This trend-following system is telling you to buy US stocks – and bitcoin

Dominic Frisby’s “no-brainer” trading system works across most trending markets – and right now, it’s telling you to buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I recently described a simple trend-following trading system that works across most trending markets.

Today I am going to revisit that system.

Why? Because we have recently had a couple of "buy" signals.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Potentially quite exciting ones, with long-term implications.

A no-brainer trading system

Let me start off by explaining the system.

It is a long-term strategy. Typically, you might only get two or three "buy" or "sell" signals per year; sometimes you don't even get that.

So it suits those who don't want to be looking at their screens on a daily basis, but prefer to walk away and do other things. With this strategy, you only need clock in once or twice a week if that.

I stress, this system does not work if a market is range bound. Gold, for example, in recent years has been trading in a range of roughly $200, maybe a little more, between about $1,140 an ounce and $1,360 an ounce. While the system has not lost you any significant sums, it has not made you any money either.

The system only works in markets which are trending. If they are, it will catch you the large portion of the move whether up or down while eliminating the dangers of having to think. You don't have to have an opinion about a market. In fact it is better if you don't have a strong opinion. Your biases will get in the way.

All you need to know is whether a market is trending up or down and this system will tell you that.

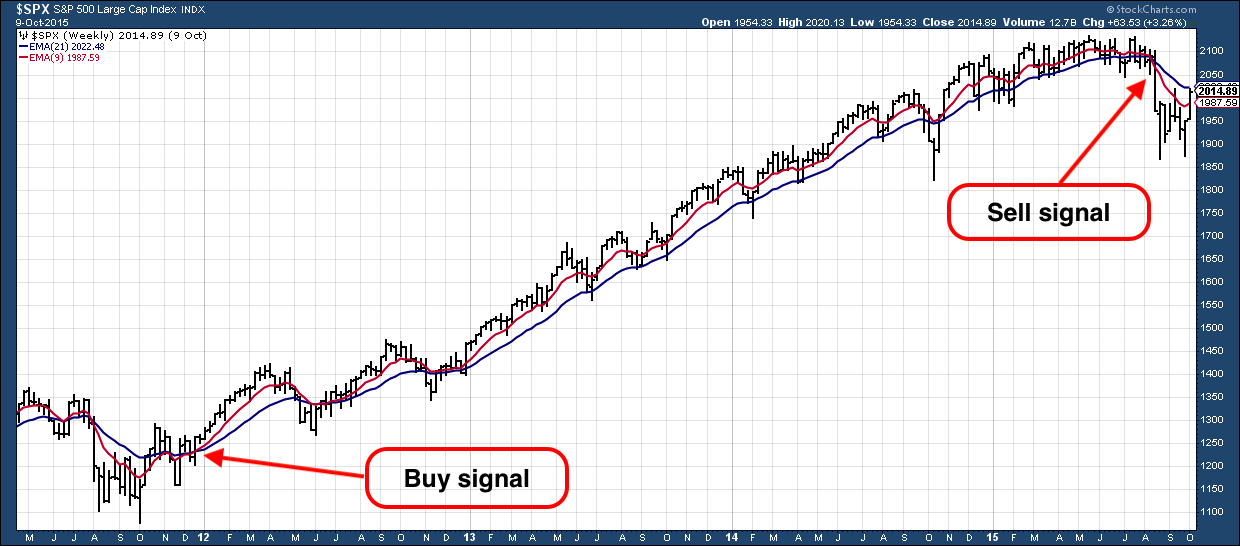

By way of example, below is a weekly chart of the S&P 500 between 2011 and 2015. In addition to the price (in black), I have plotted two moving averages: the 21-week moving average (in blue) and the nine-week moving average (red).

Note: these are exponential moving averages (EMAs). The 21-week simple moving average would show the average price of the previous 21 weeks. The 21-week EMA does that but with greater weighting to more recent weeks. It does not make that much difference which you use, to be frank, but I prefer EMAs.

In addition, you can use shorter timeframes. Sometimes I prefer the six-week moving average to the nine, but for longer-term traders the nine works well.

When the price is above the nine-week EMA, and the nine-week EMA is above the 21-week EMA, and both EMAs are flat or sloping up, you have a "buy" signal. The trigger is the point at which the nine-week EMA (blue line) crosses up through the 21-week EMA (red line), as marked in the chart below.

Similarly, the "sell" signal is the reverse. When the red line (nine-week EMA) crosses down through the blue line (21-week EMA) and the price is below, that is your cue to sell.

You can see we got our buy signal in late 2011 with the S&P 500 at 1,250. And we stayed long for almost four years. In all that time we did not get a sell signal, until late 2015 with the S&P at 2,050.

There were a couple of near-misses, particularly in June 2012, but the system kept you long in what turned out to be a great bull market.

So that's the system.

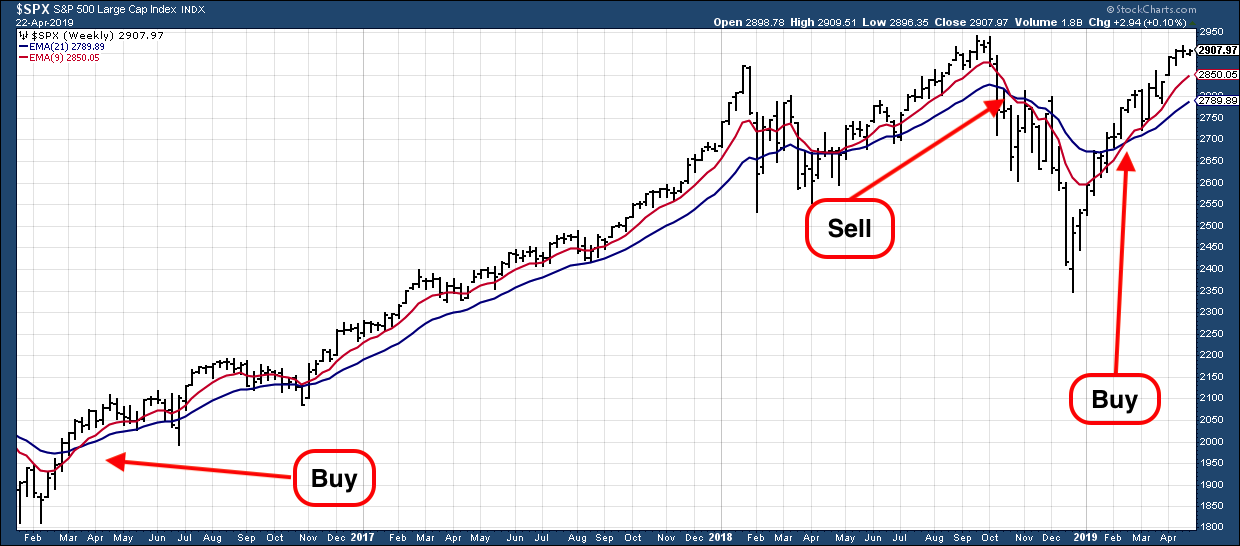

Now here's why I bring it up today. The S&P 500 is back on a "buy" signal. So too are the Dow and the Nasdaq.

Here's the S&P 500, over the past three years. You can see the "buy" signal in early 2016, the "sell" signal in October last year, and the "buy" signal which came in February.

You might expect some wobbles as the markets flirt with all-time highs, but the beauty of this system is that it takes such thinking out of the equation. The system says be long.

The system is not perfect. I have been working on methods which take you out of the market closer to tops. One option is to keep a stop just below the 21-week EMA. Another is to sell if goes a certain percentage above the 21-week EMA.

But the "buys" work beautifully well as long as the markets are trending. I'm now long the S&P 500 and I plan to stay long, until such time as I get a "sell" signal. I pray the market gods give us a trend such as we saw in 2016 and 2017.

This could be a good time to buy bitcoin

Of all the different markets I look at, I think thistrading system works best of all with bitcoin.

Here is a chart of bitcoin from 2011 to 2014. You can see we got a "buy" signal in 2011 with bitcoin below $5. The "sell" came three years later with bitcoin a hundred times higher at over $500.

Something similar happened during bitcoin's last bull run. We got the "buy" at $250 in October 2015. The "sell" came over two years later in early 2018, with bitcoin around $9,000.

It would have been nicer to get out at $20,000, but I don't think anyone would complain at turning $250 into $9,000!

What's important is that this "buy" signal has come just three times in bitcoin since 2011 once in 2011, once in 2014 and once in 2015. The 2014 signal didn't work and it turned to "sell" fairly soon after. But the other two bull markets were bull markets of the life-changing variety.

And we got another such "buy" signal in bitcoin last week.

As I said last week, I "think" this rally in bitcoin is a relief rally in a bear market. I "think" it is going to take us to the $6,000 area what was support before we go back down and retest the lows at $3,200. But that is nothing more than one man's opinion.

The beauty of the trading system I have described is that thinking is removed from the equation. We just got a "buy" signal in bitcoin. As far as the system is concerned, that is all you need to know.

Dominic Frisby is author of the first (and best, obviously) book on bitcoin from a recognised publisher, Bitcoin: the Future of Money?, available from all good bookshops (and a couple of rubbish ones too). Follow Dominic @dominicfrisby

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices