Currency Corner: is it comeback time for the pound?

Everyone knows the pound is undervalued, says Dominic Frisby. But once Brexit is sorted, it will rally. And we are looking down the barrel of that now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Are we at the start of the pound's long-awaited Brexit recovery?

The rumour floating about for some weeks now is that Boris Johnson and the European Union are getting closer to securing a deal for the UK to leave the EU on 31 October.

Any such deal obviously still has to get through Parliament, which is an interesting question in itself.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It will be decided at the margin. There are many MPs the direction of whose vote we already know.

But will those Leaver MPs, who would prefer no withdrawal agreement, compromise and support a Johnson deal? Will those Remainers representing leave-voting constituencies go with their hearts and vote against? Or will some vote for a deal, in a last-ditch attempt to save their seat at the next election?

By hook or by crook, I think he'll get it through (assuming he gets one). The forex markets certainly seem to think he will.

From $1.19 in early September, the pound was within spitting distance of $1.26 yesterday. Against the euro, there has been a similar rally, but since early August the pound has been surging from €1.07 to just shy of €1.14.

We all know the pound is undervalued. I've been saying it till I'm blue in the face: the pound will rally once Brexit is sorted. We are looking down the barrel of that now.

Your bet on sterling depends on which outcome you see as most likely a Johnson deal, no deal or delay.

Fair value for the pound is somewhere closer $1.50 and €1.25. With that in mind let us consider what some say is the trade to play a sterling recovery the pound against the Swiss franc.

Sterling versus the Swiss franc

Currently a pound will buy you CHF1.24. The low was in August at CHF1.16.

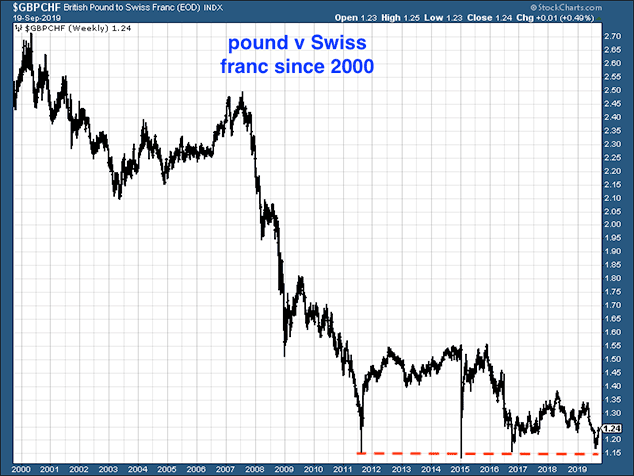

Here's a 20-year chart, since 1999. The pound bought CHF2.70 back in 2000.

What can I say? One nation looks after its currency; one doesn't.

Look at those declines in the 2007 to 2011 period. Oof.

If you pulled back and looked at a longer time frame, the story is even worse. Back in the 1970s, I remember my dad took me skiing and you got as many as six Swiss francs to the pound.

So the broader story is one of endless decline.

That said, we see something of a low on the above ten-year chart, where I've drawn the dashed red line, at around CHF1.15.

In the context of that chart, the rally from CHF1.16 to CHF1.24 that we have seen since August is tiny.

However, short-term trend followers will already be jumping on board of this, and of course, if Johnson gets his deal through, then this rally will have legs. CHF1.30 and, eventually, CHF1.40 both look possible.

According to my favourite, long-term trend following system see here for more details we don't yet have a buy signal. But this is based on weekly moving averages so is inevitably a little behind the curve. Its aim is to catch long-term trends, not short-term.

All in all, the Swiss look after their currency. We don't. Brexit or not, that is unlikely to change. So, unless we have some huge cultural shifts in our leadership, especially at the Bank of England, and sound money is suddenly prized, we will continue to devalue.

(In fact, some mathematicians have studied the probability of a change in attitude at the British establishment towards its currency, and compared it to pigs flying and found that the latter is more likely).

So it is probably better to play a longer-term sterling recovery against the currency of a nation that is less inclined towards preserving the purchasing power of its money.

The Swiss franc should be nothing more than a short- to intermediate-term play. For now, CHF1.15/1.16 is a clear line in the sand. You do not want to be "long" below that level.

Above it maybe.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how