Sophos: US scoops up another UK success story

British cybersecurity company Sophos is a successful company with good prospects. So it’s no surprise that the American private-equity firm Thoma Bravo has offered £3.1bn for it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

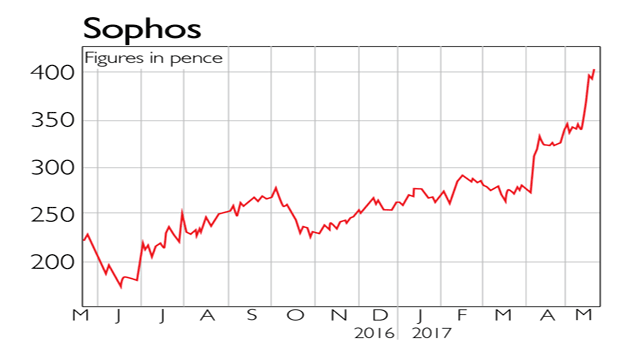

British cybersecurity company Sophos is a "homegrown success story" with "good prospects", says the Financial Times. So it's not surprising that the American private-equity firm Thoma Bravo has offered £3.1bn for it. Those who bought the stock when it floated in 2015 have more than doubled their stake.

While there will be the inevitable "hand wringing" at the idea of a British tech firm being taken over by a foreign company, fears of losing local tech expertise are "overdone": Thoma Bravo intends to keep Sophos as a standalone business.

It's easy to see why Thoma Bravo is interested in Sophos, says Liam Proud for Breaking- views. Its network of 45,000 sales partners, such as regional computer shops and consultants, which sell its products to businesses, means that the new owner "can buy up other products and turbocharge sales by pushing them out to Sophos's distributors". Still, the American fund is having to pay a "punchy" 37% premium, implying that the company is valued at "almost six times last year's revenue".

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Thoma Bravo is the latest US firm attracted to the UK by the low value of the pound and restrained stockmarket valuations, says Simon Duke in The Times. However, Sophos's shareholders should be "wary" of hanging on "in the hope of a counterbid". This deal is backed by Sophos's founders and Apax Partners, its biggest shareholder, and Thoma Bravo already owns Sophos's biggest competitor, Barracuda. It's "hard to see other funds wanting to lock horns with this powerful suitor".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Student loans debate: should you fund your child through university?

Student loans debate: should you fund your child through university?Graduates are complaining about their levels of student debt so should wealthy parents be helping them avoid student loans?

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.