The charts that matter: hopes for a trade deal and a Brexit breakthrough

John Sepek looks at how the latest Brexit negotiations have affected the chart that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. Brexit is nearing what might be its final crunch moment, as I write. As a result, you really need to book your ticket now for our Wealth Summit on 22 November.

By then, we'll have a better idea of what deal we're getting (if we're getting a deal at all, for that matter), and what that will all mean for the general election that might well be looming by then.

If you want to preserve your wealth through the turbulence up ahead, you'll need a good grip on what the consequences might be, and that's what we'll be discussing.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

From how Brexit might affect your investments, to the massive changes to the taxation regime that would take place under a Labour government, to the opportunities elsewhere in the world, we'll be covering everything you need to know to protect and grow your wealth.

Don't delay sign up today. You won't see a group of experts like this under one roof at any other conference this year.

Podcasts, Money Morning and Currency Corner

On the podcast front, we've got two new ones for you this week. There's a third and final recording from Merryn's Edinburgh Fringe festival show, recorded in Adam Smith's front room in this one, Merryn and I discuss crony capitalism, the damage done by student debt, and the trouble with regulation, with Anne Richards, CEO of Fidelity International, and economist and journalist Frances Cairncross. Listen here.

And last weekend I recorded a podcast at Politics Live with the team at The Week Unwrapped, guest starring Iain Dale of LBC Radio. It was all about Brexit, I'm sure you'll be overjoyed to hear you can check it out here.

If you missed any of this week's Money Mornings, here are the links you need:

Monday: Are Trump and Xi desperate enough to kiss and make up yet?

Tuesday: How will WeWork's woes affect the London property market?

Wednesday: Once again active fund managers are no better in bear markets than in bull runs

Thursday: Are we heading for another October crash, or should you stay long?

Friday: The US Federal Reserve is quietly paving the way for further stimulus

Currency Corner: The Romanian leu a currency that has fallen even harder than the pound

Subscribe: Get your first 12 issues of MoneyWeek for £12

Deal: get 25% off a copy of my book, The Sceptical Investor

The charts that matter

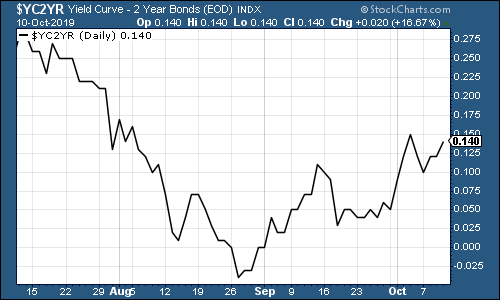

The yield curve inverted at the tail-end of the summer, which is an indicator that recession will likely arrive 18 to 24 months.

It is back in positive territory now in other words, the yield on the ten-year US government bond is higher than the yield on the two-year, which is the normal way of things.

And while this portion of the curve was little changed this week, it's interesting to note that the gap between the three-month Treasury and the ten-year also nudged back into positive territory this week after several months of inversion. I suspect that the Federal Reserve's decision to add more liquidity to the market helped with this.

That said, it's not terribly meaningful in terms of the indicator itself as far as that goes, once inversion has happened, you're on recession watch, and the yield curve turning positive after that is irrelevant.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

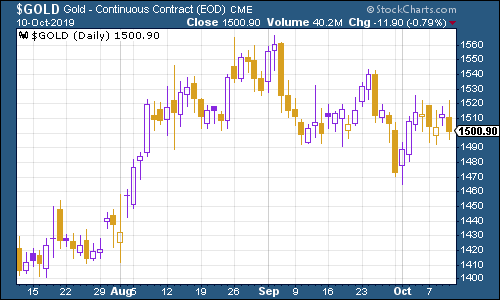

Gold (measured in dollar terms) has drifted lower as investors grow a little more convinced that a US-China trade deal might be pulled off.

(Gold: three months)

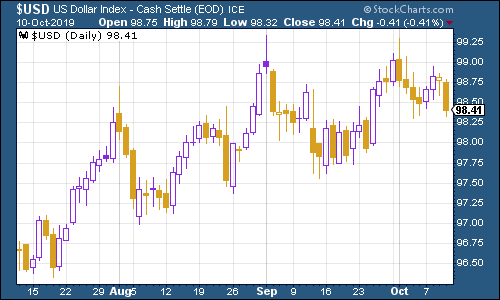

Interestingly, the US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners has drifted lower alongside gold this week. The short explanation for this is that markets are feeling a little less panicky this week, what with the Fed topping up liquidity, and signs of even a half-hearted coming together on trade.

(DXY: three months)

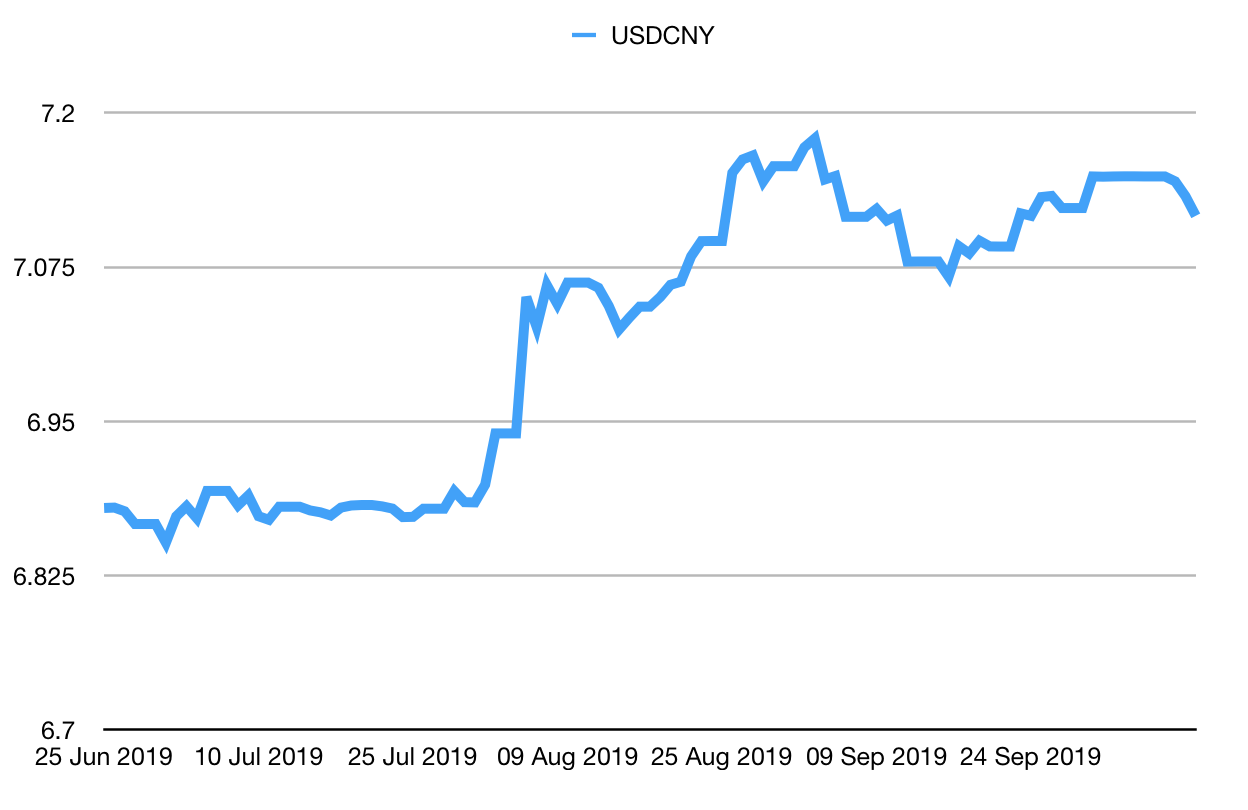

In another sign of market concerns easing, the number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) fell back towards the 7.0 level. The stronger the dollar gets against the yuan, the worse Chinese relations are with the US, and the more markets fear global deflation. So a stronger yuan is a "risk-on" sign.

(Chinese yuan to the US dollar: three months)

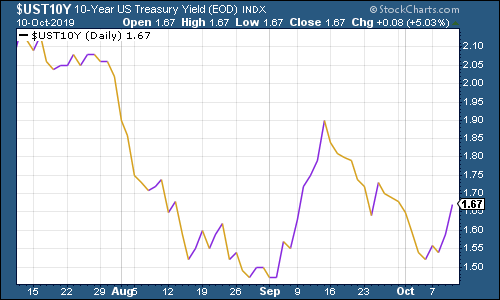

We've also seen the "risk-on" mood in the behaviour of ten-year yields on major developed-market bonds, which have rallied this week, mainly based on those growing hopes for a deal between the US and China.

(Ten-year US Treasury yield: three months)

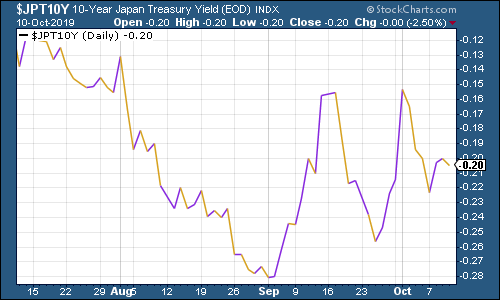

Japan was little changed, but that's partly because it had a spike higher last week due to changes to Japanese central bank policy.

(Ten-year Japanese government bond yield: three months)

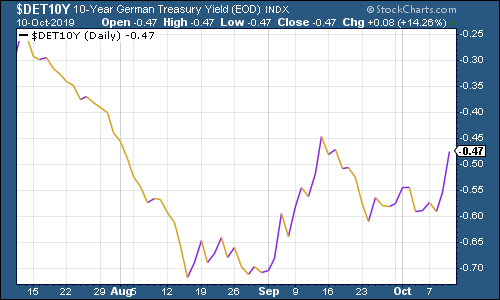

German yields meanwhile moved sharply higher. Why? Because Germany is massively exposed to global trade, so if relations thaw between the US and China, that's good for German markets. Some sign of movement on Brexit helps, but it's the international trade war angle that's been giving Germany the biggest headache.

(Ten-year Bund yield: three months)

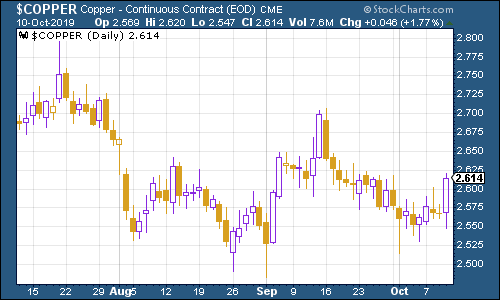

The price of key infrastructure metal copper perked up on hopes for a trade deal.

(Copper: three months)

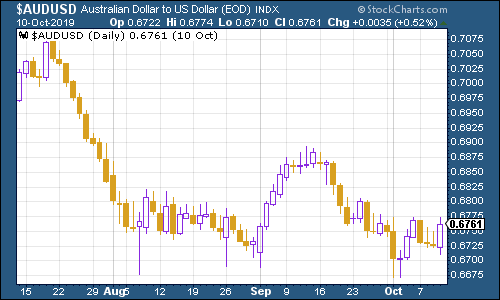

The Aussie dollar was little changed against the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin was on the slide again earlier in the week but perked back up. Again it's hard to say what's driving it it's not "safe haven" flows, given how other assets have been behaving this week.

(Bitcoin: ten days)

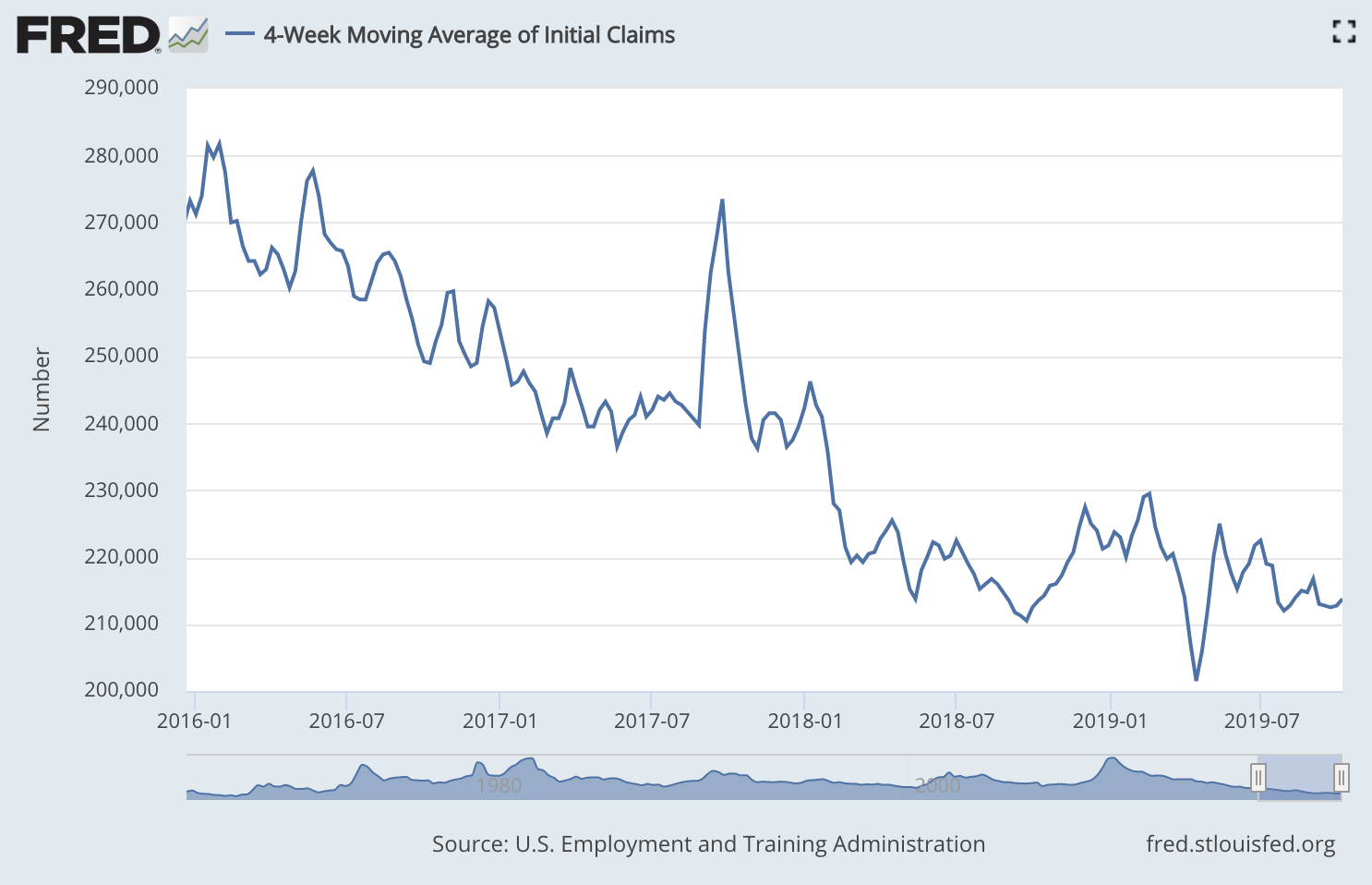

US weekly jobless claims fell this week to 210,000, lower than expected, down from 220,000 last week (which was revised higher by 1,000). The four-week moving average rose a little to 213,750. So again, we still aren't seeing the sustained uptrend that would indicate that a recession is close.

(US jobless claims, four-week moving average: since January 2016)

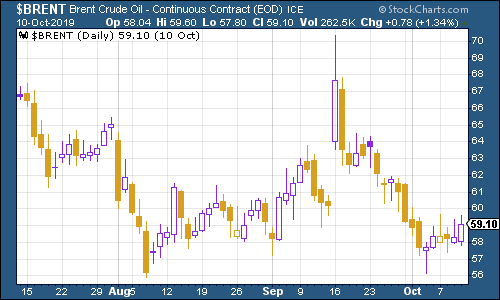

The oil price (as measured by Brent crude, the international/European benchmark), moved higher a little, amid more tension in the Middle East, as an Iranian oil tanker was apparently hit by two missiles. There was also some tough talk from oil cartel Opec about being determined to keep prices from collapsing although of course, there are significant limits to how much control they actually have over the market.

(Brent crude oil: three months)

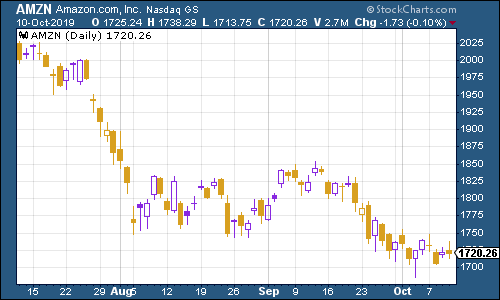

Internet giant Amazon's share price was little changed this week.

(Amazon: three months)

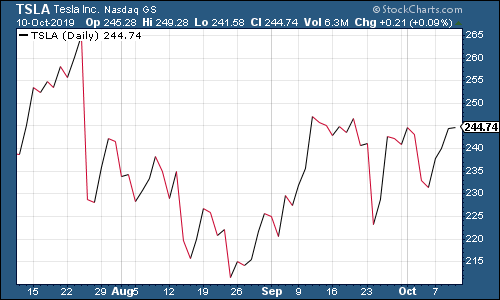

Shares in electric car group Tesla bounced back following its slightly disappointing third quarter results last week.

(Tesla: three months)

Have a great weekend. And don't forget to book your ticket!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.