Currency Corner: is the New Zealand dollar about to make a big comeback?

In this week's Currency Corner, Dominic Frisby explains why he's tempted to buy the New Zealand dollar.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I stumbled across a trade I rather like the look of yesterday the New Zealand dollar vs the US dollar. I think I'm about to be a buyer of the former here's why.

Some background first. The New Zealand dollar (or Kiwi) like just about every dollar, divides into one hundred cents. It was introduced in 1967 to replace the pound at a rate of two dollars to one pound. Today there are still two dollars to a pound. How about that?

The New Zealand dollar is one of the ten most traded currencies in the world it always seems to be accounting for about 2% of global forex turnover. Given New Zealand's relatively small share of global GDP and its tiny population (4.7 million), that is quite an achievement.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It might have something to do with the fact that, according to Transparency International's Corruption Perceptions Index, New Zealand is the most honest country on earth.

To establish some parameters here, we're looking at the Kiwi against the US dollar since shortly after the turn of the century. The chart below shows how many US dollars there are to a Kiwi. Currently one Kiwi dollar gets you 66 US cents.

When the chart goes up the Kiwi is strong. When it goes down the US dollar is strong.

Peak Kiwi strength came in 2011 and then again in 2014 at around US$0.88. Peak Kiwi weakness came during the global financial crisis in early 2009 at just below US$0.50.

I've also highlighted in red what looks like a double bottom stretching between 2015 and the summer of this year at US$0.62.

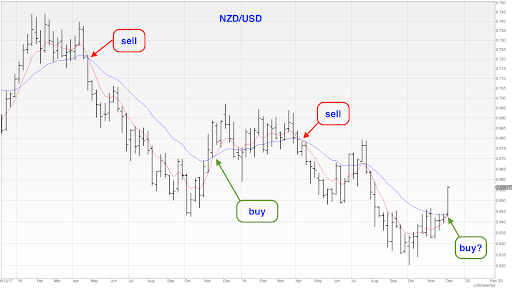

With that low in mind, let's zoom into a more recent two-year weekly chart. In addition, I've drawn the six- and 21-week exponential moving averages (EMAs) which show the average price of the past six (red line) and 21 (blue line) weeks, with greater weight given to more recent weeks.

The sell signal occurs when the red line crosses down through the blue, both are sloping down, and the price is below. The buy signal occurs when the red line crosses up through the blue, both are sloping up, and the price is above.

I've marked both the buy and the sell signals.

And you can see we are about to get a buy signal, assuming the Kiwi dollar doesn't capitulate over the next few days.

What excites me about this buy signal is that it is coming off the back of that double bottom I identified in the first chart above. My feeling is that we are going to get a run to the US$0.73 area, where there will be resistance. We might get there by early next year.

In the longer term, we might even get back into the US$0.80s. Donald Trump is agitating for a weaker dollar after all. He might actually get his way.

Dominic's new book Daylight Robbery: How Tax Shaped Our Past And Will Change Our Future, published by Penguin Business, is available at Amazon and all good bookshops. Audiobook at Audible.co.uk. Signed copies are available at dominicfrisby.com

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how