Currency Corner: clash of the commodity currencies

In this week's currency corner, Dominic Frisby looks at the Australian dollar and the Canadian dollar – two currencies heavily geared to natural resources.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Today I'm going to pick another currency pair pretty much at random and see if there's a trade to be had.

The pair I'm going to go with is the Australian dollar (the Aussie) and the Canadian dollar (the loonie).

Without having looked at a chart, and knowing absolutely nothing about their relative performance, I thought this might be quite an interesting combination.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Both economies are heavily geared to natural resources; both economies enjoyed huge booms alongside the commodities bull market of the noughties; and both have struggled since 2012.

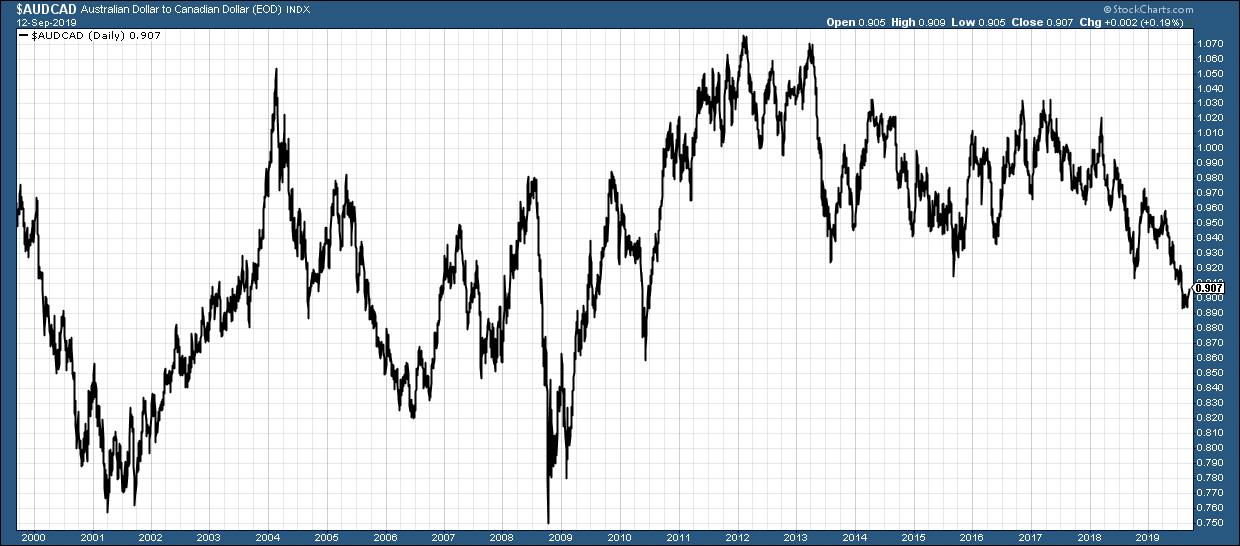

Let's start with a long-term chart. It's always important to do this, as it will establish the long-term parameters.

So here's 20 years of the Australian dollar against the Canadian dollar. This chart shows how many Canadian dollars there are to an Aussie. Currently, one Australian dollar will get you C$0.90.

When this chart is falling, the Aussie is getting weaker. When the chart is rising, the Aussie is strengthening and the loonie is weakening.

Straight away we can see a clear, long-term range. Roughly C$0.75 marks the lows in the Aussie and C$1.05 to C$1.07 marks the highs. Given this is 20 years of trading we are looking at here, in which fortunes have no doubt been won and lost, a C$0.30 range is pretty tight, I'd say.

That the lows for the Aussie came in 2001 which was the bottom of the market in natural resources, pretty much and 2008, when natural resources capitulated in the financial crisis. In other words, those lows in the Aussie came at the same time as major lows in commodities markets. That might be a useful indicator for those who follow natural resources.

It would appear the Australian dollar is even more geared to natural resources than the Canadian dollar, which is quite interesting.

The highs, meanwhile, came in 2004 and in early 2012, the latter also marking the peak in commodities markets generally.

This really is one for the trend-followers. You can see that since 2012, there has been a clear downtrend in place. The Aussie has been steadily weakening.

But sell-offs in 2013, 2015 and 2018 all found support around the C$0.91-C$0.93 area. That line of support was firmly broken in July however.

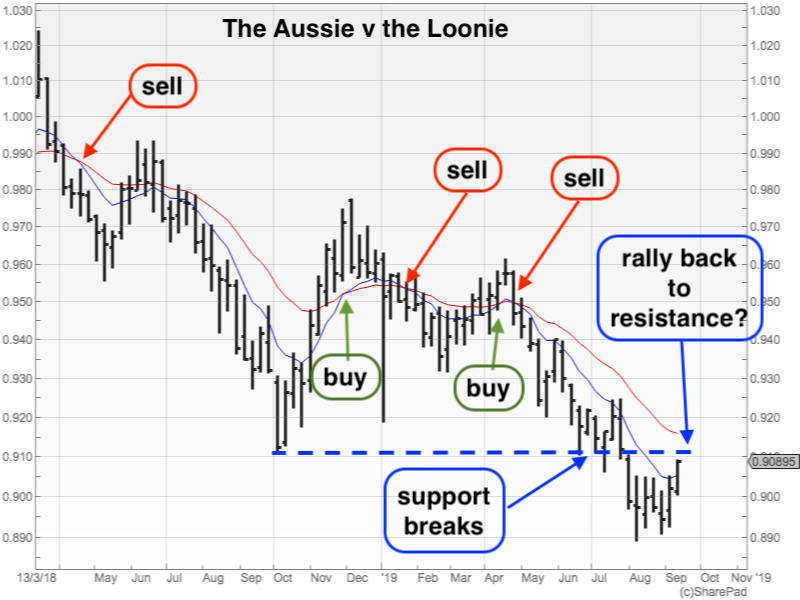

We zoom in now to a chart of the last two years. This is a weekly chart. Also drawn are the 21-week and nine-week exponential moving averages, which I use to define and follow trends. You can learn the system here.

I've marked the sell-signals in red and the buy signals in green. These occur when the moving averages cross.

The months around the turn of the year were not a good time for the system. As the market ranged between $0.91 and C$0.98 we got whipsawed.

But in April of this year, we got a clear sell around $0.95c and rode the market down. Since August however the Aussie has staged something of a rally. A few more weeks of rallying and that sell will turn to buy.

But, typically, old lines of support turn into lines of resistance. Remember that line of support at C$0.91? I've marked it with a dashed line here. But if you think of the support in 2013 and 2015, it is more of a resistance zone that extends to, say, $0.93c.

How far is this rally in the Aussie going to extend?

I think that a small wager that it gets into that C$0.91-C$0.93 zone and then stalls, before that downtrend resumes, is well worth a flutter, because you can limit your risk to a penny or two above the zone.

So there we go, the Australian dollar against the Canadian dollar. The Aussie is in a downtrend. It's staging a relief rally. The question is: is this a just a relief rally, or is it something more?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?