Currency Corner: what does Boris Johnson mean for sterling?

Boris Johnson is in at No 10 and he's made himself feel at home with a round of sackings. Dominic Frisby looks at how the currency markets have reacted, and what lies in store for the pound.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Hello and welcome to this week's Currency Corner. So we have a new prime minister. What does it all mean for sterling? At the cabinet level, Boris has had what you might term "a right clear out" with virtually all of Theresa May's big guns either sacked or resigning. The result is, effectively, a new administration, albeit one with a tenuous working majority in parliament. It seems this cabinet has been selected not so much as to fight a general election, but with a general election in mind. If needs be, in terms of dealing with the looming threat of the Brexit Party, this is an administration that is equipped to take it on. Any recalcitrant Remainers in Leave-voting seats who might be thinking of causing trouble will be conscious that this administration is prepared to fight an election if it must, and that their recalcitrance may mean them losing their seat.

In addition, this cabinet is brimming with pro-free market, classical liberals. John McDonnell, probably the most old-school, left-wing shadow chancellor I have known in my lifetime, described the cabinet as "the most right wing cabinet in my lifetime". But the likes of Dominic Raab, Liz Truss, Priti Patel, Jacob Rees Mogg, Andrea Leadsom, Kwasi Kwarteng, as well as Johnson himself, are all, essentially, free marketers, though some more militantly so than others.

How has the market reacted?

Often people will look to the stock exchange when they pass judgement on a political administration. Oh, look. The FTSE is up, or the S&P 500 is up, the X Party is doing a great job. They would be wiser to look at the national currency. While it may be a government's duty to oversee the economic environment, and make sure markets are properly functioning, the companies listed on a stock exchange often have little to do with the government and their market performance is down to them, not the X Party.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The FTSE 100 is heavily weighted to natural resources. But what does the relative success or failure of Royal Dutch Shell, BHP Billiton or even non-resource international behemoths such as HSBC, British American Tobacco or GlaxoSmithKline have to do with do with the X Party? Very little.

Far more relevant is the national currency which is the issuance of the government. Indeed, a currency will often be the measure of its government. From the moment the majority of MPs came out in favour of Boris Johnson at the beginning of this leadership campaign, it has been clear he would win. We made that point back in early June. Johnson always had the support of the membership; what he lacked was the support of MPs. As soon as he had that and the Brexit Party's rise forced MPs' hands he was home and dry.

The thought of a Johnson administration did not go down well in the forex markets. Sterling was at $1.27, and over the course of the leadership campaign, sterling slid, especially towards the end as no-deal rhetoric got ramped up. Here we see sterling since the first MPs' vote, when Johnson passed the 105 threshold he needed to make it to the membership.

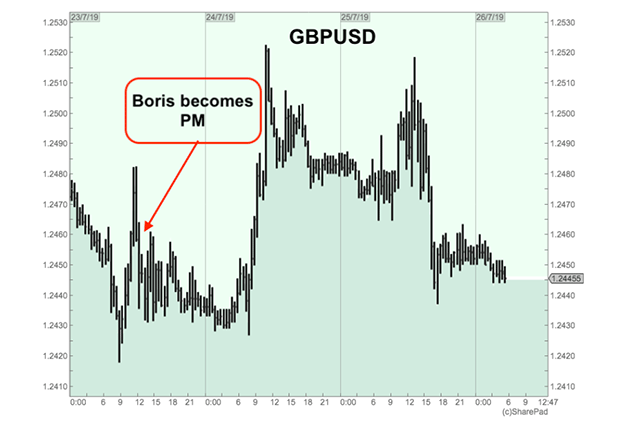

At 11.45am on Tuesday, 23 June, the 1922 Committee announced what everyone knew already: Boris Johnson would be Britain's next prime minister. Over the next 72 hours he did all the things a new prime minister does visit queens, make speeches, announce cabinets. Here is sterling against the dollar since the announcement.

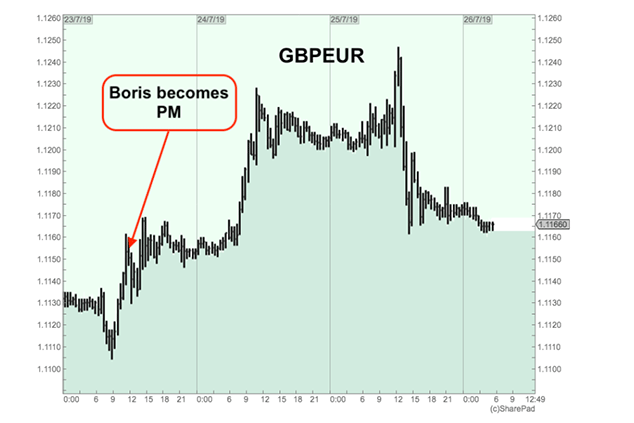

It's fractionally lower. Let's call it $1.246 when the announcement was made compared to $1.245 now. And here we see sterling, perhaps more relevantly, against the euro.

We are slightly higher. It was, let's say, €1.115 at 11.45am on Tuesday and it's €1.116 as I write. So those are the two numbers on which we should judge the success of this administration. $1.24 and €1.11, at least in terms of their performance in the currency markets.

Given how beaten up sterling is, I don't think the new administration is going to be angling for a lower currency to boost exports. I could be wrong, of course. But if Britain becomes the free-trading hub of Europe, the Singapore of the West, with low taxes, strong rule of law and a booming economy if it goes in the direction that was "sold" in the run-up the the EU referendum then sterling should rise. Let's see if we can get there. We've just got Brexit to get through first.

Over to you, Boris.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how