Currency Corner: this trend looks very promising for the Canadian dollar

The "loonie" has been on something of a roll against the euro since 2018. Dominic Frisby checks the charts to see where the Canadian dollar is heading next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In today's Currency Corner, I thought I'd pick a forex combination at random and see where it takes us.

So, for no particular reason, let's go with the Canadian dollar aka, the loonie against the euro.

(The reason the Canadian dollar is known as the "loonie", by the way, has nothing to do with the sanity of Canada's inhabitants. It's because of the bird, the loon, which is pictured on one side of the coin.)

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

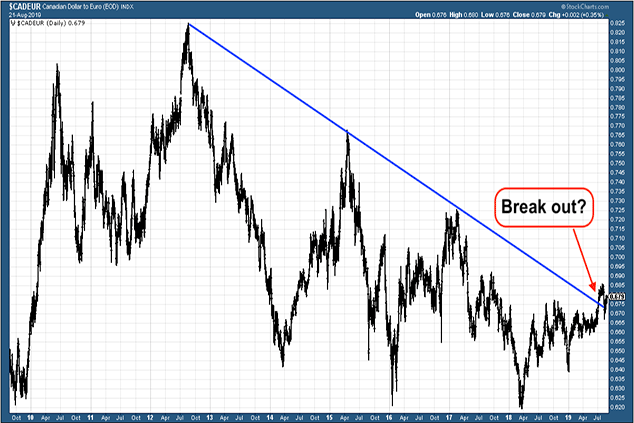

So let's start with a long-term chart. A ten-year chart, and straight away I'm interested.

For clarity's sake, in the chart below we are looking at how many euros there are to the Canadian dollar. So when the chart is falling, that means there are fewer euros to the Canadian dollar.

In other words, the euro is strengthening. When the price rises, that means the loonie is strengthening.

The Canadian dollar enjoyed a tremendous bull market all through the noughties. It accompanied the boom in commodities, whether metal, fossil fuel or grain, to which the Canadian economy is highly leveraged.

Canada weathered the financial crisis much better than most. The peak in commodities came in 2011, but against the euro the peak came a year later in 2012. There were 82.5 euro cents to a Canadian dollar.

Since then you can see the dollar has been in a steady decline, each high lower than the last, each low lower too. (I've illustrated that decline with a blue trend line in the chart above.)

The final low came in April 2018 at €0.62c to C$1. Notably, this was something of a "double bottom", corresponding with lows made in 2016 and 2009. There is considerable long-term support there.

Since April 2018, the loonie has been in something of an uptrend. What peaked my interest about that long-term chart is that there was something of a break out earlier this year, with the loonie popping above that blue downtrend.

Today the price is about €0.68c to C$1. So, we are €0.06 off the lows.

But we have something of an uptrend.

The Canadian dollar is looking like a good bet against the euro

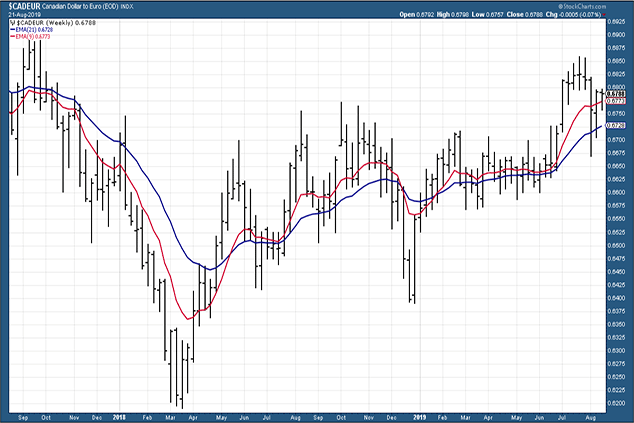

As well as the weekly price (in black), I've plotted the 21- and 9-week exponential moving average (EMA), which shows the average price over the past 21 (blue line) and 9 (red line) weeks, with extra weight given to more recent weeks.

I use this system to identify trends. You can read more about how it works it here.

You can see that the December 2018 low at €0.64c was higher than the April 2018 low at €0.62c. The lows in spring and summer have been higher still at around €0.66c.

Each high of 2018 was higher than the last, which is good, but that momentum was lost in 2019 until we got another higher high in July of this year.

The EMAs are both sloping up and correctly aligned. The price itself has wobbled a bit these past few weeks, but it has held and is now back above the EMAs.

In other words it is on a "buy" signal. And the trend is up.

The sell signal should come when the EMAs cross down, as outlined here as that is where risk should be limited.

Let's see how this one pans out. But the bottom line is this: the Canadian dollar is in an uptrend against the euro.

Let the trend be your friend and enjoy the ride.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.