How to catch the best of a bull market while dodging the big bears

Dominic Frisby outlines a beautifully simple, long-term trend-following strategy that works across most markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I'm in Mexico this week where I am giving a couple of talks at a cryptocurrency conference.

Beautiful weather; long sandy beaches; big waves which for some reason remind me of the movie Papillon; nice food; nice people. It's a tough life.

In today's missive, I thought I'd go through one of the arguments I made in one of my talks.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And it's got very little to do with crypto, before you ask.

How to stop your convictions from ruining your investments

There are a lot of hard-money advocates out here. Gold-, silver- and bitcoin-bugs from around the world have made their way Mexico's Pacific coast.

This is, as you will know, a world view with which I have a great deal of sympathy. However, I learned a long time ago that however "right" a certain cause maybe, the reality is that there are bull markets and bear markets.

Nothing goes up in a straight line. To be wedded to any investment for ideological reasons can be a dangerous mindset. On the one hand, it might keep you long in a bull market, but it also means you can overstay when things turn bearish. In bear markets, for the sake of your net worth, you do not want to be long.

So I challenged the audience to find means to overlook their prejudices. One such way is trend-following. And I'd like to outline for you today, the trend-following strategy I outlined at the talk.

It is beautifully simple. It's a fairly long-term strategy which means you only execute a few trades a year, and do not need to be glued to your screen on a daily basis. You can go to the beach instead.

However, I stress it does not work all of the time. When markets are range bound, you will probably get whipsawed out. However, when they trend in a certain direction, the system keeps you on that trend, so that you end up enjoying 80-90% of the move.

You need to be looking at a weekly chart. As well as the price, you need to plot the 21-week exponential moving average (21EMA) and the six-week exponential moving average (6EMA). The 21EMA shows the average price of the previous 21 weeks, with greater weighting given to the more recent weeks unlike the simple moving average which weights each week equally.

When the 6EMA crosses up through the 21EMA and the price is above, you have your buy signal. Both EMAs should be flat or sloping up. When the reverse happens the 6EMA crosses down through the 21EMA, and the price is below, you have your sell signal.

Here's how the system works

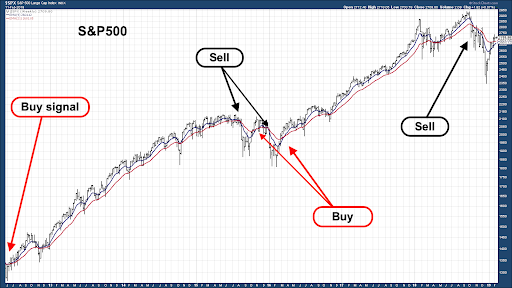

In order to make this clearer, let me illustrate this for you. Here is a weekly chart of the S&P 500 since 2012, with the buy and sell signals marked.

You can see the buy signal in 2012, which kept you long until August 2015, when the sell signal came. The buy signal of November 2015 turned out to be a duff one and by December the market was on a sell signal. (The system would have lost money in 2015.)

There then followed another buy signal in April 2016 which kept you long until October 2018, when we go the next sell signal. It now looks like we are getting set up for another buy signal. (It wouldn't surprise me to see this buy signal turn out a bit like 2015, as I rather suspect we are in a range-trading rather than runaway bull market, but that is just me second-guessing the system.)

I said the system works best in clearly trending markets. Here's bitcoin since 2015, which has seen both runaway bull and bear markets.

The buy signal came in October 2015 with bitcoin at $300, the sell signal came March 2018 with bitcoin around $8,500.

Timing your trades in the pound

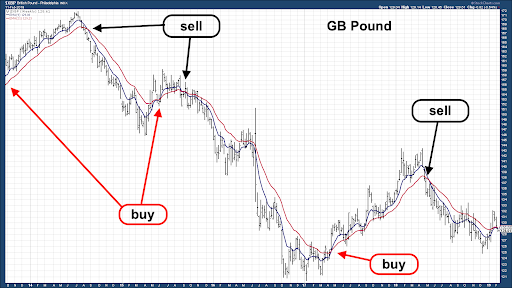

The system can work across most markets, but it can work especially well in forex (as always especially when there is a strong trend). Here is "cable" (the pound vs the dollar).

The buy signal preceded the chart, which starts in 2013. The sell signal came with sterling at around $1.60 in August 2014. We got a buy signal in June 2015, which didn't work, as by September there was another sell. The trade rode the market all the way down until April 2017, when the next buy signal came in. The next sell signal came in May 2018. We almost got a buy signal earlier this month, but not quite.

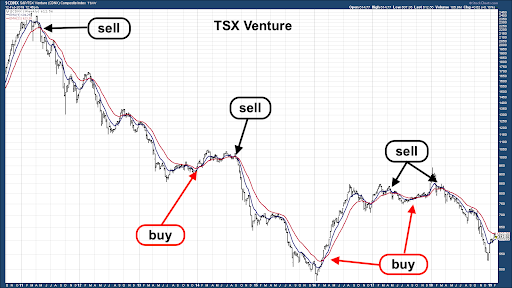

I have an interest in small-cap natural-resource stocks, many of which are listed on the Venture exchange in Canada. It can be useful to know what the bigger state of play is, particularly in an industry as cyclical as mining and other natural resources.

Here we see the buy and sell signals of the Venture since 2010. Again pile in when the market is on a buy signal, avoid when it isn't. Natural resources have been awful this decade, as this chart shows.

So there we go folks: a weekly trend-following system for you to use or not, as you see fit. Some people would charge you fortunes to learn systems like this, but not us.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How should a good Catholic invest? Like the Vatican’s new stock index, it seems

How should a good Catholic invest? Like the Vatican’s new stock index, it seemsThe Vatican Bank has launched its first-ever stock index, championing companies that align with “Catholic principles”. But how well would it perform?

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up