Does owning an electric car make financial sense?

The idea of owning an electric car seems appealing. But what are the financial practicalities of buying and running one?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

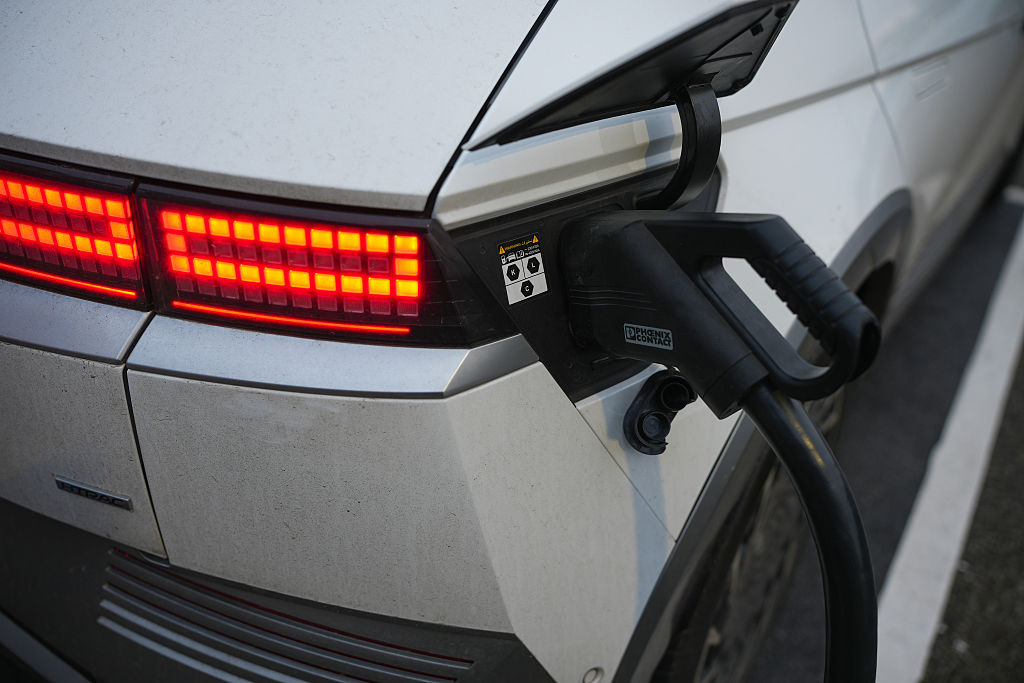

The idea of owning an electric car seems appealing. You get to feel mildly smug about helping the environment and there are now many different models on the market, so you won't have to drive something clunky and ugly. But what are the financial practicalities of buying and running an electric car?

As well as being environmentally friendly, an electric car should be cheaper to run than a normal one, factoring in fuel costs, government subsidies and emissions penalties. However, the government has begun to phase out some subsidies.

Last November the government axed the grant for plug-in hybrid cars and cut the subsidy on fully electric cars from £4,500 to £3,500 (you are entitled to 35% of a car's purchase price, up to that maximum).This applies to category 1 cars those with CO2 emissions of less than 50g/km and a zero-emissions range (how far it can go on one charge) of at least 70 miles.Category 2 and 3 vehicles, which either emit more or have a shorter zero-emissions range, are no longer eligible for this grant.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the plus side, all ultra-low emission vehicles remain eligible for the electric vehicle home charge scheme. This is a 75% contribution towards the cost of a home charge point and its installation, up to a maximum of £500 per household or vehicle. The total cost, before taking the grant into consideration, should be somewhere between £850 and £1,250, including paying someone to fit it.

Savings versus petrol

One of the most affordable and best-selling electric cars is the Renault Zoe, says James Mills in the Daily Telegraph. The Dynamique Nav R90 ZE 40 version costs £28,270, with battery included. Batteries lose their capacity over time, so another option is to buy without a battery for £21,970, and lease one for £99 per month instead. Assuming you drive 10,000 miles a year for three years, leasing would make for a total cost of £25,534.

The next important thing is to get an idea of how much it will cost you to keep it charged. Look at the capacity of the battery, measured in kilowatt hours (kWh).Taking a 100kWh Tesla Model S, and assuming a typical public rapid charging point in the UK which costs roughly 35p per kWh the cost is 100 times 35p, so £35 if you charge from empty to full, says Curtis Moldrich in Car magazine.

If you can charge your car at home, a good-value overnight tariff would be 12p per kWh, so a full charge would cost £12. "That's a major saving over the cost of a £70-£100 petrol/diesel tankful for a typical executive car."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sarah was MoneyWeek's investment editor. She graduated from the University of Southampton with a BA in English and History, before going on to complete a graduate diploma in law at the College of Law in Guildford. She joined MoneyWeek in 2014 and writes on funds, personal finance, pensions and property.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Electric vehicle drivers to be charged new per mile tax from 2028

Electric vehicle drivers to be charged new per mile tax from 2028Electric vehicle drivers will be forced to pay a 3p per mile tax, as taxation will be brought closer in line with petrol and diesel cars

-

Should you buy an electric car?

Should you buy an electric car?If you're thinking about buying an electric car, you might be wondering whether they offer good value for money. We look at the costs versus savings.