The charts that matter: as the year draws to a close, optimism reigns

At the end of an eventful year, John Stepek casts his eye over the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you missed any of this week's Money Morning articles, here are the links you need:

Monday: The big risk for 2020: what if everything goes right?

Tuesday: Don't bet on a stellar 2020 for the pound but UK stocks should do fine

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wednesday: Frisby's forecasts the year-end autopsy: how did he do?

Thursday: Markets don't care about Trump's impeachment, and nor should you

Friday (from the MoneyWeek editor's letter): How long can the good times roll?

Subscribe: Get your first 12 issues of MoneyWeek for £12

You'll be able to get my book, The Sceptical Investor, for 40% off deal after Christmas, so if you're looking for a value investment, hold off until then but if you fancy signing up for an audiobook subscription with Audible (which I'd recommend, if you can carve out the time to listen to the things), you can get it for free over there.

The charts that matter

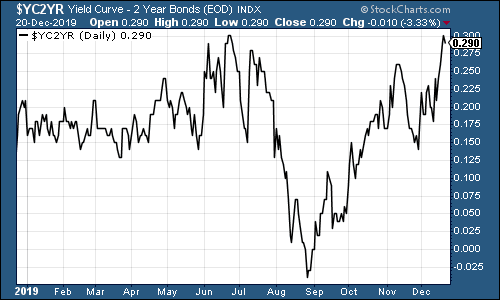

When I talk about the yield curve here, I'm talking about the one that gets the most attention that is, the gap between the yield on the ten-year US government bond and that on the two year has expanded.

In a healthy economy, you expect the ten to yield more than the two (because you expect to get paid more interest on a long-term loan than on a shorter-term one). When it inverts, it means people are expecting short-term rates to crash and that's usually because they see a downturn on the horizon.

The yield has now widened again. But history shows that once inversion has happened, it doesn't matter what the yield curve does next it always steepens, and there is always a recession within 24 months (certainly since World War II in any case). But no indicator is infallible. We'll see what happens this time.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back 12 months)

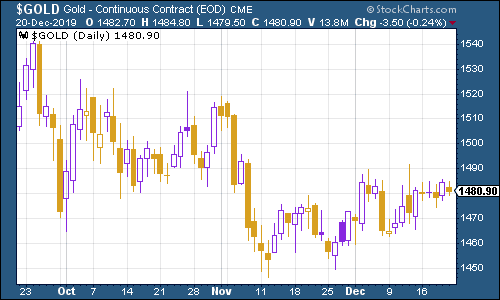

Gold (measured in dollar terms) crept higher this week. That's not typically what you see when markets are climbing and bond yields are ticking up. But it does tend to happen when oil rises which it has.

Is the inflation narrative getting some traction? We'll see.

(Gold: three months)

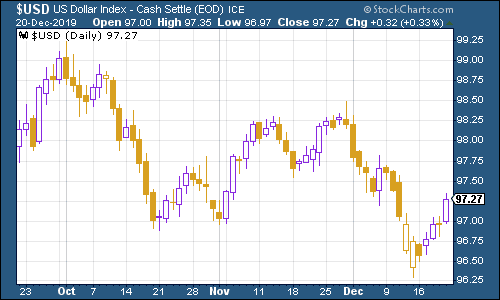

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners rebounded somewhat this week after last week's slide. The dollar still hasn't made a decisive move, and probably more than anything else, this is the chart to watch as we go into 2020. Long story short a weak dollar means more happy times, a strong dollar means buckle up.

(DXY: three months)

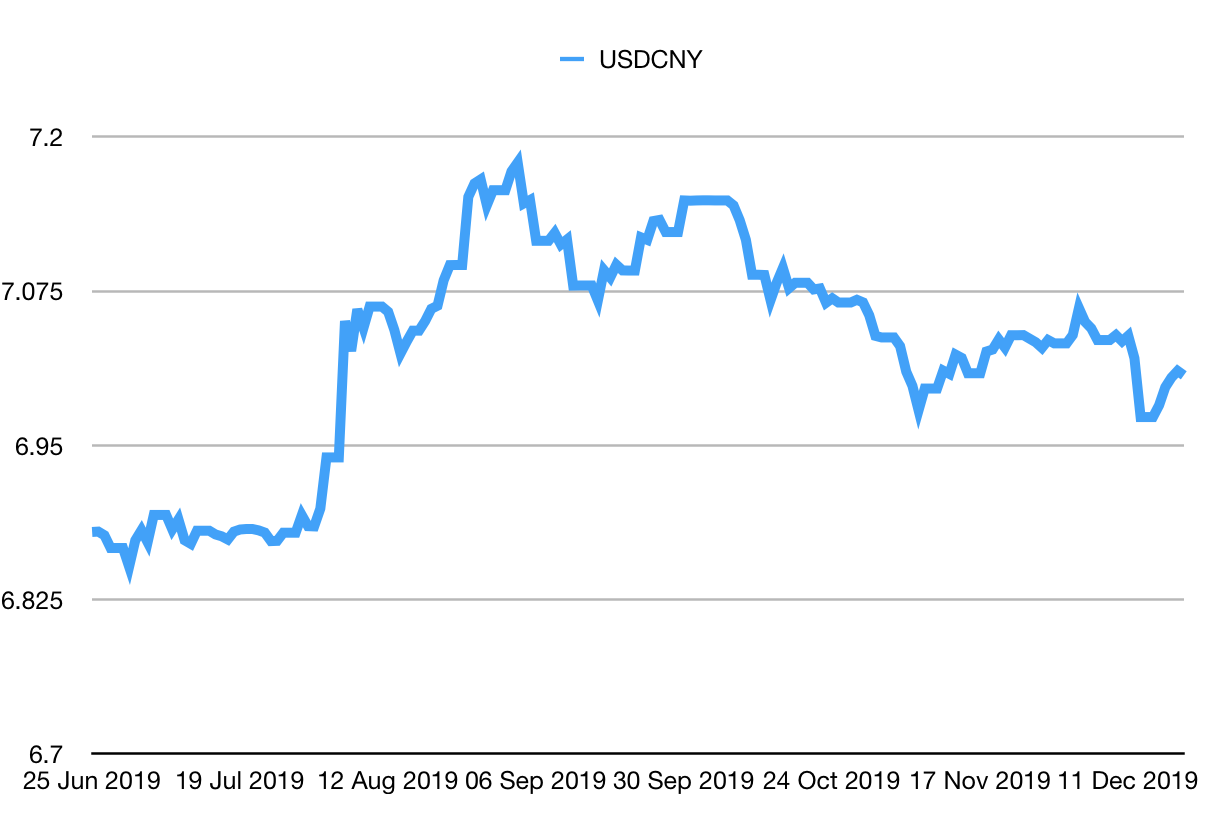

The number of Chinese yuan (or renminbi) to the US dollar (USDCNY) meandered around the key "seven" level. When the dollar is strengthening (the line on the chart below is rising), that's deflationary; when the yuan is strengthening (the line is falling), that's inflationary.

It was a big deal this year when that seven level was breached the assumption had been that the Chinese would not let the yuan weaken that far. But while the breach drew attention at the time, there hasn't been any real follow-through. We can think of it as a warning shot, aimed at reminding the US that China does have a lot of options when it comes to the trade wars.

(Chinese yuan to the US dollar: since 25 Jun 2019)

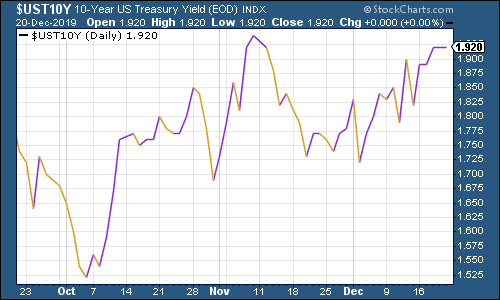

The ten-year yield on US government bonds ticked higher again when markets are in "risk-on" mood, bond prices tend to fall (and so yields rise).

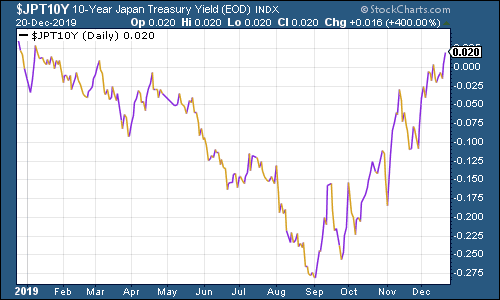

Having spent the vast majority of the year in negative territory, the yield on the Japanese ten-year bond has turned positive just as we head towards the end of 2019.

(Ten-year Japanese government bond yield: 12 months)

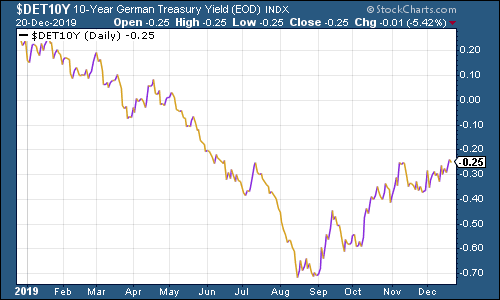

The yield on the ten-year German bund is rising too German industry has struggled this year but optimism over China coming out of its doldrums is helping to improve sentiment in the eurozone's biggest economy.

(Ten-year Bund yield: six months)

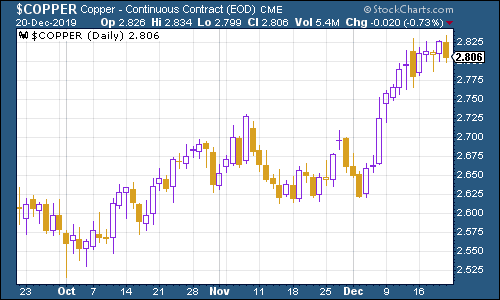

Copper continued to be strong this week as investor optimism about China grows.

(Copper: six months)

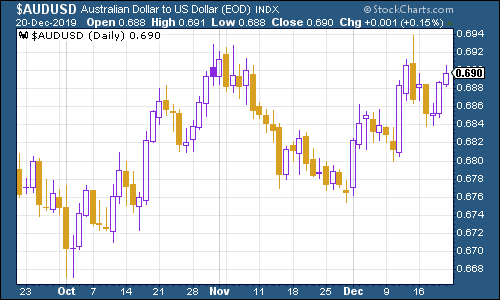

The Aussie dollar ticked lower through the week but then jumped on Friday as employment data beat market expectations.

(Aussie dollar vs US dollar exchange rate: three months)

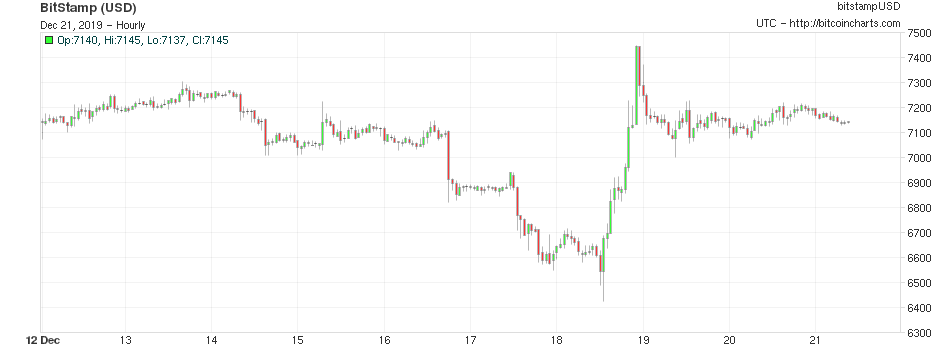

Cryptocurrency bitcoin sagged in the middle of the week, which sparked some buying interest, but it feels like investors have again grown tired of the story for now again.

(Bitcoin: ten days)

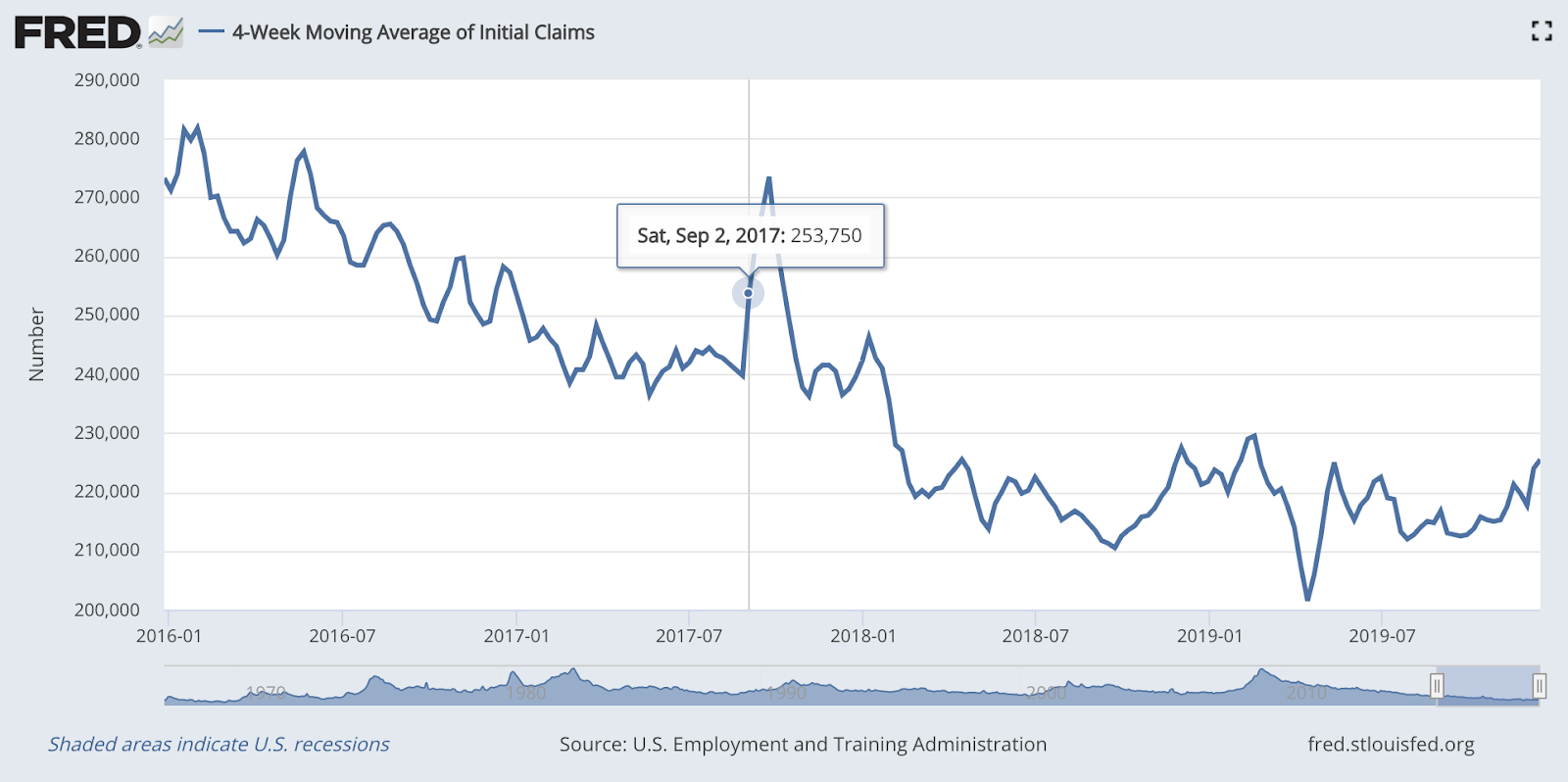

US weekly jobless claims fell from last year's two-year high, but they were still worse than expected. Claims came in at 234,000, from 252,000 before. The four-week moving average is now 225,500.

So we're ending 2019 with jobless claims still low, but looking as though they are on a rising trend. That may or may not pan out. But we'll keep an eye on it a steady rise in jobless claims would be a sign that not all is well.

(US jobless claims, four-week moving average: since January 2016)

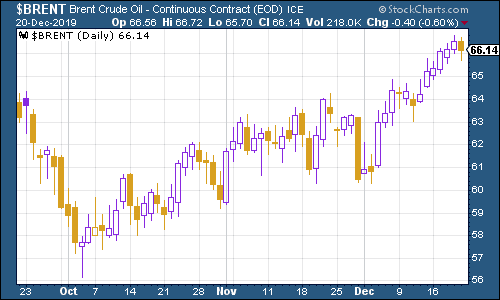

The oil price (as measured by Brent crude, the international/European benchmark) continues to head higher. It's been in a rising trend for about three months now. Is this going to be one of 2020's big surprises?

(Some of the participants at our roundtable were very bullish on the oil sector more generally by the way if you aren't already a subscriber, you should subscribe now to make sure you get your double issue of MoneyWeek on 27 December 27th, which is packed with tips and contrarian views for the year ahead.)

(Brent crude oil: three months)

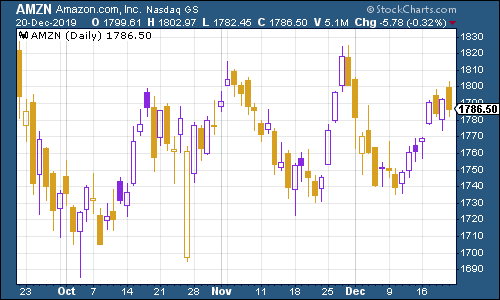

Amazon the ultimate Christmas stock, of course is still well off its all-time highs, but it's pootering along. I suspect that if the melt-up scenario arrives next year, then investors will notice that Amazon is not at an all-time high, and will pile in.

Remember this is the stock your fund manager won't get fired for owning. So all the reluctant bulls (ie those who are sure that the good times can't last but are forced by career risk to participate) will be queuing up to buy it.

(Amazon: three months)

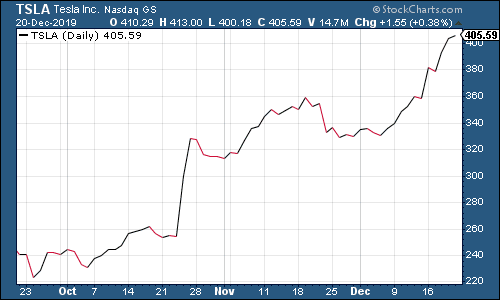

Shares in electric car group Tesla hit an all-time high. I can't help but feel that that's appropriate. We're reaching the end of a decade in finance that's been defined, perhaps more than anything, by people crossing their fingers and hoping that stuff works and that interest rates stay low enough to make blue-sky companies profitable at some point in the future.

So why wouldn't Tesla, a company run by a man who is entirely unafraid to dance across the thin grey line between genius and charlatan, be hitting an all-time high? WeWork showed that the market won't just swallow anything there's a limit to investor credulity, even today. But Tesla Tesla's still hanging in there. This is still a "jam tomorrow" market.

(Tesla: three months)

Have a great weekend. This is the last Saturday roundup of the year we'll be back on January 11th. Have a wonderful Christmas and a very Happy New Year!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI will change our world in more ways than we can imagine'

'AI will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China