Currency Corner: is sterling finally on the comeback trail?

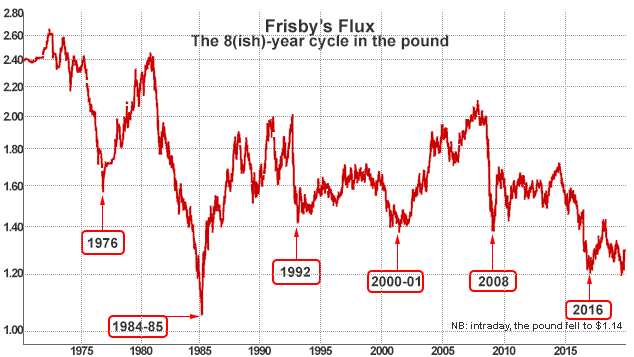

Sterling seems to work in an eight-year cycle, says Dominic Frisby. And that cycle is suggesting several good years ahead for the pound.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today we are going to take a look at sterling.

I've written about Frisby's Flux before this strangely consistent eight-year cycle in sterling. I'm deeply cynical about cycles, as regular readers will know. It's easy to look back at historical events, arbitrarily find some pattern, and declare it a cycle. Nevertheless, there does seem to be something to this one, as you'll see.

And now that political certainty and stability slowly seem to be returning, it's time for that cycle to come into play.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

You may find my last remark ridiculous. Political certainty and stability returning? Nonsense! We are just going into a general election. Anything can happen.

The forex markets wouldn't agree. They have been remarkably calm, in the context of the last couple of years. When Prime Minister Boris Johnson came back from Europe with his surprise deal last month, the pound shot up from $1.22 to the $1.29 area, give or take a penny, and it has remained there ever since, even though Parliament failed to ratify it and Brexit did not happen last night as it was supposed to.

Normally, this would have brought on volatility, but it didn't. The $1.28 level held comfortably.

Forex traders are looking at the polls just the same as everyone else, and they can see that this general election is going to purge Parliament. Of the 57 MPs who are stepping down, the vast majority are Remainers. Many more of those who have scuppered the Brexit process the likes of Dominic Grieve and Anna Soubry are likely to lose their seats. The Speaker himself is gone. Parliament is going to be a very different place on 13 December.

The polls show Boris Johnson has a strong lead. We don't yet know what the Brexit party has planned we find out today. But whether it fields 20 or 30 candidates, or several hundred, it is going to hurt Labour as much as it hurts the Tories. One way or another, it looks as though Johnson is going to have the majority he needs to make Brexit happen along the lines of his deal.

A lot can change of course, but some version of Johnson's deal now looks probable.

You may think it's a bad deal, or you may think that leaving the EU is a dumb idea no matter. Forex markets like stability and certainty. For the first time in a long time, the outlook is clear.

That's my interpretation of why sterling has held up in the $1.29 area.

What does Frisby's Flux tell us about the future for sterling?

So to Frisby's Flux and the eight-year cycle.

For some reason, every eight years, the pound seems to make a decisive low. There was 1976 when the then chancellor, Dennis Healey, had to go to the International Monetary Fund. In 1984-1985, with the miners' strike at home, extraordinary strength in the US dollar led to the Plaza Accord and the G5 nations agreeing to its devaluation.

In 1992, we had the pound crashing out of the European Exchange-Rate Mechanism, and the infamous Black Wednesday. In 2000-2001, the pound made another low as dotcom bubble burst and the US dollar peaked. The financial crisis of 2008 saw another sell-off.

And, finally, in 2016, with Brexit out of control and Theresa May's infamously bad conference speech, we got the "flash crash" which saw the pound crashing to $1.14 during Asian trading hours.

According to the logic of this cycle, 2016 was the low. The pound should rally from here, now that the political direction looks so much more certain than it has done for so long.

There's a lot that can go wrong, of course. This is Brexit after all. But the cycle suggests several good years ahead for the pound.

Perhaps around 2022 or 2023, we should be looking to get short again, in anticipation of another crash low in 2024. That, funnily enough, will probably come around the time Parliament has to approve our future trading arrangements with the EU.

Remember the last three years have only been about the Withdrawal Agreement. There is still a long way to go!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn