Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It is said that "Too many cooks spoil the broth"; it is also said that "Many hands make light work". Which of these sayings is accurate and which is false? The answer is that at different times, in different circumstances, they are both correct.

It is also said that "Bull markets climb a wall of worry". Many investors use this maxim to sustain themselves against bad news, such is the mindset of those who believe the strong FTSE since March is a new bull market. However, if we are right in saying that this is not a new bull market but a secondary reaction in a primary bear market, what kind of wall has FTSE been climbing? The same "wall of worry", but the worries are real ones that will unhinge the rally and reset FTSE on its primary bear market path.

One way to establish the truth is to consider if it is reasonable that the primary bear market ended last March because, before a new primary bull market can start, the bear market preceding it must have ended.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The bull market that preceded the bear market encompassed extraordinary characteristics and was borne of outrageous economic behaviour. Following this, the banking system was on the very edge of total failure only a year ago. So the primary bear market was fuelled by the huge amount of bad debt and the toxic debris from burst asset bubbles. Before the healing process had started it was overwhelmed by government stimulus packages, financed by massive new debt. This deluge kept the bear at bay but did not return the economy or the stock markets to a sound basis.

Tim Geithner recently said to the Senate Foreign Relations Committee "As stabilisation and recovery take hold, our policy challenge will shift to catalysing private demand and business investment. This will require continued policy support. We cannot make the mistake of putting on the brakes too early or withdrawing support prematurely."

This week President Obama warned of a double dip recession unless urgent steps are taken to reign in public debt. Are they talking to each other? The President is concerned that the recession will get worse unless public debt is reigned in; Tim Geithner, his Treasury Secretary, is concerned that it will get worse if they don't maintain support.

The US Fed recently said, "Household spending appears to be expanding but remains constrained by ongoing job losses, sluggish income growth, lower household wealth and tighter credit." Bearing that in mind, can Americans today raise their consumption to levels to where they account for 70% of GDP? Quite obviously they can't, and the Fed realises that.

It's no wonder that the so-called 'recovery' is deemed to be precarious and if that is so, how can anyone genuinely believe in a 'V' shaped recovery and a new bull market for equities.

This year's rally is not a reversal of the primary bear trend but a secondary reaction of the primary bear trend. The extent of the secondary reaction cannot be forecast but would seem, at the time of writing, to have run out of steam.

It is a simple truth that by definition all secondary trends fail whilst primary bear markets persist until, when measured by valuations, they are far too cheap. To reach that zone, we estimate that FTSE would have to lose 50% of its value from here!

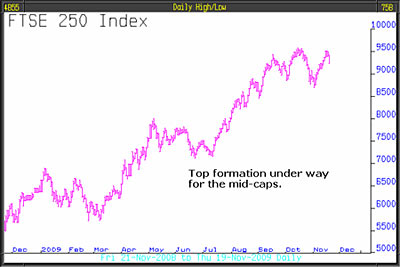

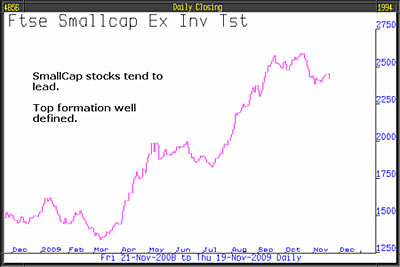

On Guy Fawkes Day, we said that FTSE's uptrend was about to blow up. A week later, on Friday 13th, we said that the 250 and SmallCap indices were further ahead in the process of top formation.

Other stuff as follows, gives weight to our view:

Dow Theory. The Transports have still failed to confirm the positive Industrials; unless that happens, a reversal of direction is likely.

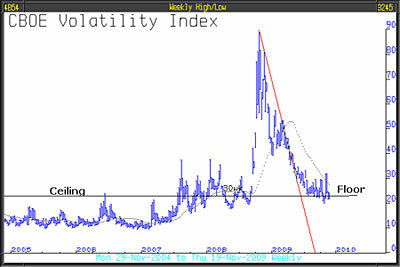

Volatility Index (the VIX). It continues to trend sideways at its 2009 lows. From examination of the longer term chart it can be seen that those lows were the highs of a preceding era. The fact that the VIX has not fallen further since May is testament to the demand for insurance by worried institutional investors to protect portfolios.

The Informed Buyers' Index. We published this a week ago. Each day the advances are compared to the declines; if the advances predominate on higher volume, it is an accumulation day the institutions are buying. If declines exceed the advances on high volume, it is a distribution day the institutions are selling. Just one look at the chart illustrates a significant change since early September. It screams a warning signal to anybody who is watching that the game is over.

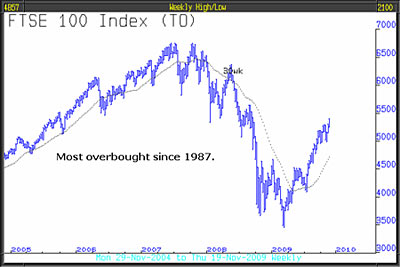

Overbought. The stock market rally from March has taken FTSE to an over-bought condition, more than 16% above its 30-week moving average, the dotted flowing line. It's about as extreme an overbought condition as we have ever seen and demands a correction. The last time it was so extreme was in October 1987!

Assuming the rally has ended, then reliable confirmation of FTSE's top will be a close below 4955, the 2nd October low.

Andrew Lapthorne, of Socit Gnrale, has said that investor expectations at present assume growth of about 20% in operating profits next year, it would be the strongest rate since the early 1990s. In order to achieve such an outcome, blockbuster revenue growth must take place. This is most unlikely given the vulnerable condition of consumers and the unwillingness of companies to invest.

The Baltic Dry Index has made a very significant move up. We have previously used this as one of our 'wrong notes'.

This article was written by Full Circle Asset Management, and was published in the threesixty Newsletter on 20 November 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Inheritance tax investigations net HMRC an extra £246m from bereaved families

Inheritance tax investigations net HMRC an extra £246m from bereaved familiesHMRC embarked on almost 4,000 probes into unpaid inheritance tax in the year to last April, new figures show, in an increasingly tough crackdown on families it thinks have tried to evade their full bill

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.