UK house prices continue their long, slow drift lower

With UK house prices still falling in real terms, property is getting more affordable. John Stepek examines the reasons behind the slow decline, and what the future might hold.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Before I get started this morning just another quick reminder to grab your tickets for the MoneyWeek Wealth Summit the early bird tickets are on sale now, so make sure you secure your seat today.

It's been a while since we checked in with everyone's favourite topic house prices in the UK.

So let's have a look at what's been going on...

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

House prices are still falling in real terms

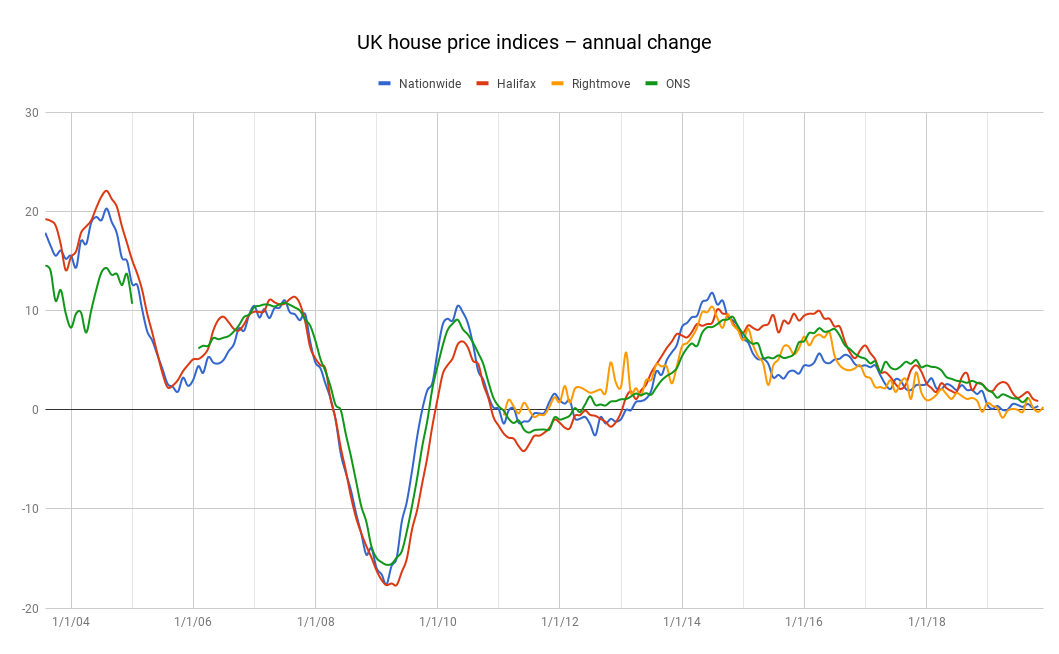

This week we got house price data from both Halifax and Nationwide. According to Nationwide, house prices were up 0.5% year on year in June, compared to a rise of 0.6% in May.

That covers quite a wide spread across the country prices were down by between about 0.7% and 2% in London and the South East, whereas they're rising in Wales (up about 4%) and roughly gaining in line with inflation in northern England.

Northern Ireland also remains a bit of an outlier prices are up about 5% there, but you have to remember that its crash was even more drastic than anywhere else in the UK, due to its experiencing knock-on impacts from Ireland's epic housing boom and bust.

Then the Halifax data just came out this morning. Halifax and Nationwide record data in a similar sort of way but sometimes their figures come out very differently. According to Halifax, house prices are now 5.7% higher year-on-year than they were in the same quarter last year.

That's a particularly big gap between Halifax and Nationwide, and I suspect it's more due to something weird going on with the way the Halifax statistics are calculated, and also that it apparently is more skewed towards the north of England (where the market is a bit healthier). So, put simply, I'd be inclined to take it with a pinch of salt.

Especially given that the Office for National Statistics figures which come out a bit later, but are more comprehensive suggest that in April (the most recent data available), prices across the UK rose by just 1.4%.

So overall, it's a dispiriting picture for investors in property, and a more hopeful one for potential buyers of property. In most cases, if you are in the market for a house, you'll find that your wages are rising faster than house prices are.

It strikes me as healthy and desirable that within an improving economy, life's necessities (which include shelter), should become cheaper over time, in the way that food and clothing prices have fallen, for example.

The market and regulatory failures that mean this isn't happening in the property and land market are a topic for another day and the subject of much debate but making it our end goal might be helpful.

Anyway, for now the good news is that affordability while still stretched is improving, because prices are falling in real terms (ie, after inflation).

There's no catalyst for house prices to take off again, which is good news

So what's next for the housing market? On the upside for house prices, global bond prices are tumbling hard. Meanwhile, Mark Carney has been warning that he might cut rates if Brexit doesn't go exactly the way he hopes. You'd expect all that to have an effect on mortgage rates.

However, given that they're already so low, it's hard to see any changes in average rates delivering much of a boost to the market. There's also the ongoing pressure on Help to Buy. It's not a popular scheme, and when the early buyers start to run into problems with selling their properties or keeping up payments on the interest side of the loan, then I suspect that it will get even more bad press.

Then, of course, we have the squeeze on buy-to-let landlords. As Imogen Tew reports in the FT's Financial Adviser, the price of buy-to-let loans has fallen over the past three months. That sounds like good news for landlords.

However, it's being viewed as the result of "providers trying to entice landlords in a difficult market". In other words, competition between suppliers is going up because the number of landlords looking for mortgages is being squeezed.

As far as I'm concerned, landlords and potential landlords are right to be wary. We're still seeing George Osborne's tax changes filtering through the system, and the reality is that we still haven't seen the worst of the restrictions come in for example, landlords can still claim 25% of their mortgage interest payments against rental income. From April 2020, that will reduce to 0%.

That means the market is probably still vulnerable to people getting unexpectedly high tax bills. And that's before you consider the political landscape.

Until we get a new Tory party leader, it'll be hard to say what their policies might be as far as housing goes. But it's pretty clear what the policies of the opposition will be. As Merryn pointed out a few weeks ago, some of Labour's ideas for land reform are ones we'd actually agree with.

But the fundamental problem is that any changes and extra taxes will end up coming on top of existing ones. And whether you agree with the specifics of housing market reform, the fact remains that landlords remain a prime political target, and a very easy one to hit.

In short, a chunk of demand from a previously very active group of buyers has been removed from the UK housing market, and I don't see that changing soon (at least, not until the economic and political cycle swings again).

So what's the outlook? More of the same, I guess. House prices drifting lower in "real" terms and hopefully becoming more affordable and less contentious as a result. So far, so good.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how