The charts that matter: relative calm – and a surge for Tesla

As shares in electric car group Tesla surge, John Stepek looks at the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Quick thing very exciting announcement to make about the Wealth Summit we've got Dylan Grice, formerly of Societe Generale, now of Calderwood Capital, joining our panel on The Future of Money.

Dylan has long been one of the most interesting thinkers in the investment world don't miss the chance to see him in conversation. Get your ticket here now.

We've also got a fantastic investment trust panel lined up Sebastion Lyon of Personal Assets Trust, Simon Elliott of Winterflood and Dan Whitestone of Throgmorton will be giving Merryn their views on everything from the investment outlook to a certain fund manager's downfall.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That's just a tiny sample of what we've got planned for the day. And we haven't even announced all the guests yet. Seriously, you'll be kicking yourself if you miss it book now.

Podcasts, Money Morning, Currency Corner and Merryn's blog

On the podcast front, Merryn and I finally recorded a new one this week. In fact, we had to record it twice. On Wednesday, we were talking about what might happen to Woodford Patient Capital if another manager took it on. The next morning, Schroders promptly did just that, stealing our thunder somewhat. Here's the Friday afternoon version, where we ponder whether Patient Capital is now a buy' or not.

If you missed any of this week's Money Mornings, here are the links you need:

Monday: Another Brexit delay so what happens now?

Tuesday: Markets are getting over their burst of summer panic but why?

Wednesday: The future of money is borderless and difficult to tax

Thursday: A beginner's guide to gold: what's it for?

Friday: Is it time to buy Patient Capital Trust?

Currency Corner: What's next for the mighty US dollar?

Subscribe: Get your first 12 issues of MoneyWeek for £12

Deal: get 25% off a copy of my book, The Sceptical Investor

And don't miss Merryn's blog on the demise of cash machines.

The charts that matter

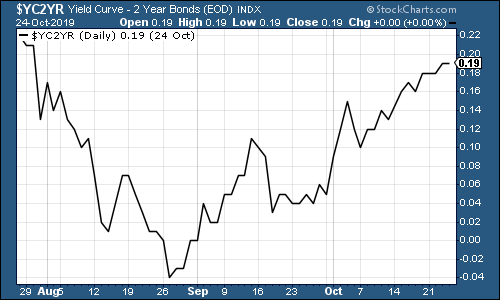

The yield curve edged further into positive territory this week (in other words, the yield on the ten-year US government bond is higher than the yield on the two-year, which is how things should be). The curve inverted about two months ago, which usually indicates that a recession is on the way within 18-24 months. We'll see if it holds true this time (I have no reason to doubt the indicator, but these things are rarely 100% accurate).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

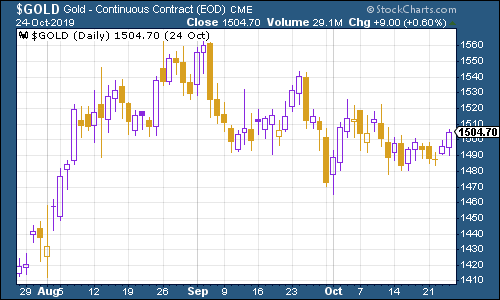

Gold (measured in dollar terms) had a largely uneventful week, drifting sideways.

(Gold: three months)

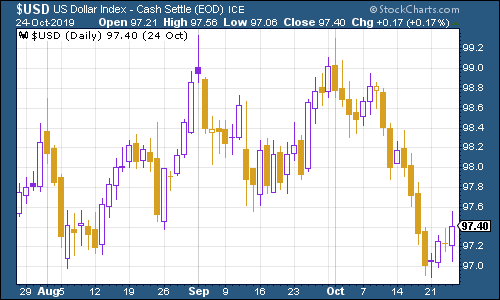

Similarly to gold, the US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners was little changed. Right now it seems to be grinding higher in the long run, as Dominic noted in Currency Corner this week.

(DXY: three months)

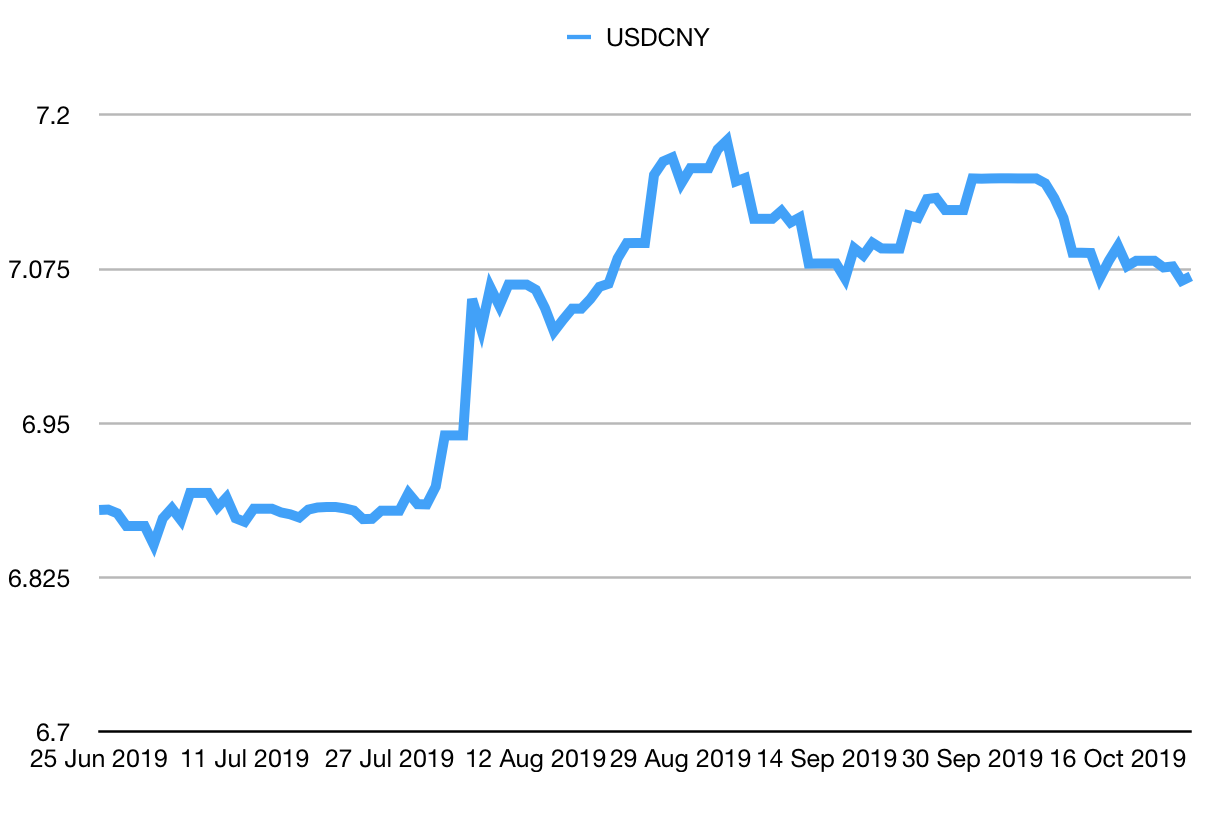

The number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) edged lower.

(Chinese yuan to the US dollar: three months)

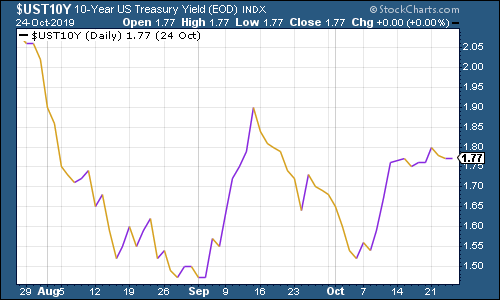

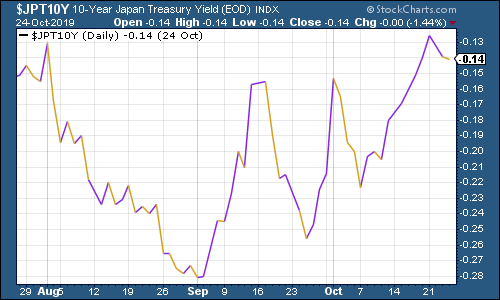

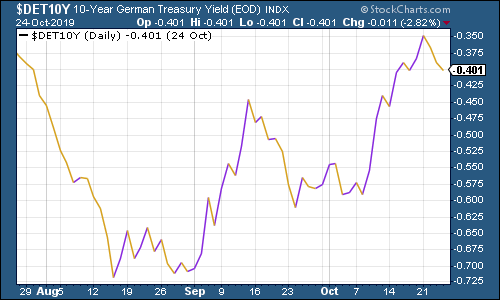

Yields on ten-year yields on major developed-market bonds were little changed on the week.

The US ten-year was basically flat on last week.

(Ten-year US Treasury yield: three months)

As was Japan...

(Ten-year Japanese government bond yield: three months)

And Germany.

(Ten-year Bund yield: three months)

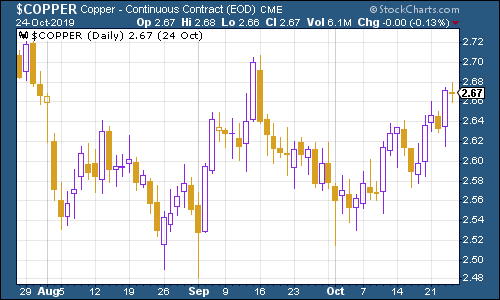

The price of copper perked up amid concerns that social unrest in Chile will hit supply Chile is one of the world's most important copper producers.

(Copper: three months)

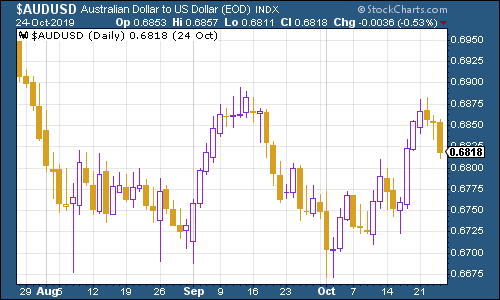

The Aussie dollar was little changed on last week.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin had another bumpy week - the price tumbled on Wednesday then perked right back up on Friday.

(Bitcoin: ten days)

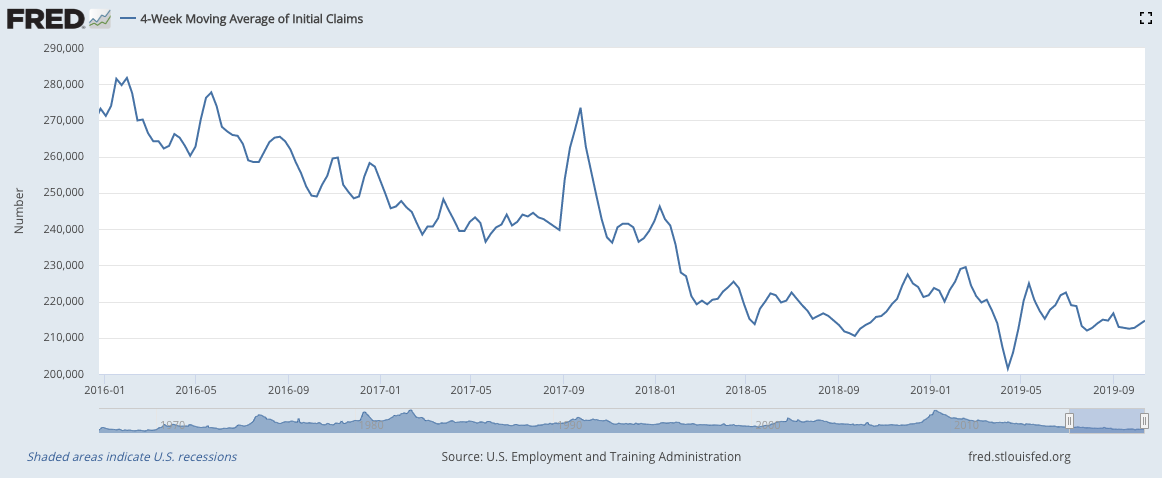

US weekly jobless claims fell back this week to 212,000, a bit lower than expected, from 218,000 (revised up from 214,000) last week. The four-week moving average came in at 215,000.

A sustained uptrend would indicate that a recession is close. We're not there yet, but it'll be interesting to see what the US nonfarm payrolls due on Friday reveals.

(US jobless claims, four-week moving average: since January 2016)

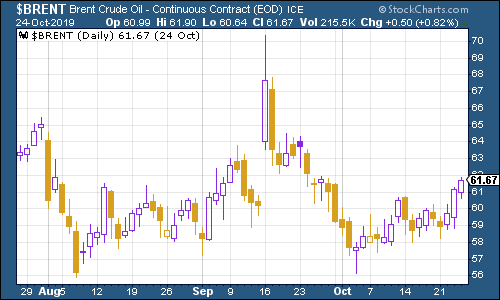

The oil price (as measured by Brent crude, the international/European benchmark), edged higher this week.

(Brent crude oil: three months)

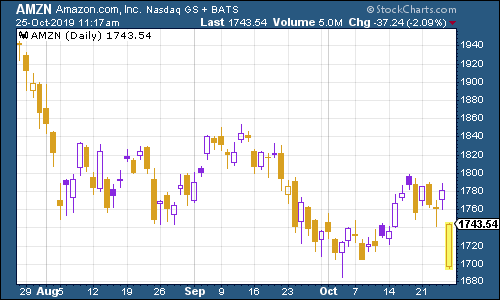

Internet giant Amazon's share price fell somewhat this week after third-quarter earnings missed expectations. But initial falls were tempered because as usual with Amazon, it's because Jeff Bezos was spending lots of money making the group even harder compete with, by expanding the company's same-day delivery service.

(Amazon: three months)

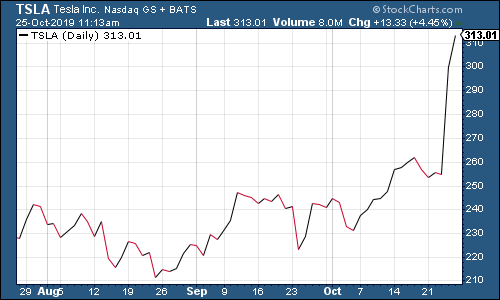

Meanwhile shares in electric car group Tesla surged this week as investors applauded the company's third quarter results. The company actually made a profit (analysts had expected a loss) and said that its Chinese factory is running ahead of schedule.

(Tesla: three months)

Have a great weekend. Hope to see you on 22 November!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.