inflate away their debts, they don't look compelling for the long run. So be prepared to get out when conditions turn.

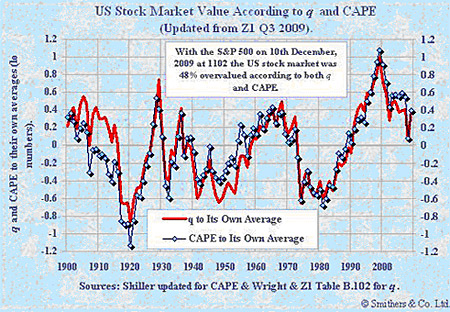

Meanwhile, developed world equities remain a mixed bag. Most markets don't look expensive. But the obvious exception is the S&P 500. This is still significantly overvalued on long-term measures, such as the cyclically adjusted price/earnings ratio (CAPE) or the q ratio.

Figure 8. US stockmarket value based on CAPE and q (via Smithers & Co)

In developed world markets, I'm happy to buy high-quality companies. Ideally you want those that have pricing power (and so can pass on the effects of higher inflation) and relatively low debt (in case I'm wrong and deflation is more persistent in developed economies than I expect). With yields of 4% or so available, this generally strikes me as more attractive than bonds which yield slightly more, but offer no inflation protection.

However, while decent developed world stocks should deliver a reasonable income, the best prospect of a genuine bull market is definitely in emerging markets, just as the US market soared for two decades during the rising prosperity of the consumer boom. Emerging market equities are certainly not dirt cheap as they were a year ago, but they still offer fair value. For example the MSCI Asia ex-Japan is currently on a price/book ratio of 1.95 times, around its long-term average.

Be careful what you're buying

Still, those aiming to gain access to EM consumer themes through exchange-traded funds (ETFs) or other low-cost trackers need to be careful. Many emerging market indices are not especially well constructed and don't reflect the economy and potential growth sectors well.

Why is this? When buying a tracker for a developed market index like the S&P 500 or the FTSE 100, you usually get a reasonably balanced basket of stocks. But emerging market indices are often heavily biased towards a few industries (typically resources, finances, real estate and telecoms). They're also frequently dominated by state-owned companies or messy family-controlled conglomerates, which tend to be the biggest companies in the local stock market.

In fact, if you're looking for a broad emerging markets tracker, it's worth noting that small-cap specific ones often have a higher weighting towards these promising consumer sectors than large cap ones. For example, the iShares Emerging Markets ETF and Far East ex-Japan ETF have around 12% each in sectors such as consumer staples, consumer discretionary and healthcare. The smallcap versions of these benchmarks have 35% and 25% respectively.

I'll write about this problem in more detail in a future email and review a few more funds. But the key point is that even if you're buying an index tracker, it's as important to understand exactly what it invests in, just as you'd check the track record of a managed fund or the fundamentals of a company before you invested. Otherwise you may find that what interests you about a market say the consumer potential isn't what you are invested in.

This article is from MoneyWeek Asia, a FREE weekly email of investment ideas and news every Monday from MoneyWeek magazine, covering the world's fastest-developing and most exciting region. Sign up to MoneyWeek Asia here

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify