Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

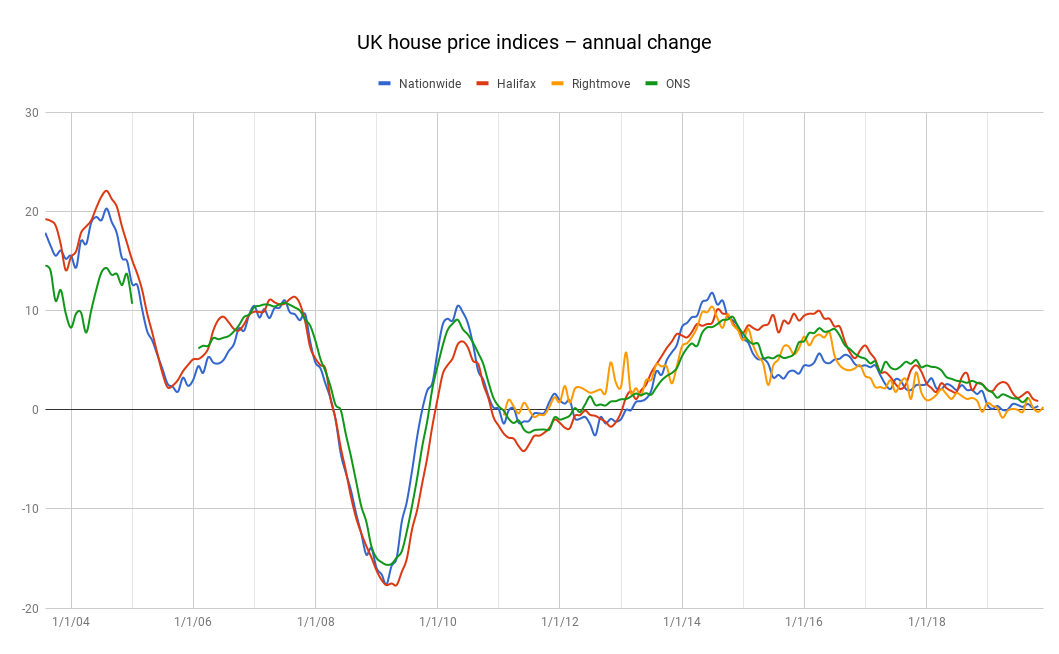

The number of people putting their house on the market has seen its biggest fall for over ten years, according to the latest data from property website Rightmove. Asking prices have also fallen but that is normal for this time of year as the market slows ahead of Christmas.

In the four weeks to 9 November, the number of sellers fell by almost 15% compared with the same period last year and is the biggest annual fall since August 2009. Miles Shipside, director of Rightmove, speculates that sellers may be put off by a combination of Brexit and a general election; something that's "obviously a new combination for many thousands of buyers and sellers". Many owners may be waiting to see what, if anything, happens to stamp duty after the election.

The average asking price of a home in the UK has risen by 0.3%, compared with a fall of 0.2% in the previous month. But with wages rising at 3.6%, says the Office for National Statistics, and consumer price inflation running at 1.5%, affordability continues to increase and the risk of a catastrophic house price crash subsides.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Just one region saw asking prices rise in the last month the East Midlands registered a rise of 0.3%.

On an annual basis, London house prices are among the country's biggest fallers the average asking price of a home in Greater London fell by 0.8% in the last year to £609,506. The top end of the market is bearing the brunt of the falls, with a 5.4% monthly slide and a 3.7% annual fall.

The biggest annual fall was in the East of England region, where the average asking price fell by 1.1% in a year to £346,981. Sellers in Yorkshire and the Humber, while seeing a monthly fall of 1.3%, have seen the biggest annual rise at 3.1%, with the average asking price now £192,808.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.