The charts that matter: a fresh hope for the global economy?

John Stepek looks to the charts that matter most to the global economy to see if he can glean some signs of hope.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. No new podcast this week I'm afraid, but we'll do our best to rectify that next week, particularly as we've got the joys of the general election coming up.

Meanwhile, if you missed any of this week's Money Morning articles or blogs, here are the links you need:

Monday: How to invest when surrounded by threats to your wealth

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: Corporate debt is at record levels here's what the risks are

Wednesday: Short selling is not unethical whatever the world's biggest pension fund tells you

Thursday: Why on earth does anyone own open-ended property funds?

Friday: Have markets hit a top? Or are we heading for a Santa rally?

Currency Corner: Is the New Zealand dollar about to make a big comeback?

Merryn's Blog: What level of income really makes you "rich"?

Subscribe: Get your first 12 issues of MoneyWeek for £12

I also had a few interesting conversations on Twitter this week one was on short-selling, the other on open-ended property funds. Have a look and feel free to chip in.

Oh, and my book, The Sceptical Investor was yesterday described by a very nice chap on Twitter as a "very good read". I have to agree, and I suggest you buy it in time for Christmas or even your New Year financial tidy-up right here.

(Or here, if you prefer your books in audio form rather than my dulcet Scottish tones, it's actually read by a real-life professional).

The charts that matter

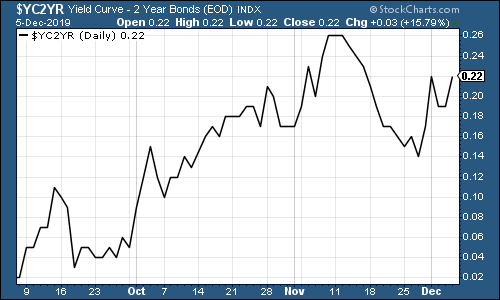

The yield curve has widened again in the past week. In other words, since last week, the gap between the yield on the ten-year US government bond and that of the two year, has expanded, which is what you'd normally hope to see in a healthy-ish economy.

The curve inverted earlier this year, in August. The two-year was yielding more than the ten-year at that point, which suggests markets were expecting a recession. The bad news is that, even although the curve is no longer inverted, history shows that any inversion means a recession is likely to be on the way within 18-24 months. Now, no indicator is 100% accurate. Maybe it'll be wrong this time. But it's something to bear in mind.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

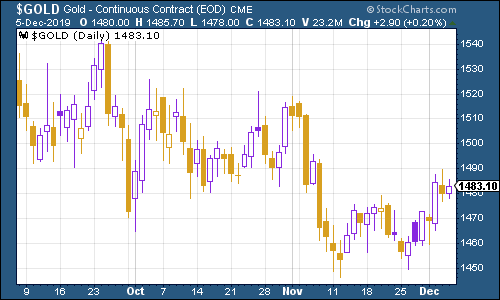

Gold (measured in dollar terms) grew a little stronger this week, but with the dollar rebounding after the strong jobs report on Friday (more below), I'm not sure this will continue in the near term. Particularly if the market decides it's "risk-on" time ahead of Christmas.

(Gold: three months)

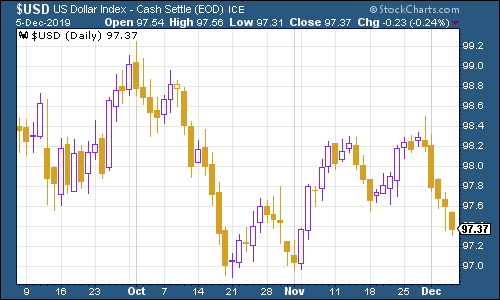

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners weakened somewhat this week, before rebounding in the wake of the jobs report on Friday (more on that in a mo).

(DXY: three months)

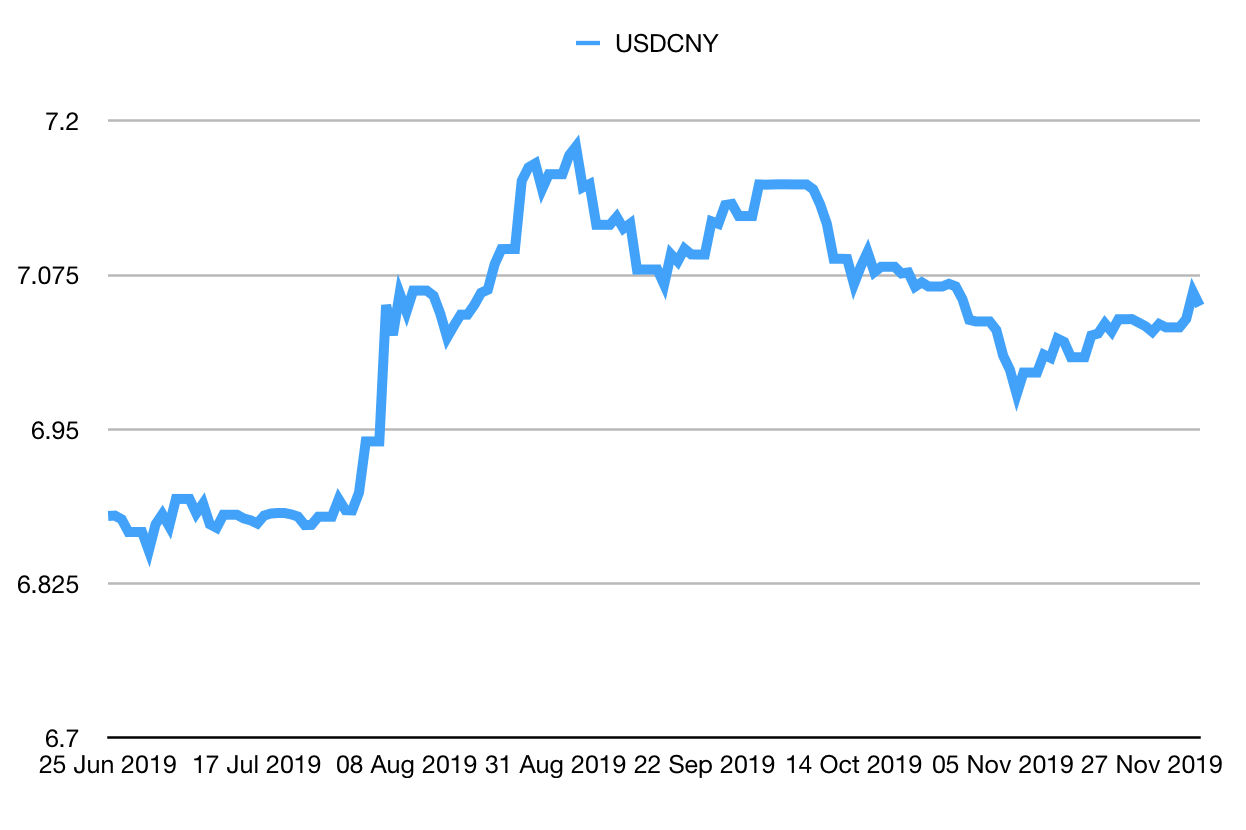

The number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) remains above the key seven to the US dollar mark. This week it has ticked further above seven (despite the dollar weakening against most other currencies) amid concerns about the state of any trade deal, after US president Donald Trump appeared to be in no real hurry to act.

The higher the yuan goes, the more concerned markets are by deflation, which points to a "risk-off" mood and weaker equity markets.

(Chinese yuan to the US dollar: since 25 Jun 2019)

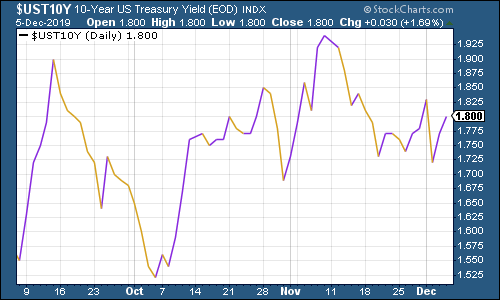

Until Friday afternoon's jobs report (not captured in the charts below), the ten-year yield on the US government bond had changed little. It punched higher after the strength of the report reduced market expectations of further interest rate cuts from the Federal Reserve, the US central bank.

(Ten-year US Treasury yield: three months)

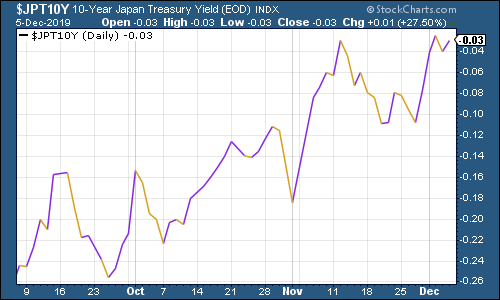

The yield on the Japanese ten-year bond is almost back in positive territory, after prime minister Shinzo Abe unleashed a fresh fiscal stimulus package that was much bigger than expected.

(Ten-year Japanese government bond yield: three months)

Meanwhile, the yield on the ten-year German bund rose a little this week, given hope by Chinese data that the global manufacturing cycle might be taking a turn for the better.

(Ten-year Bund yield: six months)

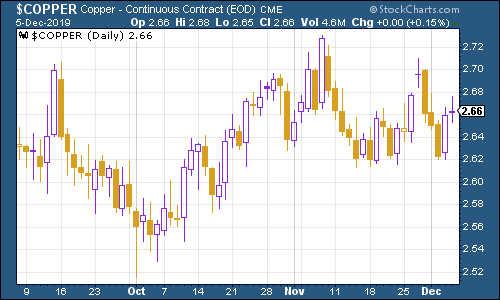

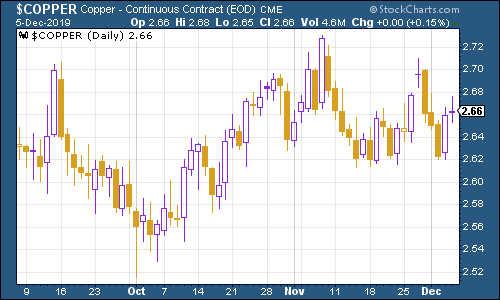

Copper was unsure of what to do it liked the signs of economic improvement from China, but wasn't keen on the idea that a trade deal might not appear any time soon.

(Copper: six months)

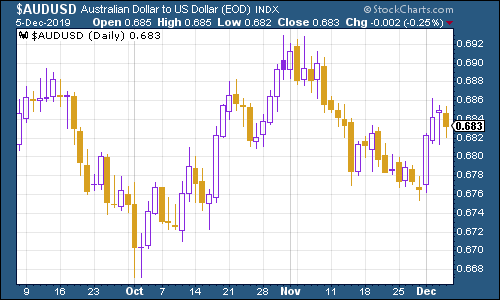

The Aussie dollar strengthened this week against the US dollar, helped by the Chinese data although again, the US jobs data on Friday capped the gains.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin stayed in a pretty tight range this week.

(Bitcoin: ten days)

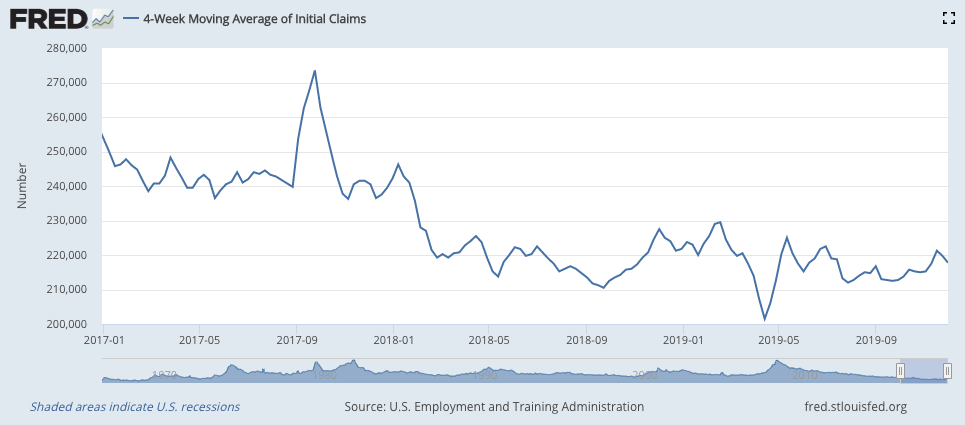

US weekly jobless claims fell sharply to 203,000 this week, a better figure than expected (although it might be distorted by Thanksgiving). That was down from 213,000 last week. The four-week moving average dipped to 217,750.

Why is this all significant? Long story short, once this latter figure has troughed for the business cycle, it means a stock market top and a recession are likely to follow relatively quickly afterwards.

Obviously, the problem is that you never know the trough has arrived until after the fact, but it's worth watching for a rising trend, just in case.

Certainly, the latest nonfarm payrolls figures don't suggest problems with the US labour market. The US economy added 266,000 jobs in November, absolutely hammering forecasts (the average forecast was 180,000). The previous month's figure was revised higher too.

The unemployment rate fell to 3.5% (the lowest since 1969), and wages rose more rapidly than expected by 3.1% instead of 3%.

These figures are frequently revised, but at first glance, they make fear of recession look very overdone, and markets reacted with relief bond yields rose (ie people became less scared of deflation) and shares prices headed higher.

(US jobless claims, four-week moving average: since January 2016)

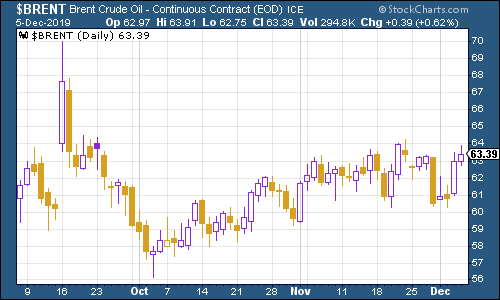

The oil price (as measured by Brent crude, the international/European benchmark) continues to meander higher. Oil cartel Opec met at the end of this week to try to agree further production cuts, aimed at propping the oil price up (in turn helping a massive Saudi Arabian oil company on its way to market).

(Brent crude oil: three months)

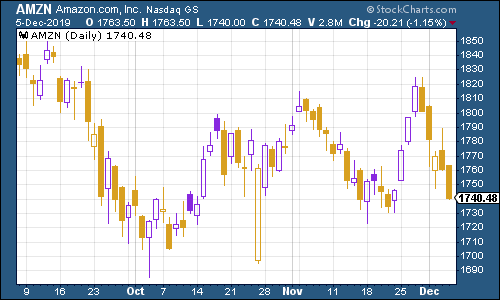

Shares in internet giant Amazon came off the boil a little this week.

(Amazon: three months)

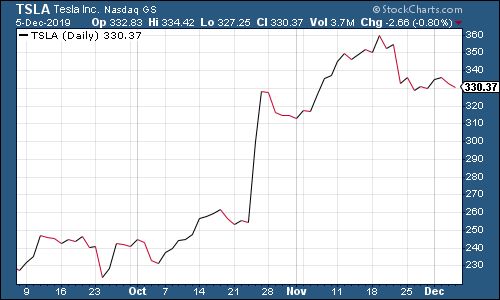

Meanwhile, shares in electric car group Tesla were little changed.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.