Don’t sell in May this year – the market is telling you it’s time to be long

Investment lore has it that you should “sell in May, go away, come back on St Leger Day”. That may have worked in the past. But not now, says Dominic Frisby. Here's why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's 1 May, so, according to some investment lore, we should be selling our holdings and looking to come back on St Leger Day (that's the second week of September, if you're not a follower of horse racing).

Our American brothers have it that Labor Day 2 September this year should be the day or return.

But that is all flimflam in my view. I'm long, I'm especially long the US indices, and I've no current plans to lighten up this May. I don't see any reason to.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here's why.

Forget "sell in May", stick with "the trend is your friend"

The maxim, "sell in May, go away, come back on St Leger Day" was born in a time when markets really did slow down over the summer, because brokers, traders, and the rest, were all taking their summer holidays.

But these days holidays don't last as long. We can fly to where we want to be in a few hours. It doesn't take several weeks by steamer to get there.

And once we are there we have our wretched smartphones. So, save for remote parts of the Himalayas, it's impossible to get away even if you wanted to.

In the meantime, innumerable computers, quants, algos and bots are doing the work previously done by brokers and traders, and they don't need holidays. It's one of the reasons employers like them.

In short, markets no longer slow down. They don't even sleep, let alone take holidays. Whatever rationale there was behind the maxim has long since become an anachronism.

Countless studies have been done looking at the sell-in-May strategy, and overall, over the past 20 or 50 years, there has been some marginal outperformance. But there are far better strategies to be found. I outlined one of them last week. And with each passing year, the sell-in-May strategy works less and less well.

Trend following by whatever means you use to define and follow a trend works better. And so does buying the break-out. Whenever a market is going up, it will inevitably break to new highs. Break-outs lead to higher highs far more often than they don't. This is especially so under a monetary system which, unlike gold, is not finite.

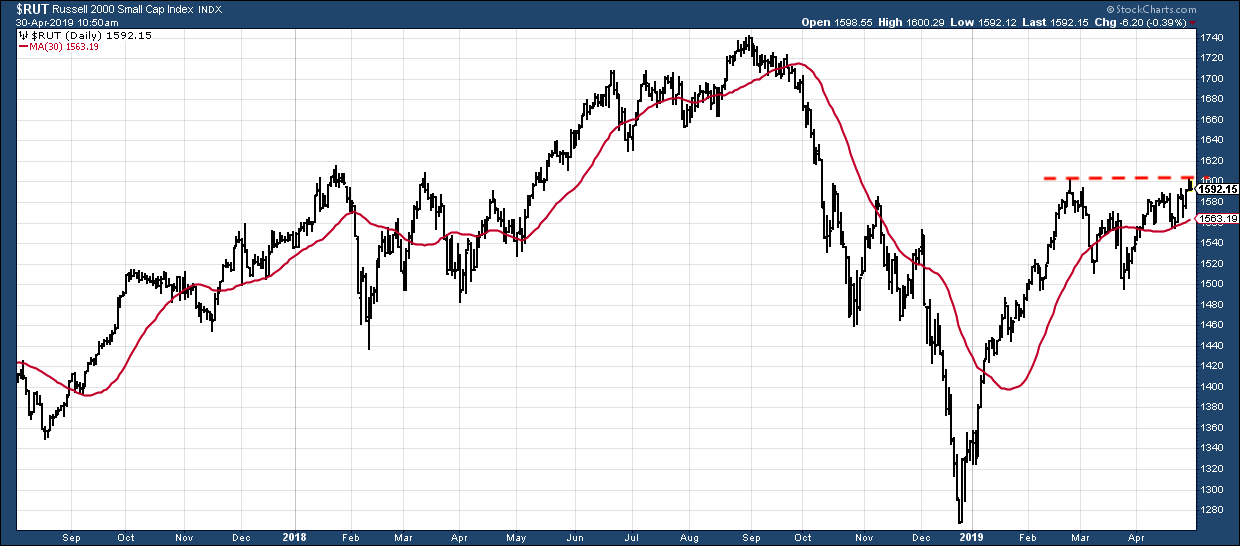

The Nasdaq broke to new highs last week. It has for years been the US market leader. The S&P 500 followed. The Dow Jones is flirting with new highs. The laggard has been the Russell 2000 index of small companies. But even though it's not at all-time highs, it is still in an uptrend.

Now, you can make the argument that the indices are making an almighty "double top". They might be. But all markets that are testing old highs look like they are making a double top until they break decidedly higher.

You could also argue that the fact that the Russell 2000 is lagging is a bearish sign. You want to see small-cap stocks leading. That could be true as well. Although small-cap leadership is something you tend to see towards the end of bull markets.

You have to think about things like capital flows. Where would rather have your money at the moment? The US? Europe? China? Russia? South America? Most money managers will be arriving at the same conclusion as you. There might be opportunities in all of those places, but surely the US looks the best bet at the moment, and so it makes sense to be overweight there.

Reasons to be moderately bullish

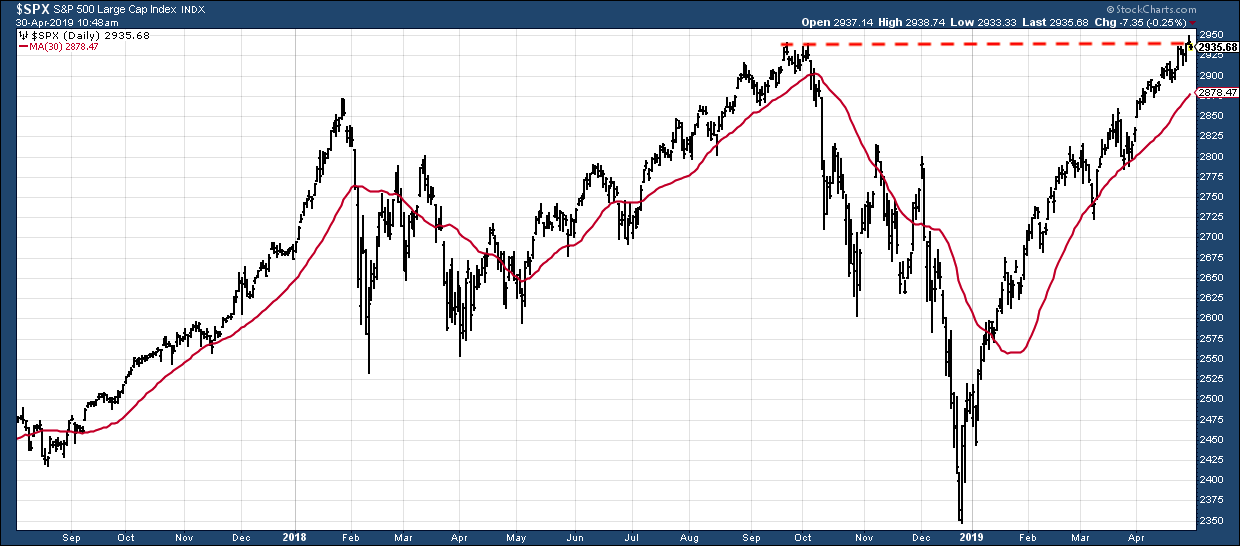

Here's the S&P 500 over the last two years. The red line is the 30-day simple moving average. It gives you an idea of the intermediate term trend. It is clearly sloping up. Yes, the market will stumble as it retests these old highs (dashed line), but there is no reason this market cannot carrying on doing what it has been doing since late last year grinding higher.

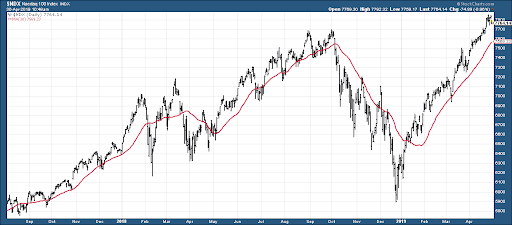

Here's the Nasdaq. This is the market leader. I know Alphabet (Google) put out some disappointing results, but I don't think this is game over for the Nasdaq. The trend is up.

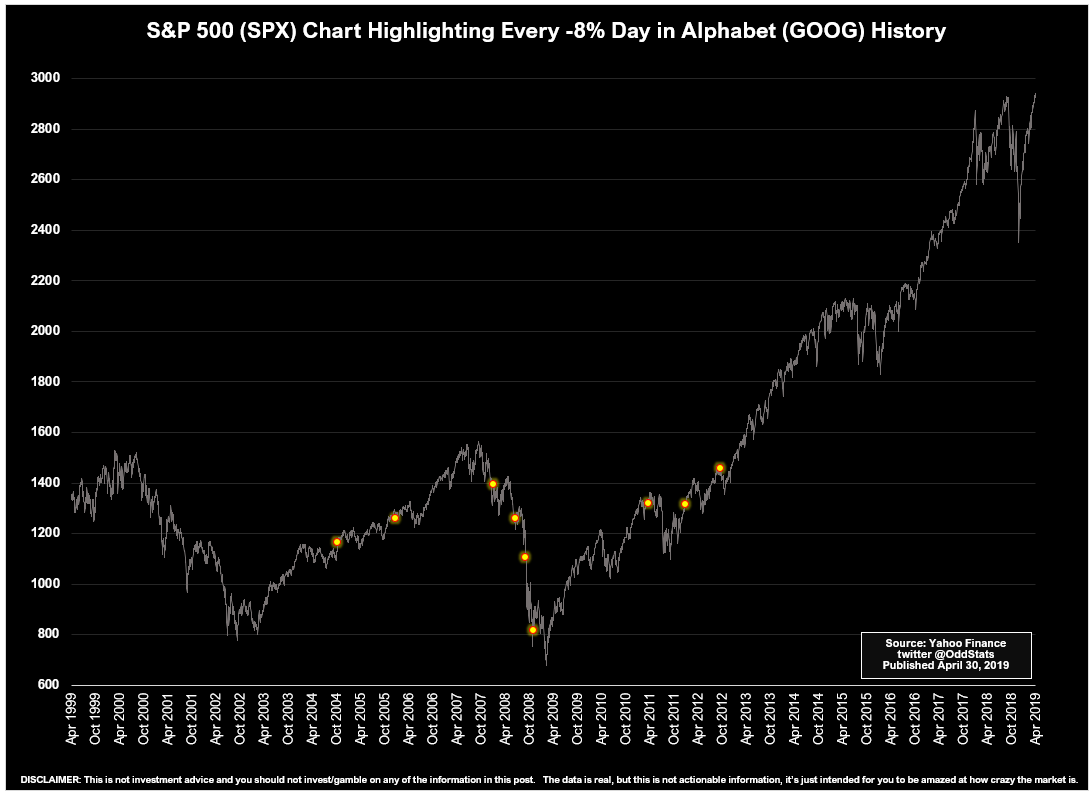

Here, by the way, courtesy of a chap on Twitter who goes by the name of "Odd Stats" is the S&P 500 with, highlighted, all the times Alphabet has a down day of 8% or more (such as yesterday). Leaving aside the 2008 crash, there were sometimes wobbles that followed, especially in 2011, but just as common was for the market to grind on higher.

Here, finally, is the Russell 2000 the laggard flirting with its February highs, which are lower than its September highs.

Barron's just published their semi-annual Big Money poll. It seems there are many fund managers who de-risked their portfolios in the market weakness of late 2018, who are only now starting to buy again. The BoAML Fund Manager Survey, meanwhile, reveals that equity weightings are low compared to their historical average. That means there are plenty of potential buyers out there. These markets can go higher.

Recent action has been that of an orderly advance, rather than a blow-off top and that can continue. If we get a proper break-out in the S&P and the Dow, then things may start to get a bit more disorderly on the upside, and the small caps will play catch up as risk-on takes hold, but we are not there yet.

In short, the trend is up. There will be wobbles as we flirt with old highs. But selling in May this year would be fighting the trend. More often than not, that has not proved an effective strategy. Let the trend be your friend instead.

Dominic Frisby is author of the first (and best, obviously) book on bitcoin from a recognised publisher, Bitcoin: the Future of Money?, available from all good bookshops (and a couple of rubbish ones too). Follow Dominic @dominicfrisby

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.