The charts that matter: markets waver amid the political turmoil

As politics becomes increasingly unhinged, John Stepek looks at how the week's events have affected the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This week, rather than the usual podcast, we have another of Merryn's Adam Smith shows, which took place at the Edinburgh festival last month.

She and her panellists investor and entrepreneur Jim Mellon (also at the Wealth Summit get your ticket now!), comedian and statistician Timandra Harkness, and presenter and comedian Simon Evans ponder how left wing Adam Smith was, talk about what crony capitalism is doing to our society, and question whether economics is really a science. Check it out here.

Oh, and be sure to book your ticket for the MoneyWeek Wealth Summit in London on 22 November. We have an incredible line-up of some of the best and brightest minds in finance and investment, which is a good thing, because we have a great deal to chew over from the future of the monetary system, to the fallout for investors from our current and upcoming political upheaval, to how to make sure your pension lasts long enough to fund your retirement so make sure you come along!

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Money Morning, Merryn's blog and Currency Corner

If you missed any of this week's Money Mornings, here are the links you need:

Monday: Why has the oil market taken the Saudi attack so calmly?

Tuesday: What investors can learn from Thomas Cook's collapse

Wednesday: Bitcoin has just crashed hard where will it go next?

Thursday: Here's how investors should react to the latest political earthquakes in the UK and US

Friday: This could be a huge contrarian "buy" signal for oil stocks

Currency Corner: How low can the euro go?

Merryn's blog: Labour's plans for non-doms could prove costly for the UK

Subscribe: Get your first 12 issues of MoneyWeek for £12

The charts that matter

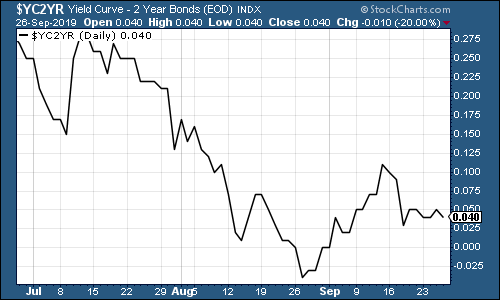

Onto the charts. The yield curve is still in positive territory (just it hasn't moved much this week as the chart shows) in other words, the yield on the ten-year US government bond is higher than the yield on the two-year, which is the normal way of things.

However, the curve did invert a few weeks ago, albeit briefly, and this has been a good recession indicator (given the limited data set) in the past. That said, the recession could still be up to 18 months to two years away, and still qualify.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

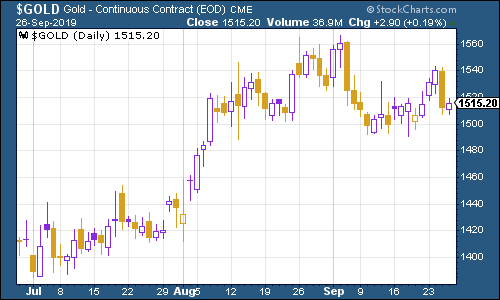

Gold (measured in dollar terms) was a bit higher this week. Dominic Frisby looks at the best ways to play gold right now in the latest issue of MoneyWeek magazine if you're not already a subscriber, you can get your first 12 issues for £12 here.

(Gold: three months)

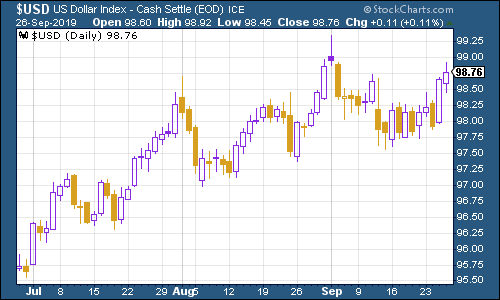

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners strengthened further this week, and is heading for its highest level in two years. Markets are unlikely to take it well if the dollar breaks a lot higher (as a stronger dollar means that global monetary policy is in effect getting tighter).

(DXY: three months)

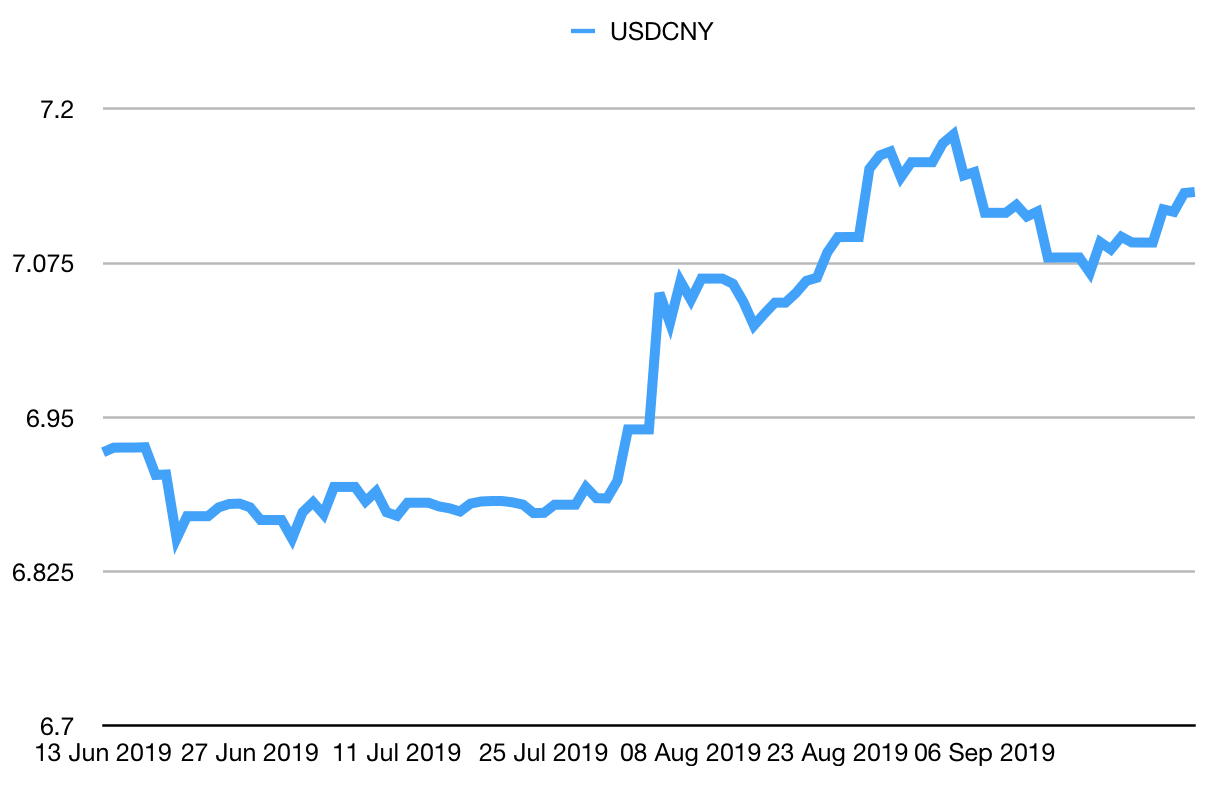

Meanwhile, the number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) remained above the 7.0 level and is creeping higher once again, which suggests a fresh turn to the risk averse.

(Chinese yuan to the US dollar: three months)

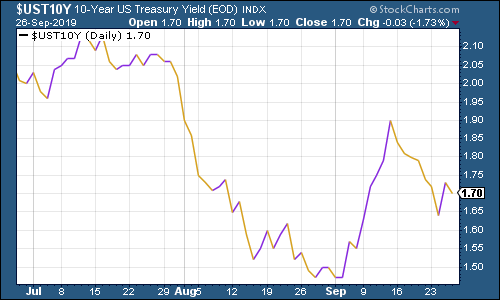

As for ten-year yields on major developed-market bonds yields have drifted lower this week. Here's the US ten-year yield:

(Ten-year US Treasury yield: three months)

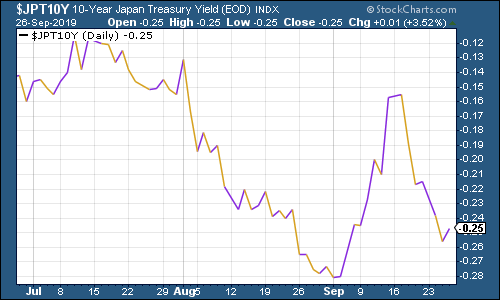

Japan's have slipped a little too.

(Ten-year Japanese government bond yield: three months)

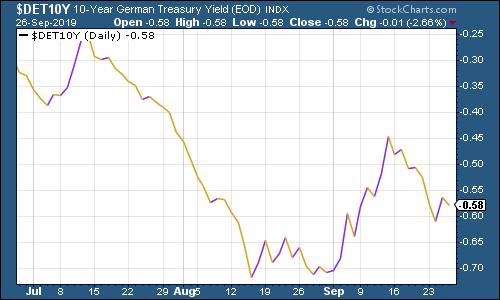

As did Germany's.

(Ten-year Bund yield: three months)

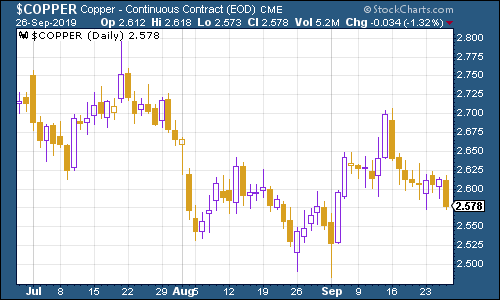

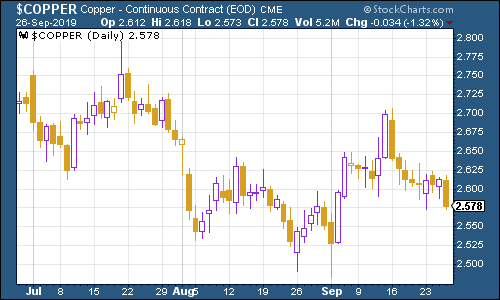

Copper fell back as economic data from China disappointed.

(Copper: three months)

The Aussie dollar fell further this week against the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin had a terrible week. Dominic wrote about it in Money Morning this week.

(Bitcoin: ten days)

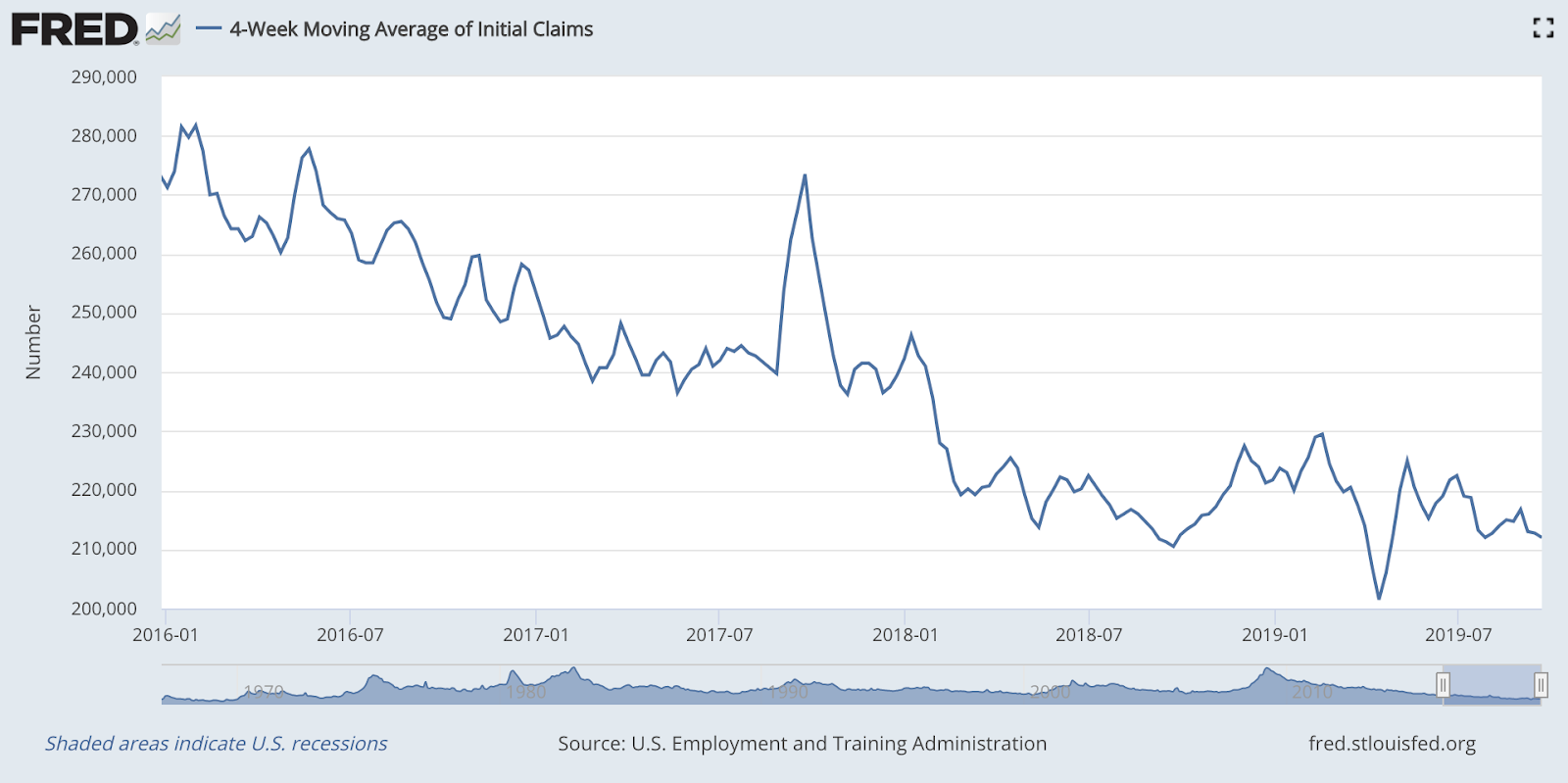

US weekly jobless claims increased this week to 213,000, roughly in line with expectations, up from 210,000 last week (which was revised higher by 2,000). The four-week moving average dipped a little to 212,000.

A sustained uptrend would indicate that a recession is on the way. As yet, despite the gloom elsewhere in the market, it's not clear that there's any sort of uptrend on this measure coming soon (although it is worth watching out for the US nonfarm payrolls data, out next Friday).

(US jobless claims, four-week moving average: since January 2016)

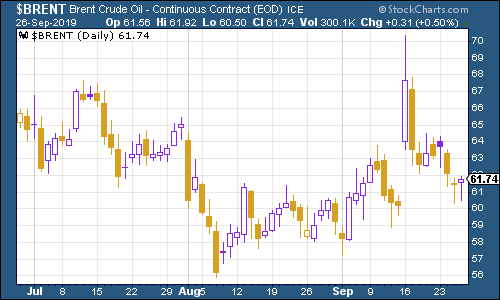

The oil price (as measured by Brent crude, the international/European benchmark), keeps falling. It's barely higher than it was before the attack on Saudi Arabia. I'm starting to feel that the market is rather too complacent on this front, as I discussed in Money Morning a couple of times this week.

(Brent crude oil: three months)

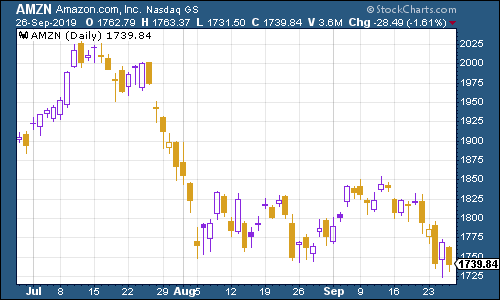

Internet giant Amazon fell back this week with the wider market.

(Amazon: three months)

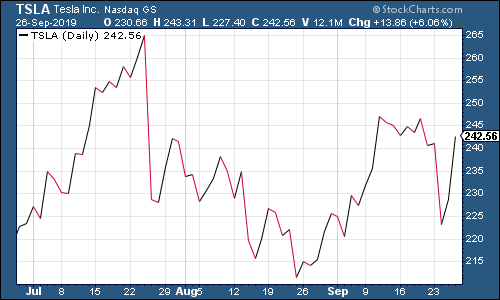

Electric car group Tesla fell but then spiked higher as Elon Musk told employees that the company has "a shot" at delivering 100,000 orders this quarter.

(Tesla: three months)

Have a great weekend. And don't forget to book your ticket!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?