Currency Corner: the Australian dollar’s dreadful decade

The Australian dollar has been falling in value since 2011. It's fared even worse than the pound. Dominic Frisby looks at the reasons for its decline.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In today's Currency Corner, I want to take a look at the Australian dollar.

By GDP, Australia is only the 13th-largest economy in the world, but its currency is the fifth-most traded behind the US dollar, the euro, the Japanese yen and the pound. Something like US$174m-worth trades hands every day.

It's also the sixth-most widely held reserve currency, accounting for just under 2% of global foreign exchange reserves.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There are a combination of reasons the Australian dollar is disproportionately liked: the Aussie political scene is relatively stable, as is its economy; the rule of law is strong; and its forex markets go relatively uninterfered with.

Also until recently, interest rates were comparatively high. There was a period in the early part of this decade when rates were still at 5%, even as they were close to zero in Europe, the US and Japan. But rates have been creeping lower and this week saw them drop yet another notch, to an unprecedented low of 1%.

Another attractive aspect of the Aussie dollar is the relative exposure it gives to Asian economies and to commodities prices, to which the Australian economy, as such a large producer, is inevitably geared. That said, even its commodity exposure is quirky. It's a major exporter of coal, iron and copper, as well as more "niche" metals such as gold and uranium, but it is also a major importer of oil, so shifts in the relative value of each can have an impact.

It is also quite a new currency, having only been around since 1966. Historically, Aussie money was pegged to the pound and it was known as the Australian pound, although the devaluation of sterling in 1931 led to the two detaching, and then decimalisation in 1966 led to the invention of the Australian dollar.

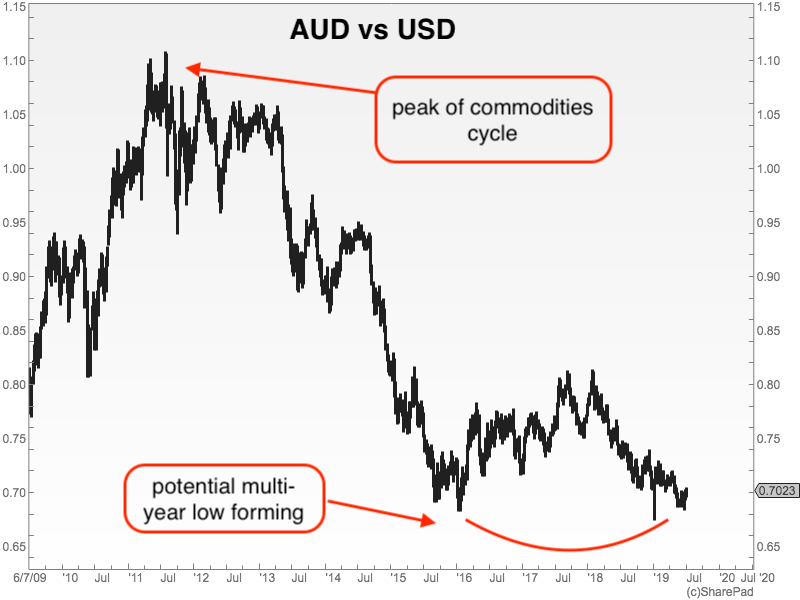

Here we see the Aussie dollar against the US dollar over the past ten years.

It has, basically, been in a secular bear market. The commodity cycle peaked in 2011, and the Aussie dollar has been declining ever since.

Back then it traded at a premium to the US dollar it got you US$1.10. Now it is barely US$0.70.

It's had a pretty ropey 2018 and 2019, but there are technical signs that the Aussie dollar is putting in a double bottom, formed over several years. If so, that would tie in with my argument of last week that the US dollar is at the beginning of a downtrend.

As long as it holds above US$0.67, I don't think that's an unreasonable theory. But there is plenty of room for it to go lower. In 2001 it was below US$0.50, so it has previous form. A lot will depend of commodity prices.

Here we see it against its neighbour, New Zealand.

There were the same declines reflective of the commodities markets after 2011. But since briefly reaching parity in 2015, the two have been trading in a relatively stable range between about NZ$1.04 and NZ$1.14.

I'd be interested to know which way any Kiwi or Aussie readers think that range is going to eventually resolve. My suspicion is to the upside, but I expect that the range will prevail for a few years yet.

This has not been a good decade for the Aussie dollar.

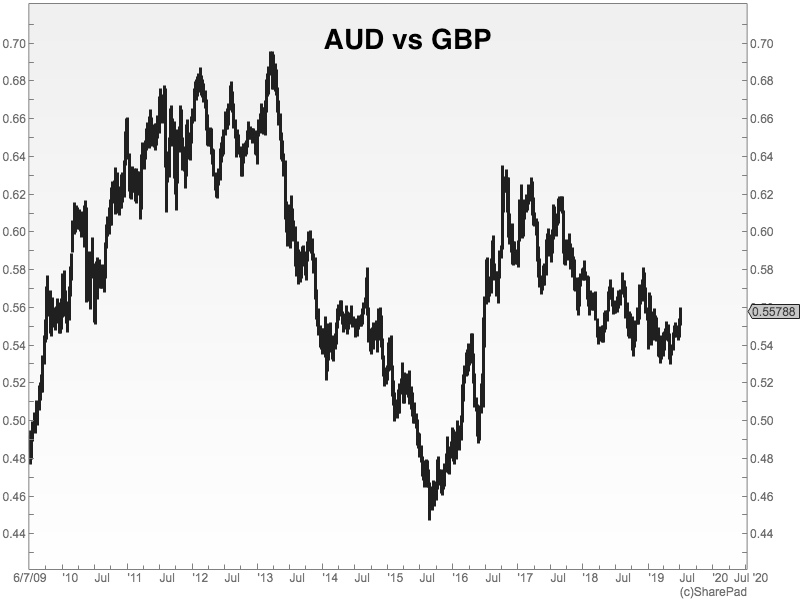

Finally, let's look at the Aussie dollar against another currency that has not had a good decade the pound. Sterling has been such a basket case, I almost think it's not worth considering this chart but needs must.

Today about £0.56 buys you an Aussie dollar. This is a far cry from the early part of the century when there were as many as AUD$3 to the pound £0.33 could buy you a dollar. At the peak of the market, it was closer to £0.70.

It takes some doing, but the Aussie dollar has actually been falling against the pound, even with everything that's been going on with Brexit.

That's how bad the Aussie dollar has been!

Have a great weekend,

Dominic Frisby

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.