The charts that matter: China’s scepticism on Trump

With China sceptical of getting a trade deal out of Donald Trump, John Stepek looks at how that affects the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I keep telling you to get hold of your ticket for the MoneyWeek Wealth Summit. Now that we're facing a general election the cherry on the cake, as it were I think it's even more important that you come along.

There are so many fantastic investment experts coming Gillian Tett of the FT (yes, that Gillian Tett, the one who actually pointed out that 2008 was coming and that subprime mortgages were a big problem before it all went pear-shaped), James Anderson (a man who has made many MoneyWeek readers a great deal of money indeed via Scottish Mortgage Trust), and the frankly brilliant Russell Napier, one of the most interesting investment strategists on the planet.

It'll be a great day. And I'll be there too! Come along and grab a drink and a chat at the end of the day. Book your ticket here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Podcasts, Money Morning, Currency Corner and Merryn's blog

On the podcast front, Merryn and I didn't get the chance to record one this week (we're aiming for Monday afternoon) but The Week team did invite me back on their podcast (it's a miracle after last time, but it seems I got away with it) where alongside discussions on riots in Chile, and paperless bureaucracies, I tried to explain why passive funds are better for most investors than active management.

If you missed any of this week's Money Mornings, here are the links you need:

Monday: The US dollar is still the most important price in the world

Tuesday: House prices in the UK are still gently falling in real terms

Wednesday: How to steel yourself to buy at new all-time stockmarket highs

Thursday: Forget rate cuts what matters most is that the Fed is still printing money

Friday: What the Brexit election means for your money

Currency Corner: Is sterling finally on the comeback trail?

Subscribe: Get your first 12 issues of MoneyWeek for £12

Deal: get 25% off a copy of my book, The Sceptical Investor

And don't miss Merryn's blog on why charities need to spend more of their money.

The charts that matter

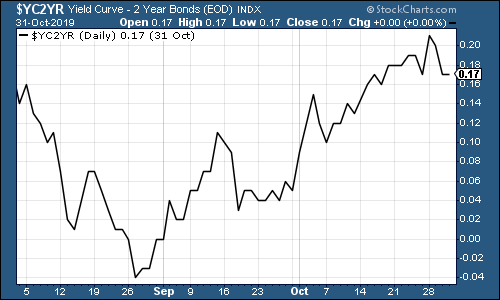

Despite the Fed's money-printing efforts (just don't call it QE) the yield curve hasn't really budged much. It's still positive the yield on the ten-year US government bond is higher than the yield on the two-year, which is the normal way of things.

The gap between the two was widening, but the spanner in the works at the end of the week was that, just as Donald Trump has been drumming up prospects for a trade deal, China turned around and said that it doesn't see a lot of hope for a more comprehensive deal, at least not while Trump is at the other side of the table.

The curve inverted about two months ago now, which usually indicates that a recession is on the way within 18-24 months. We'll see if it holds true this time (I have no reason to doubt the indicator, but these things are rarely 100% accurate and this was a very brief inversion).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

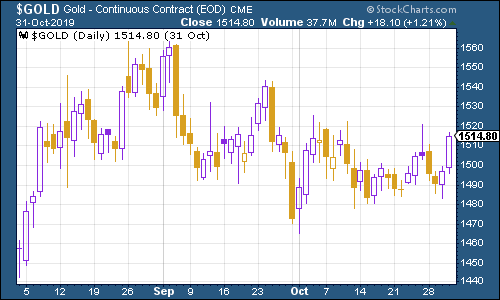

Gold (measured in dollar terms) perked up, driven partly by the weaker dollar and by the market's doleful reaction to the downbeat talk from China. Gold tends to do well when other assets are struggling, which is why we like it as part of a diversified portfolio.

(Gold: three months)

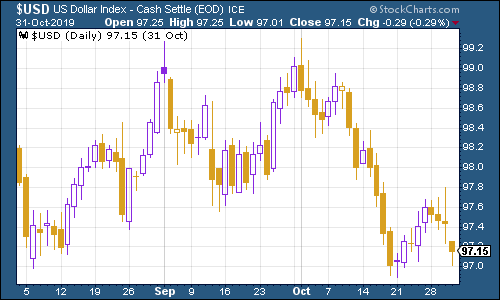

Meanwhile, the US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners is showing proper signs of weakness. Could this be the turn that everyone has been waiting for? It'll be interesting to see if the dollar continues to fall despite the "risk off" appetite you'd expect nerves about a trade deal to inspire.

(DXY: three months)

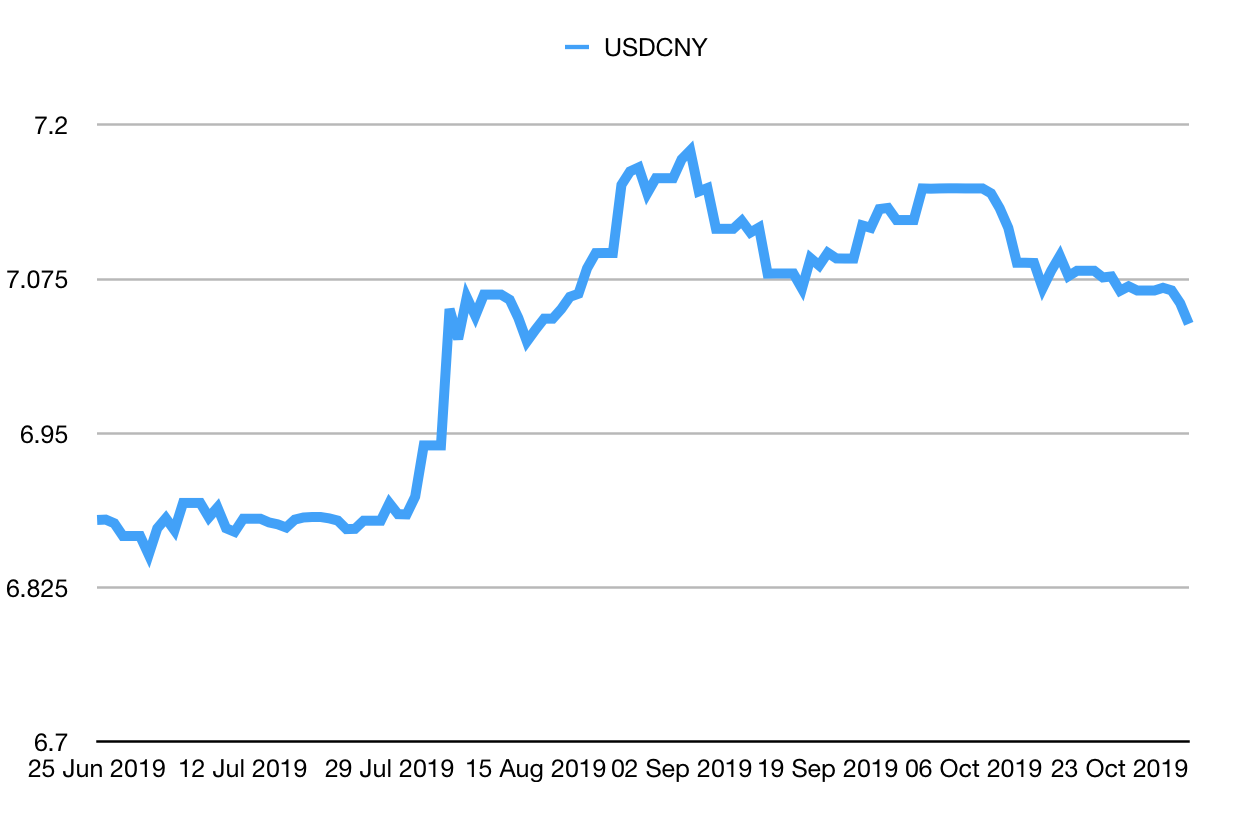

With the fall in the dollar, the number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) also fell. In fact, we are now close to the point where the number of yuan you can get for a dollar falls back below the 7-to-the-dollar level that rattled everyone so badly when it was first broken. The dollar growing weaker against the yuan is generally not considered a bad sign - it makes life easier for emerging markets as a whole and it means the risk of a deflationary yuan devaluation is diminishing.

(Chinese yuan to the US dollar: three months)

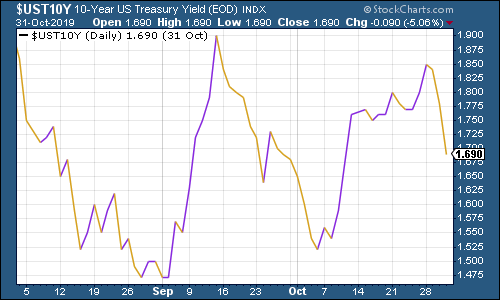

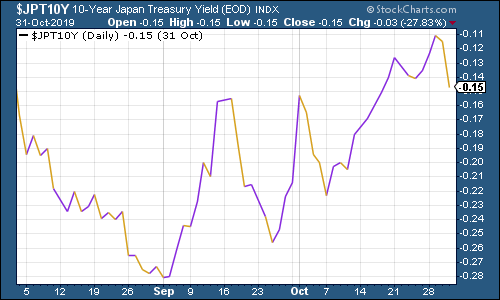

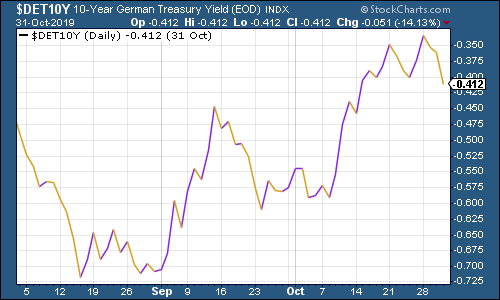

Yields on ten-year yields on major developed-market bonds were rising before the China trade news knocked sentiment late in the week.

The yield on the US ten-year crept higher then slid by the week's end.

(Ten-year US Treasury yield: three months)

Japan slipped too...

(Ten-year Japanese government bond yield: three months)

As did Germany, although there's probably an element of Brexit uncertainty caused by the general election in there.

(Ten-year Bund yield: three months)

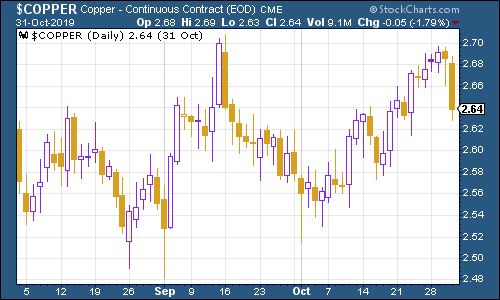

The price of copper had bounced partly due to the unrest in Chile, but pessimism over trade hit it hard late in the week.

(Copper: three months)

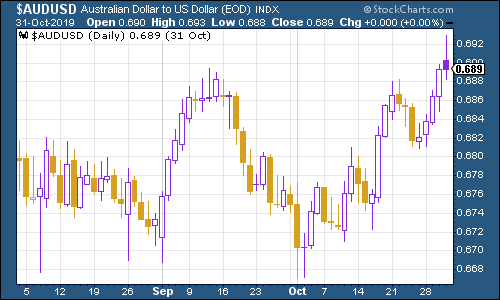

The Aussie dollar rose against the US dollar, primarily because the dollar was having a hard time generally. But you can see at the tail-end of the week where the currency took a hit on the Chinese news - given that Australia's economy is very dependent on China's growth, that's no surprise.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin - well, unlike most assets, it got a boost from China this week. That wasn't anything to do with trade - it's because China sounded a lot more sympathetic to cryptos than governments in the developed world have recently.

(Bitcoin: ten days)

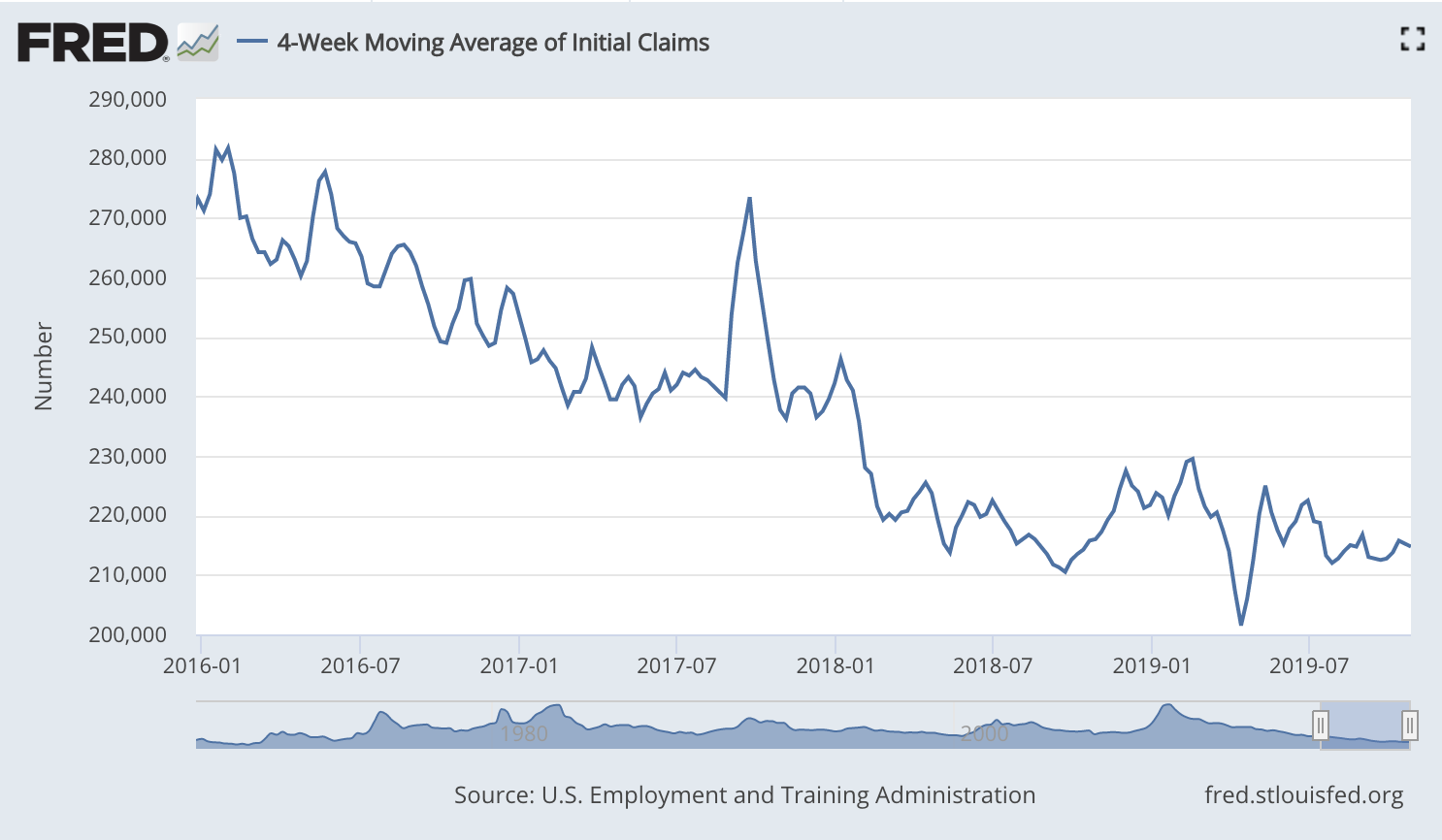

US weekly jobless claims rose by a bit more than expected this week, to 218,000, a bit more than expected, from 213,000 (revised up from 212,000) last week. The four-week moving average came in at 214,750.

A sustained uptrend would indicate that a recession is close. But at the same time, the all-important nonfarm payrolls actually ended up being a good bit stronger than expected. Last month, 128,000 jobs were added to the US payrolls, but economists had expected a gain of just 89,000. This was despite the strike at GM causing havoc with the figures. Meanwhile the figures for the previous two months were revised up. So it's hard to argue that the wobbly economy is showing up in employment data yet.

(US jobless claims, four-week moving average: since January 2016)

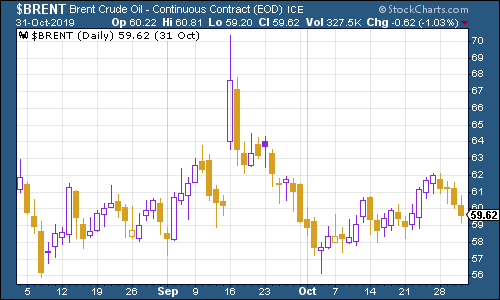

The oil price (as measured by Brent crude, the international/European benchmark), made gains this week, although that's as much to do with the weak dollar as anything else.

(Brent crude oil: three months)

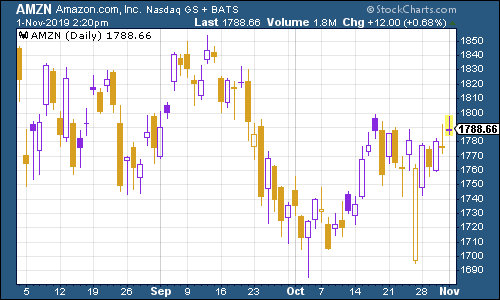

Internet giant Amazon's share price rose along with the rest of the market.

(Amazon: three months)

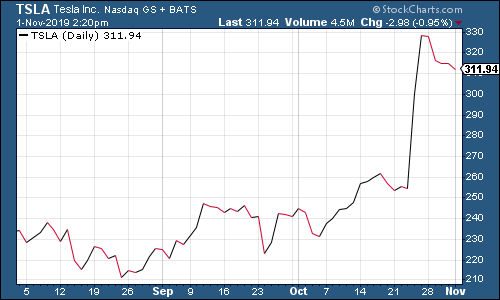

Shares in electric car group Tesla trickled a bit lower after a post-results surge last week, but it's clear that the faithful have not yet lost that faith.

(Tesla: three months)

Have a great weekend. Don't forget 22 November!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how