The movers and shakers of 2019

Men make history, but not in circumstances of their own choosing, said Marx. Some men make more of it in less time than others. Here are four figures who changed the world this year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Mario Draghi

The European Central Bank boss, who bowed out this year, is widely viewed as the man who ended the eurozone panic in 2012 with the magic words "whatever it takes". The question now, says Hamish McRae in The Independent, is whether Draghi can hang onto his "Super Mario" status. When central bankers retire reputations often slip, "sometimes disastrously" that, sadly is Draghi's likely fate. Many now blame the "ultra-easy" policies he championed for the eurozone's faltering growth. Indeed, Deutsche Bank recently claimed that negative rates, a favoured Draghi strategy, have "ruined" Europe's financial system.

When Italian-born Draghi got the ECB job, some said he was "more German than the Germans", says the Financial Times. How wrong they were. Still, even Bundesbank officials "speak warmly of him personally". As well as a sense of humour, Draghi had "a breadth of experience few central bankers can match", noted The Guardian in 2012. The son of a biochemist and banker, he was orphaned as a teenager "and later taken under the wing of Federico Caff, a prominent Italian economist". Draghi studied at MIT and taught at Harvard later putting in stints at both the World Bank and Goldman Sachs. Against the odds, he pulled off a "thankless task" as governor of the Bank of Italy.

Draghi's best asset is being "extremely cool in situations in which normal people are freaking out", a colleague once observed. In a way, he has been unlucky, says McRae. "He did what it took to save the euro. But what it took has done massive damage." When he left in October, it was with a warning.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Mohammed bin Salman

In the end, the Saudis got their share sale away. Shares in Aramco, the world's largest oil company, surged 10% within seconds of their market debut in Riyadh earlier this month, says The New York Times, in a "successful debut" valuing Aramco at $1.88trn. Everyone in the Saudi court must have issued a considerable sign of relief. The country's de facto ruler, crown prince Mohammed bin Salman, 34 a notoriously volatile character had considerable face to lose in the event of a flop. "The size of the deal is an in-your-face to the boss's critics, including many family members who said he couldn't do it," said one of the IPO's bankers.

When King Salman came to the throne in 2015 and "handed most of the keys to the kingdom" to his "untried but dynamic son", many feared the worst, says the FT. "MbS" was regarded as "scary". He used to be nick-named Abu Rasasa ("father of the bullet") because "he once sent a bullet in an envelope to a judge" who'd ruled against him. Subsequent events notably "an unprecedented purge of the kingdom's established elite" and the murder of journalist Jamal Khashoggi by Saudi agents have eaten into MbS's "reformist" credentials. Many Saudis these days refer to him as Abu Munshar ("father of the saw") in reference to the tools used in that grizzly murder he denies involvement.

"MbS is the kind of prince that Machiavelli might conjure," The Washington Post once observed. He's turned Saudi politics upside down and now wants to do the same to the economy. The great Italian political theorist might advise a little more work on the PR.

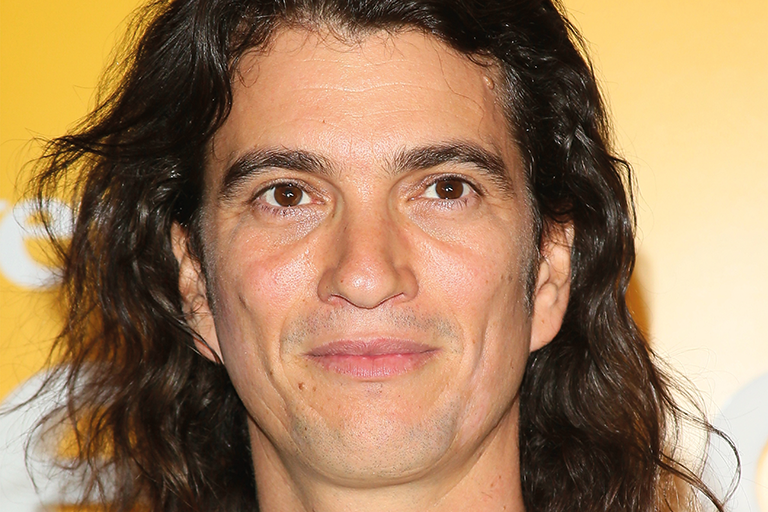

Adam Neumann

In one "tumultuous" week in September, Adam Neumann saw his dream wrecked, says The Wall Street Journal. His trendy office sharing start-up, WeWork, delayed its IPO (and later saw its value slashed by $38bn); "a bloc" of rebel directors began agitating to oust him; and lurid tales emerged of his "eccentric behaviour and drug use".

A former member of the Israeli navy, who grew up near the Gaza Strip, Neumann took less than a decade to build WeWork into a 12,500-strong company operating in 29 countries with the help of backers like SoftBank who bought into his vision of hip office life. "He was the young billionaire with a rock star life and an apparent messiah complex, who wanted to open his business on Mars and be president of the world'," says Ben Hoyle in The Times. "His charisma was integral to its appeal." Yet even as WeWork began racking up extraordinary losses, Neumann's "delusions were pronounced". He allegedly told colleagues that "three people were going to save the world": MbS, President Trump's son-in-law Jared Kushner, and him.

Neumann might have been loopy, but he was persuasive. WeWork's huge valuation was based on a plan for a complete We "eco-system" epitomised by "WeGrow" school, opened by his wife Rebekah in Manhattan. Ultimately, Neumann was remarkably adept at looking after number one, raising at least $700m for himself ahead of the botched float. Thousands of other WeWorkers have lost their jobs in the most spectacular corporate implosion of recent years.

Nigel Farage

It wasn't exactly the greatest of general elections for the Brexit Party leader but, says the Daily Express, he's got another trick up his sleeve. "Nigel Farage has revealed plans to rebrand the party as the Reform Party", with an agenda of "draining the swamp" of Westminster politics. "In the short term, the veteran anti-Brussels campaigner has not ruled out taking on a role as an EU commissioner if asked by Boris Johnson." Not much sign of that.

A former trader on the London Metal Exchange, Farage has an adjective for the good things in life, observed Henry Mance in the FT in 2016: "proper". Proper blokes, proper jobs, proper markets and proper lunches that's what he likes. The son of an alcoholic Kent stockbroker, he joined the City aged 18 from Dulwich College and rapidly became convinced that the UK needed a more eurosceptic party than the Tories. "Supporters call him the boss man; opponents call him a racist." His more recent close association with President Donald Trump has led some to pronounce him crypto-fascist too. In a recent interview with a UK evangelical TV channel, as The Guardian notes, Farage said that migration would "imperil the future of our civilisation" and "alleged that banks and multinational corporations were trying to create a dictatorial world government".

What's certainly true is that even though his Brexit party won no seats in the election Farage will go down in history as "Britain's most effective Brussels-basher", says the FT the man without whom there would have been no Brexit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify