The charts that matter: the US economy shows no sign of wilting

The US economy looks in better shape than many thought this time last month.John Stepek looks at how it's affecting the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. Exciting news this week we've just launched a new weekly column, Currency Corner, in association with currency specialists OFX. Every Friday, Money Morning regular Dominic Frisby will be looking into the big trends and the big news stories moving the foreign exchange markets. Have a read at his introductory column here if you haven't already.

No new podcast for you this week, but if you missed Merryn's interview with India expert David Cornell about the sub-continent's prospects and the opportunities for investors then check it out here.

And if you want something intellectually stimulating to listen to while you await the return of the MoneyWeek podcast, then may I not-so-humbly suggest you download the audio version of my book on contrarian investing, The Sceptical Investor. It just launched this week and you can get your copy at Audible here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, if you missed any Money Mornings this week, here are the links.

Monday: Don't expect strong US growth to mean higher interest rates

Tuesday: Are bond fund managers smarter than equity fund managers?

Wednesday: Don't sell in May this year the market is telling you it's time to be long

Thursday: Investors are still struggling to believe the Fed's sunny outlook

Friday: Markets are ignoring Mark Carney but for once, they shouldn't

And if you don't already subscribe to MoneyWeek, do it now you get your first six issues free when you sign up.

So what happened this week? There's certainly a lot of exuberance out there. Here's a selection of upcoming IPOs: ride-sharing group Uber; trendy property rental group WeWork; vegan burger group Beyond Meat; and even rumours of SoftBank looking at an IPO for its $100bn Vision Fund (which would be the most extraordinarily top-of-the-market IPO I can imagine).

Meanwhile, the US economy looks in better shape than many thought this time last month. Jobs growth remains strong and GDP figures for the first quarter were healthy. However, manufacturing data was ropey, which remains a worry for markets.

So let's look at the charts and see what they're saying about it all.

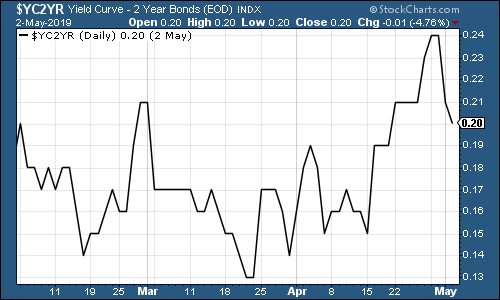

The yield curve (remind yourself of what it is here) hasn't changed a great deal this week. The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted, which almost always signals a recession (although perhaps not for up to two years).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

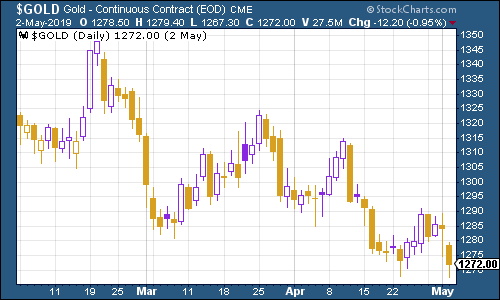

Gold (measured in dollar terms) has had another difficult week. First, the Federal Reserve was less dovish than expected. Then the US jobs picture was a lot better than markets had expected. Strong growth and a less nervy Fed represents a tough combination for gold.

(Gold: three months)

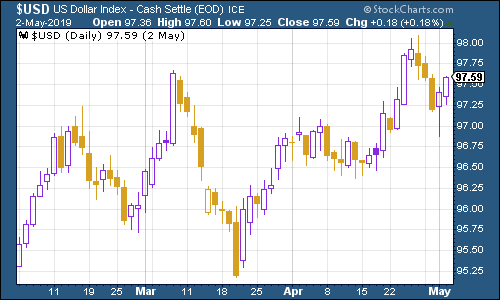

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners has stayed strong. That's not great news for markets, because they don't like a mighty dollar. The best hope for a weaker dollar now may be that European growth starts to perk up, boosting the euro but we'll see.

(DXY: three months)

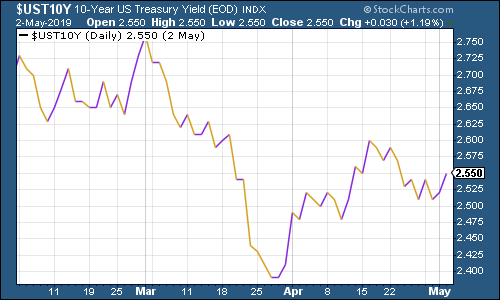

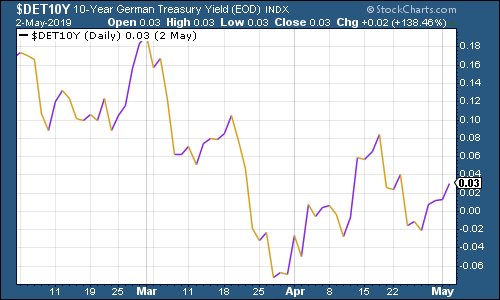

Ten-year yields on the world's major developed-market bonds were little changed.

(Ten-year US Treasury yield: three months)

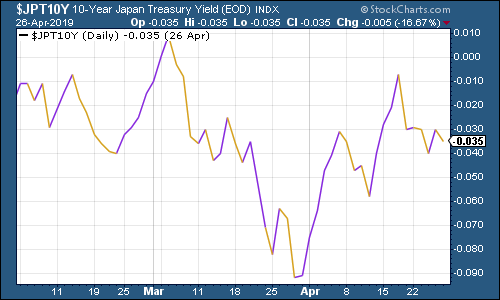

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

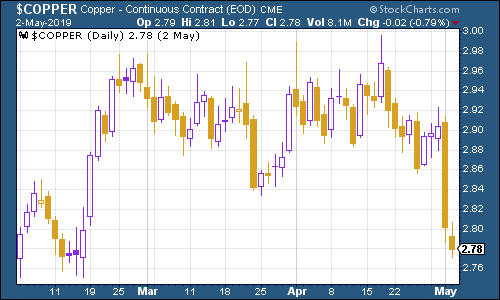

Copper slid sharply this week, despite hopes that the US and China are heading for a deal, after US manufacturing data disappointed in the middle of the week.

(Copper: three months)

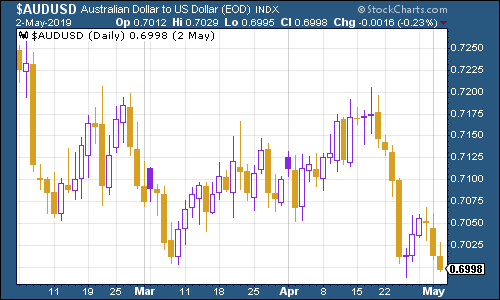

The Aussie dollar our favourite indicator of the state of the Chinese economy slid hard this week too, partly because of the strong US dollar, and partly because of weakness in the Aussie economy.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin was back on the rebound trail this week.

(Bitcoin: ten days)

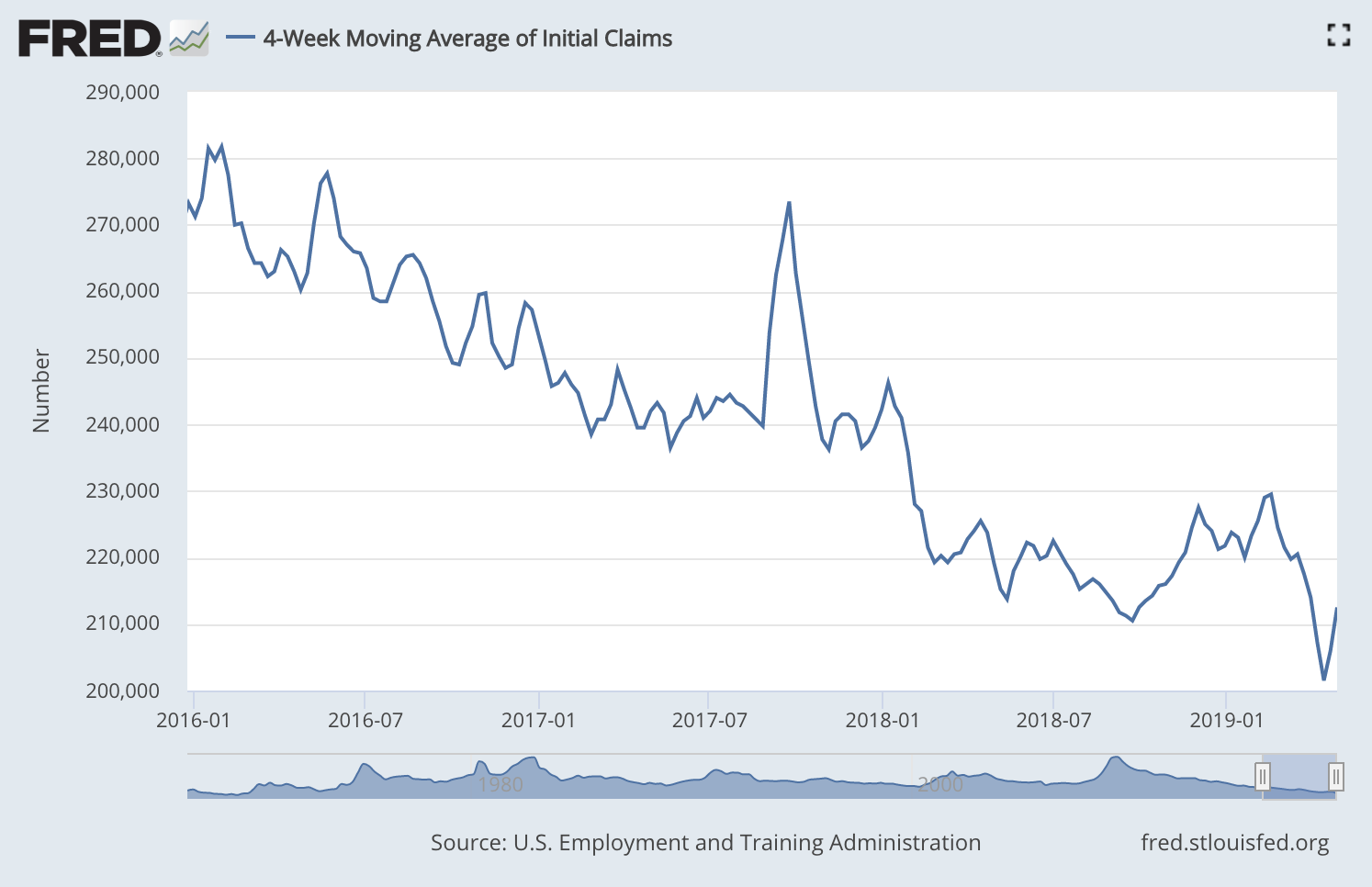

Two weeks ago, US jobless claims hit a fresh low on the four-week moving average measure, dropping to an exceptionally low 201,500. This week they rose to 212,500, as weekly claims remained at 230,000 (apparently the timing of Easter and Passover make claims more volatile around this time of year).

The reason we're paying attention to the trough is because in the past, David Rosenberg of Gluskin Sheff has noted that US stocks usually don't peak until after this four-week moving average has hit a low for the cycle. A recession tends to follow about a year later (bear in mind, judged on a tiny sample size).

Given the strength of April's nonfarm payrolls report (which came out yesterday and beat all expectations), it'll be interesting to see if we get another trough in the near future.

(US jobless claims, four-week moving average: since January 2016)

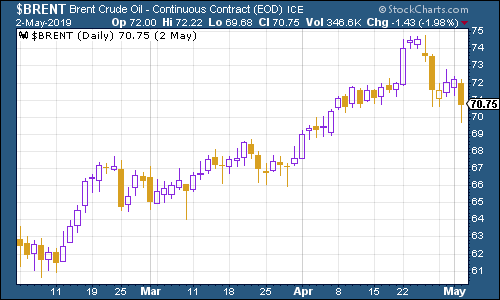

The oil price (as measured by Brent crude, the international/European benchmark) slipped back from its recent highs this week amid strong US oil output.

(Brent crude oil: three months)

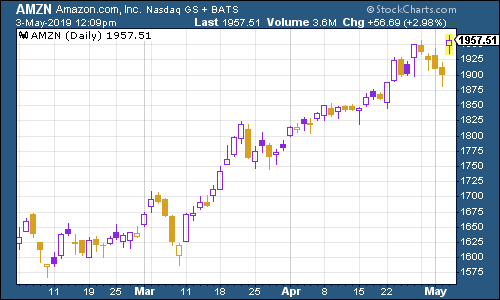

Internet giant Amazon just keeps heading higher. Amazon is the stock that no analyst will insult you for owning, so it stands to reason that with the bull market back on, the world's most-loved stock is heading higher.

(Amazon: three months)

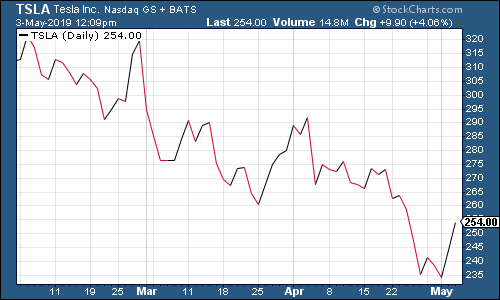

Shares in electric-car group Tesla managed to rally this week because (wait for it) the company decided to raise more money. I don't know about making cars, but Tesla is certainly very good at burning cash. The happy reaction was because everyone knew it was coming and it appears there was stronger appetite for the fundraising than expected.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.