Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

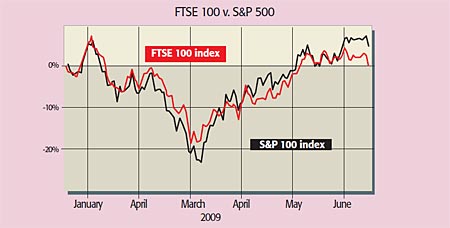

The bulls are in charge. Investors emboldened by improving data are looking forward to an economic recovery.

In Britain, the National Institute of Economic and Social Research has said the recession is over. Elsewhere, the latest data also suggest that the downtrend is easing.

Yet the data is hardly unequivocally positive. The latest Chinese export report shows that foreign shipments fell a record 26% year-on-year in May. In April, eurozone industrial production was down by a record 26.4%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And in America, unemployment claims have hit a record for 19 weeks in a row, while a widely watched manufacturing index covering the first half of June has dipped. "Optimism is not enough" to bring about a global recovery, says Wolfgang Munchau in the FT. The world economy is still contracting, albeit at a slower rate.

The statistics were bound to improve, given the vast sums of money thrown at the world economy by central banks and governments, says the FT. What's more, in downturns firms amplify a drop in overall demand and output by running down existing stocks of goods rather than making more. Once inventories need replenishing, there is always an uptick in demand and output.

The question is whether it is sustainable. That seems unlikely, given mounting unemployment, falling house prices and historically low savings, and towering debts imply consumption is likely to prove lacklustre for years in Britain and America. We have not yet "made a dent" in the ratio of private-sector debt to GDP, says Buttonwood on Economist.com.

It could take America, where household debt is still 130% of disposable income, five years to cure its debt hangover, says Capital Economics. It may still be "years away from a meaningful recovery".

And the global banking sector is hardly out of the woods. Nobody is "solving the toxic assets and recapitalisation problems of the banks", says Munchau. Yet past banking crises show that until banks' balance sheets have been "cleansed", there can be no sustainable recovery, says the International Monetary Fund's Dominique Strauss-Kahn. So the squeeze looks far from over. Throw in tax rises and public spending cuts over the next few years and full recovery seems a long way off. Markets counting on a V-shaped bounce are likely to be disappointed.

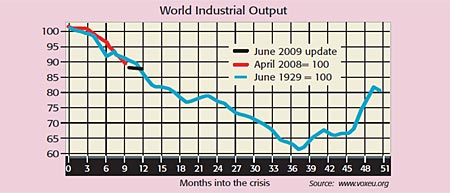

The big picture: we've a long way to fall yet

This chart puts the current global downturn into perspective and it's not a pretty sight. The slump in global industrial output has been "at least as severe" as in the Great Depression, say economists Barry Eichengreen and Kevin

O' Rourke.

Having updated the chart in early June, they see "no clear signs of green shoots". As far as stockmarkets are concerned, global equities have done far worse than they did after 1929. Fourteen months after the 1929-1933 crisis began, global stocks were down by around 20%. Now, 14 months after April 2008, they have fallen by almost twice as much.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.