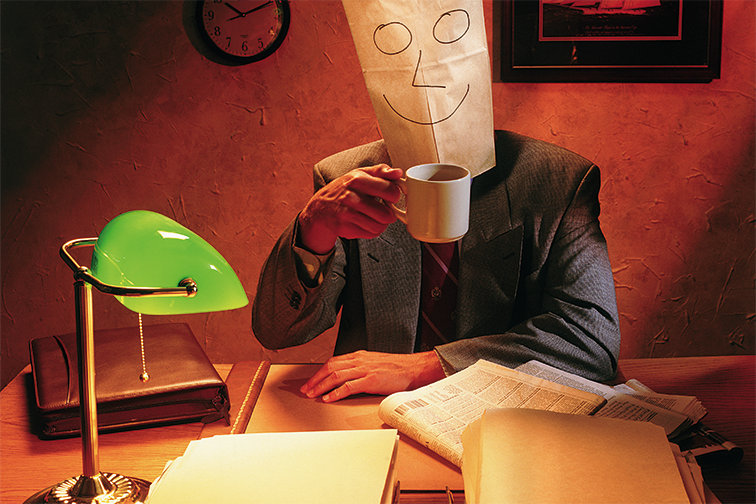

Get your business ready for IR35

IR35 – the tax rules distinguishing freelancers from employees – are getting tougher. Here's how to make sure our business can cope.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Reforms of the IR35 regime are due to come into force in April. The rules aim to tackle "disguised employment", where workers set themselves up as self-employed contractors to secure more favourable tax treatment. The arrangement suits employers too: they pay less national insurance.

While many contractors operate legitimately through such arrangements, HM Revenue & Customs has long suspected that employers and employees have been colluding in order to obtain a tax advantage. Many consultants should actually be taxed as employees, it believes.

From April, the IR35 tax rules will therefore require employers to take responsibility for determining the employee status of all contractors. Employers will only be able to treat those freelancers who meet strict criteria as self-employed. In many cases, those currently working as contractors will have to be brought into the pay-as-you-earn (PAYE) tax system in the same way as ordinary employees. Business groups have complained about the hassle and expense of the new rules, while freelance contractors warn that many may be unfairly penalised.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Small firms are exempt

The good news is that the smallest businesses are exempt from the reforms. Firms that meet two of three qualifying criteria annual turnover below £10.2m, a balance sheet of no more than £5.1m and no more than 50 employees need do nothing. But everyone else has to be ready.

Start with an audit of the freelancers and contractors that you use. How many are there and where are they deployed? Next, identify the ones likely to fall foul of the new rules because they don't match HMRC's description of self-employed consultants. The online "Check Employment Status for Tax" tool is a useful way to do this, with HMRC promising to abide by the ruling it gives as long as you've supplied accurate information.

Start communicating with contractors as soon as possible so they know you're looking into this issue; you will certainly need to tell any contractors moving to PAYE status as soon as possible. Be prepared for some push back: some contractors may seek to negotiate higher rates of pay to reflect their new tax status.

Where necessary, get contractors set up in the right way on your payroll systems as soon as you can you may need new information to move them on to PAYE and if you use a payroll agency you will need to liaise with it at an early stage.

Finally, take legal advice on any changes you need to make to the contracts and agreements you issue to new contractors. You may also need to alter the agreements you have with existing staff.

Insure against late payment

Will your customers pay their bills? Data just released by the invoice finance company MarketFinance suggests 39% of invoices were paid late in 2019, with the average delay almost doubling from 12 days to 23 days.

And with insolvency statistics suggesting company failures have risen to a five-year high, the risk of your firm not getting paid for work that it has done is rising. That could turn a cash flow difficulty into a much more serious problem.

For some firms, trade credit insurance could be the answer. This is insurance that covers your firm against non-payment of bills the number of claims made under such policies hit a ten-year high earlier this year, according to the Association of British Insurers.

Such policies work by assessing the risk of non-payment posed by each of your company's customers, with the insurer then covering you for outstanding debt up to a certain limit in each case. Claims up to this credit limit will be honoured in the event that the customer fails.

In addition to protection, trade credit insurance can provide useful early-warning signs, with insurers monitoring the creditworthiness of customers and issuing updates where they have concerns. But the policies can get quite technical and it's worth using an independent broker to negotiate the best deal.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Prosser is a regular MoneyWeek columnist, writing on small business and entrepreneurship, as well as pensions and other forms of tax-efficient savings and investments. David has been a financial journalist for almost 30 years, specialising initially in personal finance, and then in broader business coverage. He has worked for national newspaper groups including The Financial Times, The Guardian and Observer, Express Newspapers and, most recently, The Independent, where he served for more than three years as business editor.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn