The charts that matter: “risk on” rules

The “risk-off” move we saw over the past month or so has reversed. John Stepek looks at how that affects the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. Let me start with another nudge to book your ticket for the MoneyWeek Wealth Summit in November. It promises to be a great day we have some stellar guests, from Russell Napier to the Bank of England's Andy Haldane to Scottish Mortgage Trust's James Anderson and many more.

Tickets are selling fast. The event takes place in the centre of London on 22 November find out more here. (If you're a MoneyWeek subscriber, you should have received full details and a discount code with your latest magazine).

Technical difficulties got in the way of recording another podcast this week, we shall work on getting this resolved. In the meantime, have you been watching our Money Minute videos? Let us know what you think. Drop us a line at editor@moneyweek.com (put "Money Minute" in the subject line) or contact me on Twitter at @John_Stepek.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, if you missed any of this week's Money Mornings, here are the links you need:

Monday: Can Mario Draghi save the eurozone all over again?

Tuesday: Why the sacking of Saudi Arabia's energy minister matters for your money

Wednesday: Is the great bull market in politics about to peak?

Thursday: If Mario Draghi fails to deliver today, there will be a lot of disappointed investors

Friday: What Mario Draghi's legacy move means for markets

Currency Corner: Clash of the commodity currencies

Subscribe: Get your first 12 issues of MoneyWeek for £12

And don't miss Merryn's blog on the rapidly popping unicorn bubble (you can read more about my theory on big IPOs and market tops in my book The Sceptical Investor).

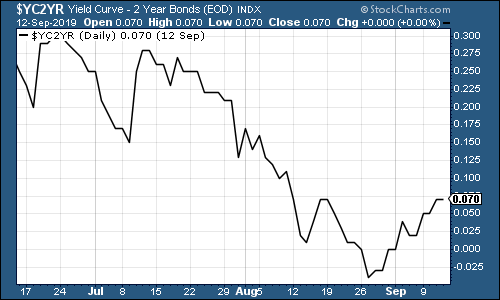

Onto the charts. The yield curve remains un-inverted (for a reminder on why the yield curve matters, here you go). In other words, the yield on the ten-year US government bond is higher than the yield on the two-year, having briefly been lower a couple of weeks ago. That said, once the reversion has taken place, well, it's happened and it cannot un-happen. It's a reliable indicator (as far as these things go) that a recession is on the way.

However, the recession could be anything up to two years away and still fall within the category of "accurate yield curve predictions". So it's not much use for timing the market (not much is, of course).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

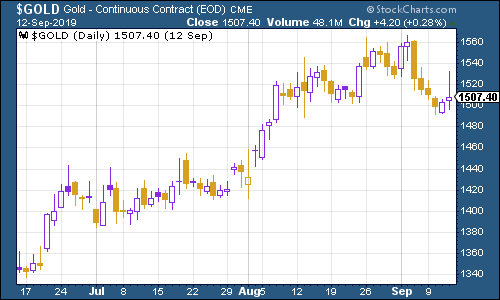

Gold (measured in dollar terms) fell again last week as investors turn more optimistic. Money printing by the European Central Bank, talk of a deal with China what's not to like? (Apart from negative bond yields and the obvious fragility of the global financial and geopolitical situation, of course.)

(Gold: three months)

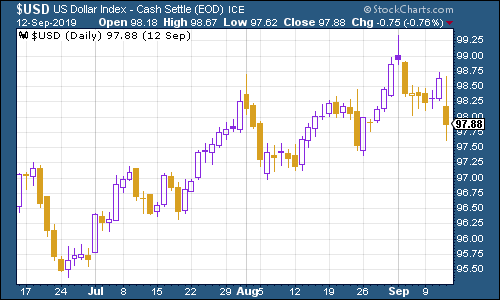

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell too this week. Typically gold and the US dollar go in opposite directions (as gold is priced in dollars), so it's pretty clear that this is a reversal of the "risk-off" move we saw over the past month or so.

A sustainably lower dollar would be bullish. It's something to watch out for but it's also something I've been pointing out for a long time, and it hasn't happened yet.

(DXY: three months)

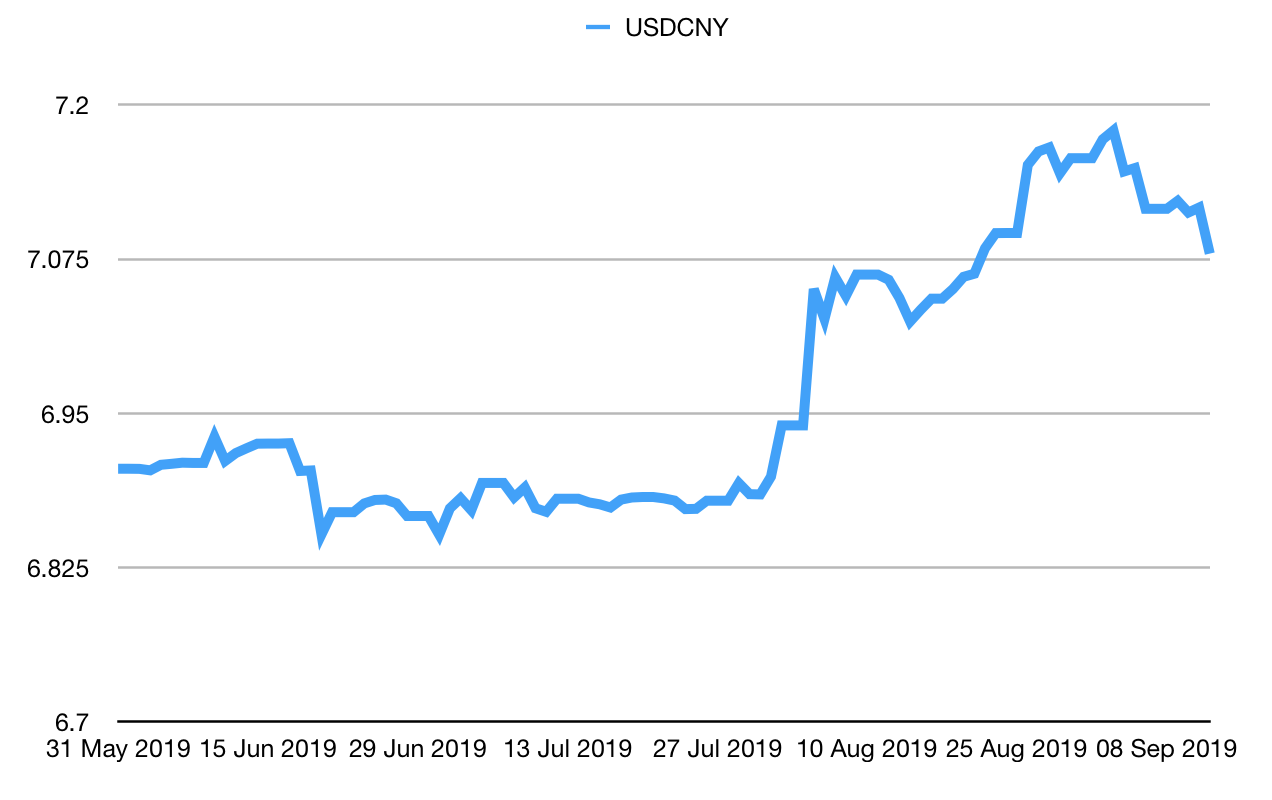

Meanwhile, the number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) remained above the 7.0 level but fell back again as the greenback weakened. This is another "risk-on" sign a big Chinese devaluation would terrify markets at this point.

(Chinese yuan to the US dollar: three months)

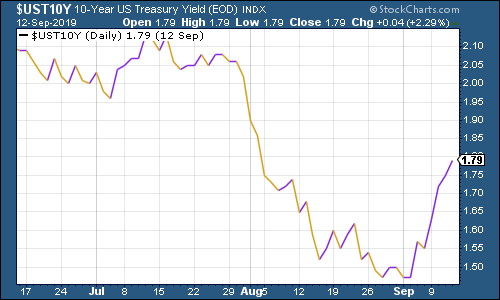

As for ten-year yields on major developed-market bonds yields rose again this week as bond prices fell, which is, again, all very "risk-on". Here's the US ten-year yield:

(Ten-year US Treasury yield: three months)

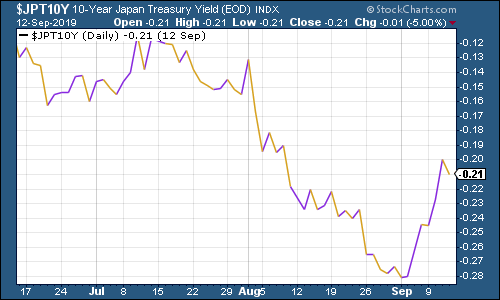

And Japan:

(Ten-year Japanese government bond yield: three months)

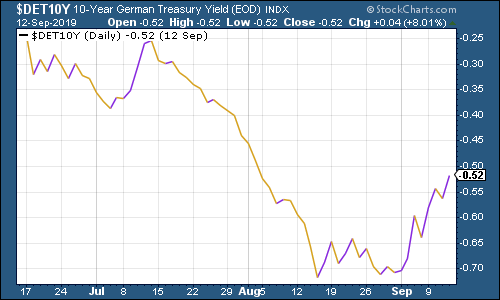

And Germany too, although bond yields are still very negative.

(Ten-year Bund yield: three months)

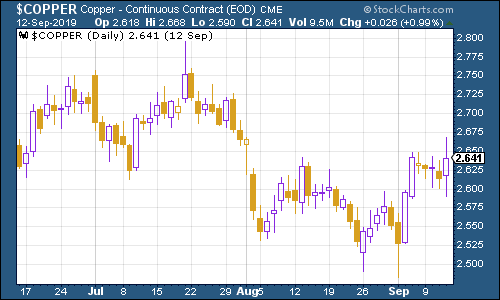

Copper was broadly flat this week although it rallied a little late in the week.

(Copper: three months)

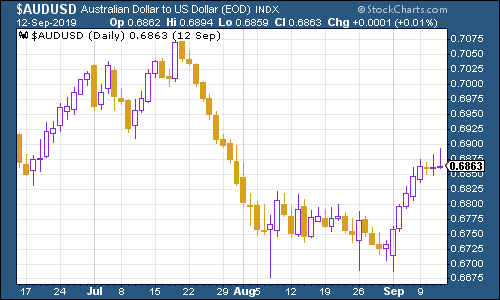

More hints at a trade deal were further good news for the Aussie dollar.

(Aussie dollar vs US dollar exchange rate: three months)

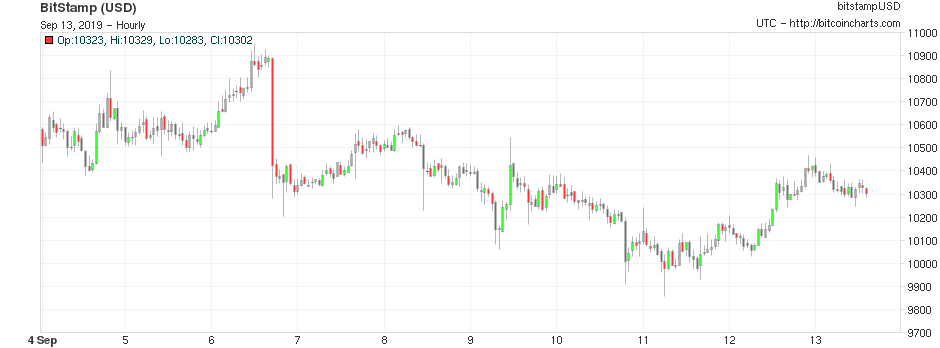

Cryptocurrency bitcoin didn't do much this week.

(Bitcoin: ten days)

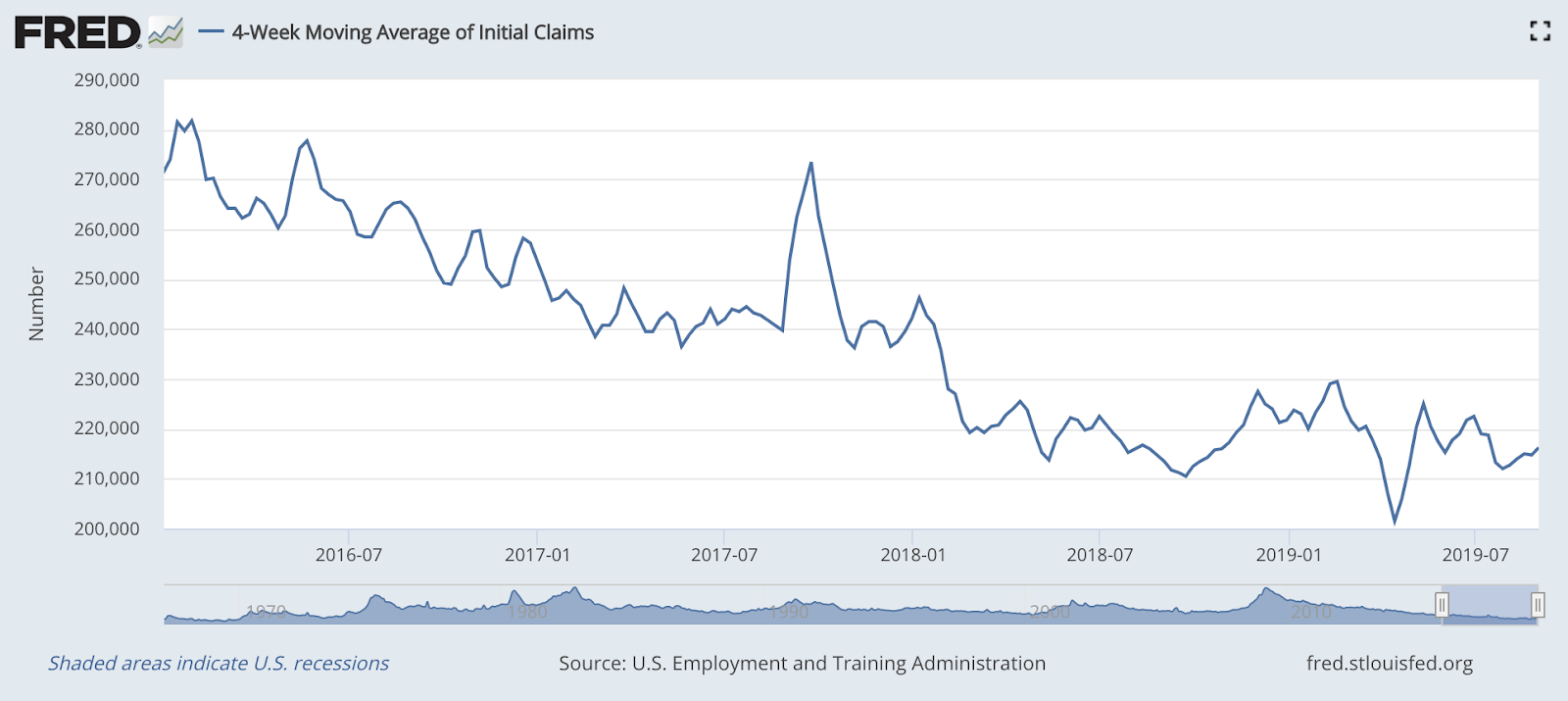

US weekly jobless claims came in at a five-month low of 204,000. The surprisingly low reading is thought to be down to public holidays in the US. The four-week moving slipped back to 212,500.

The last low on this measure came several months ago, at around 201,000. It's worth noting that US stocks typically don't peak until after this four-week moving average has hit a low for the cycle, and a recession tends to follow about a year later (note that this is taken from a tiny sample size, originally highlighted by David Rosenberg at Gluskin Sheff).

Could we get one more low before the cycle turns? As I've said before, it's impossible to rule out as yet, particularly as the US stock market the S&P 500 is not far off yet another new high (the number to beat is 3,025).

It's interesting to note that retail sales beat expectations not a sign of a weakening US consumer. Although, of course, all this positive data may make the Federal Reserve much more wary of cutting interest rates at its meeting next week.

(US jobless claims, four-week moving average: since January 2016)

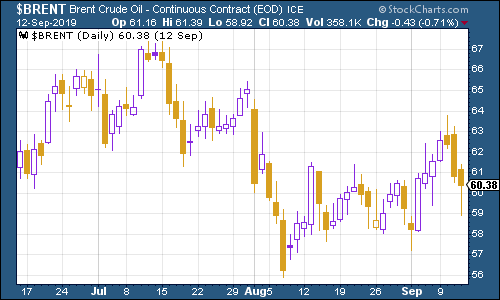

The oil price (as measured by Brent crude, the international/European benchmark) fell back. Normally in a "risk-on" week, oil would go up. However, Donald Trump fired John Bolton the notoriously aggressive national security adviser which markets have judged will make a war in Iran less likely (fingers crossed).

(Brent crude oil: three months)

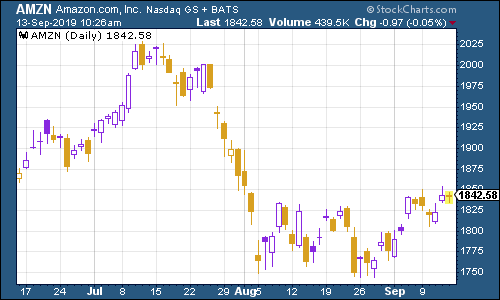

Internet giant Amazon eked out some gains this week but it's clear that the FANGs are not in favour to the same extent they previously were.

(Amazon: three months)

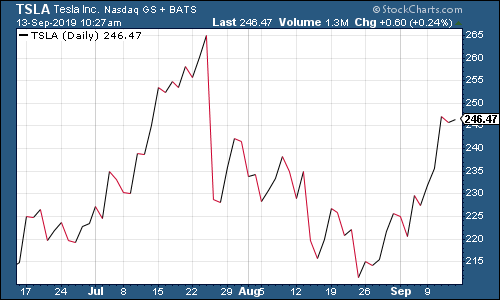

Electric car group Tesla managed to avoid any mishaps this week.

(Tesla: three months)

Have a great weekend. And don't forget to book your ticket!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now